how is the total benefit of $1,122 calculated for Sheldon Caplan?

This is in reference to a question from Byrd & Chen's Canadian Tax Principles Volume 1, Pg 131 Assignment problem three- 5

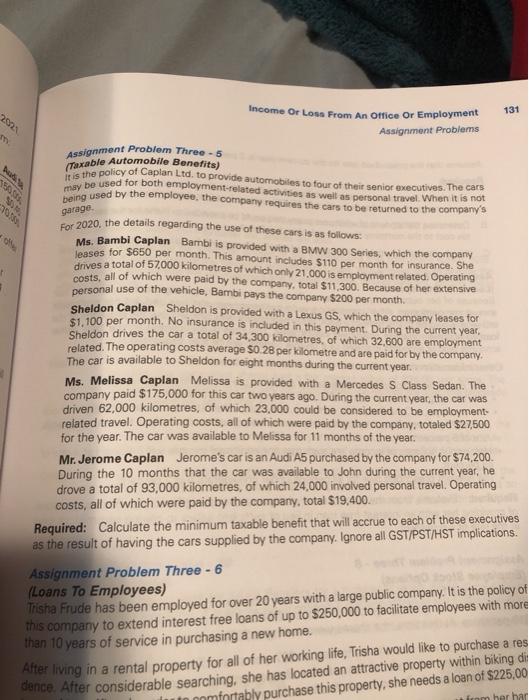

Assignment Problem Three-5 Taxable Automobile Benefits) It is the policy of Caplan Ltd. to provide automobiles to four of their senior executives. The cars may be used for both employment-related activities as well as personal travel When it is not being used by the employee, the company requires the cars to be returned to the company's Income Or Lose From An Office Or Employment 131 Assignment Problems garage For 2020, the details regarding the use of these cars is as follows: Ms. Bambi Caplan Bambi is provided with a BMW 300 Series, which the company leases for $650 per month. This amount includes $110 per month for insurance. She drives a total of 57.000 kilometres of which only 21,000 is employment related. Operating costs, all of which were paid by the company, total $11,300. Because of her extensive personal use of the vehicle, Bambi pays the company $200 per month Sheldon Caplan Sheldon is provided with a Lexus GS, which the company leases for $1,100 per month. No insurance is included in this payment. During the current year, Sheldon drives the car a total of 34 300 kilometres, of which 32,600 are employment related. The operating costs average 50.28 per kilometre and are paid for by the company. The car is available to Sheldon for eight months during the current year. Ms. Melissa Caplan Melissa is provided with a Mercedes S Class Sedan. The company paid $175,000 for this car two years ago. During the current year, the car was driven 62,000 kilometres, of which 23,000 could be considered to be employment related travel. Operating costs, all of which were paid by the company, totaled $27,500 for the year. The car was available to Melissa for 11 months of the year. Mr. Jerome Caplan Jerome's car is an Audi A5 purchased by the company for $74,200. During the 10 months that the car was available to John during the current year, he drove a total of 93,000 kilometres, of which 24,000 involved personal travel. Operating costs, all of which were paid by the company, total $19,400. Required: Calculate the minimum taxable benefit that will accrue to each of these executives as the result of having the cars supplied by the company. Ignore all GST/PST/HST implications. Assignment Problem Three - 6 (Loans To Employees) Trisha Frude has been employed for over 20 years with a large public company. It is the policy of this company to extend interest free loans of up to $250,000 to facilitate employees with more than 10 years of service in purchasing a new home. After living in a rental property for all of her working life, Trisha would like to purchase a res dence. After considerable searching, she has located an attractive property within biking di momfortably purchase this property, she needs a loan of $225,00 om her har