How is this be done with formulas on EXCEL.

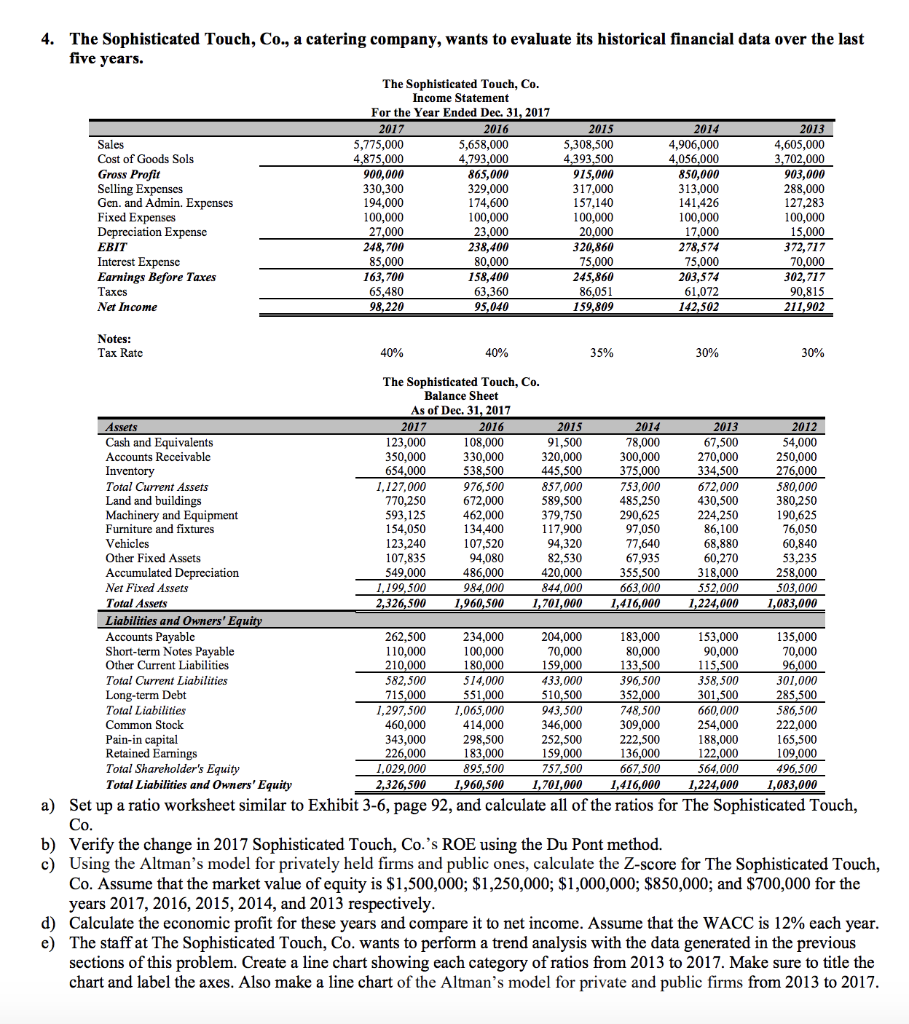

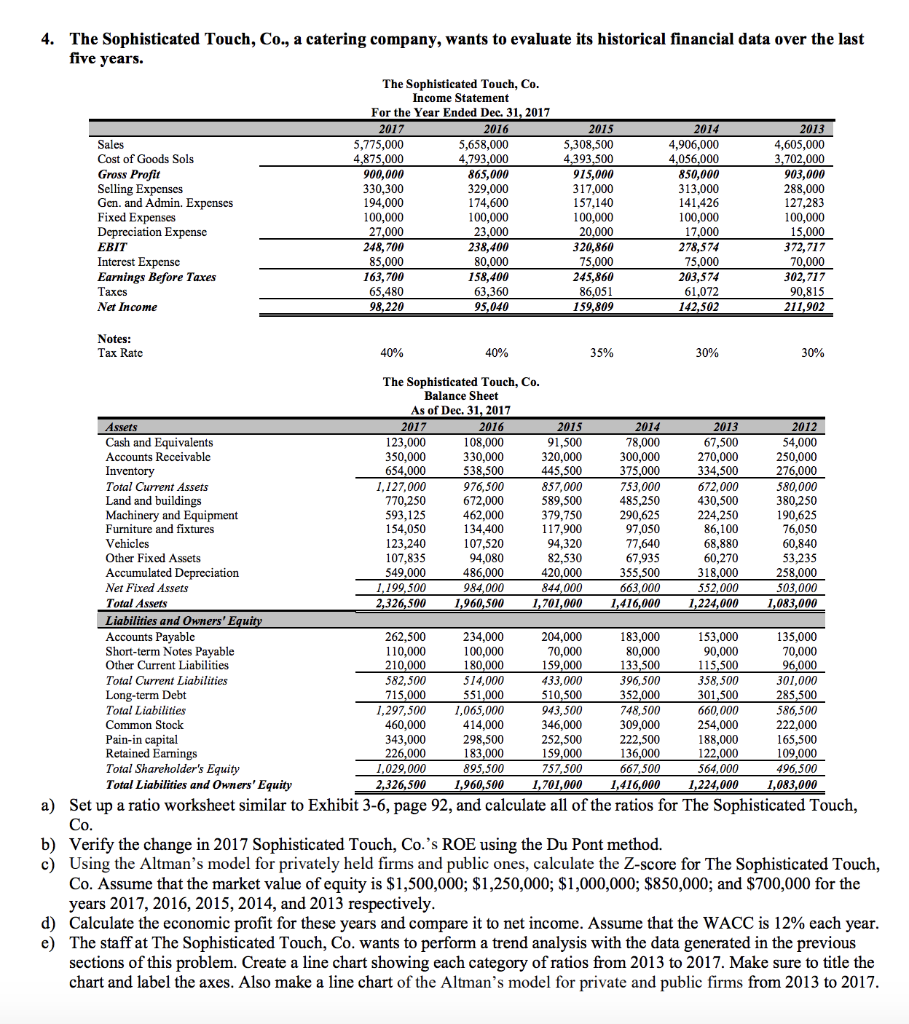

2014 2013 4. The Sophisticated Touch, Co., a catering company, wants to evaluate its historical financial data over the last five years. The Sophisticated Touch, Co. Income Statement For the Year Ended Dec 31, 2017 2017 2016 2015 Sales 5,775,000 5,658,000 5,308,500 4,906,000 4,605,000 Cost of Goods Sols 4,875,000 4,793,000 4,393,500 4,056,000 3,702,000 Gross Profit 900,000 865,000 915,000 850,000 903,000 Selling Expenses 330,300 329,000 317,000 313,000 288,000 Gen. and Admin. Expenses 194,000 174,600 157,140 141,426 127,283 Fixed Expenses 100,000 100,000 100,000 100,000 100,000 Depreciation Expense 27,000 23,000 20,000 17,000 15,000 EBIT 248,700 238,400 320,860 278,574 Interest Expense 85,000 80,000 75,000 75,000 70,000 Earnings Before Taxes 163,700 158,400 245,860 203,574 302,717 Taxes 65,480 63,360 86,051 61,072 90,815 Net Income 98,220 95,040 159,809 142,502 211,902 372,717 Notes: Tax Rate 40% 40% 35% 30% 30% The Sophisticated Touch, Co. Balance Sheet As of Dec. 31, 2017 Assets 2017 2016 2015 2014 2013 2012 Cash and Equivalents 123,000 108,000 91,500 78,000 67,500 54,000 Accounts Receivable 350,000 330,000 320,000 300,000 270,000 250,000 Inventory 654,000 538,500 445,500 375,000 334,500 276,000 Total Current Assets 1.127.000 976,500 857,000 753,000 672,000 580,000 Land and buildings 770.250 672,000 589,500 485,250 430,500 380,250 Machinery and Equipment 593,125 462,000 379,750 290,625 224,250 190,625 Furniture and fixtures 154.050 134,400 117.900 97,050 86,100 76,050 Vehicles 123,240 107,520 94,320 77,640 68,880 60,840 Other Fixed Assets 107.835 94,080 82,530 67,935 60,270 53,235 Accumulated Depreciation 549,000 486,000 420.000 355,500 318,000 258,000 Net Fixed Assets 1.199,500 984,000 844,000 663,000 552,000 503,000 Total Assets 2,326,500 1,960,500 1,701,000 1,416,000 1,224,000 1,083,000 Liabilities and Owners' Equity Accounts Payable 262,500 234,000 204,000 183,000 153,000 135,000 Short-term Notes Payable 110,000 100,000 70,000 80,000 90,000 70,000 Other Current Liabilities 210,000 180,000 159.000 133,500 115.500 96,000 Total Current Liabilities 582,500 514,000 433,000 396,500 358,500 301,000 Long-term Debt 715,000 551,000 510.500 352,000 301,500 285,500 Total Liabilities 1,297,500 1,065,000 943,500 748,500 660,000 586,500 Common Stock 460,000 414.000 346,000 309,000 254,000 222,000 Pain-in capital 343,000 298,500 252,500 222,500 188,000 165,500 Retained Earnings 226,000 183,000 159,000 136,000 122,000 109,000 Total Shareholder's Equity 1,029,000 895,500 757,500 667,500 564,000 496,500 Total Liabilities and Owners' Equity 2,326,500 1,960,500 1,701,000 1,416,000 1,224,000 1,083,000 a) Set up a ratio worksheet similar to Exhibit 3-6, page 92, and calculate all of the ratios for The Sophisticated Touch, Co. b) Verify the change in 2017 Sophisticated Touch, Co.'s ROE using the Du Pont method. c) Using the Altman's model for privately held firms and public ones, calculate the Z-score for The Sophisticated Touch, Co. Assume that the market value of equity is $1,500,000; $1,250,000; $1,000,000; $850,000; and $700,000 for the years 2017, 2016, 2015, 2014, and 2013 respectively. d) Calculate the economic profit for these years and compare it to net income. Assume that the WACC is 12% each year. e) The staff at The Sophisticated Touch, Co. wants to perform a trend analysis with the data generated in the previous sections of this problem. Create a line chart showing each category of ratios from 2013 to 2017. Make sure to title the chart and label the axes. Also make a line chart of the Altman's model for private and public firms from 2013 to 2017. 2014 2013 4. The Sophisticated Touch, Co., a catering company, wants to evaluate its historical financial data over the last five years. The Sophisticated Touch, Co. Income Statement For the Year Ended Dec 31, 2017 2017 2016 2015 Sales 5,775,000 5,658,000 5,308,500 4,906,000 4,605,000 Cost of Goods Sols 4,875,000 4,793,000 4,393,500 4,056,000 3,702,000 Gross Profit 900,000 865,000 915,000 850,000 903,000 Selling Expenses 330,300 329,000 317,000 313,000 288,000 Gen. and Admin. Expenses 194,000 174,600 157,140 141,426 127,283 Fixed Expenses 100,000 100,000 100,000 100,000 100,000 Depreciation Expense 27,000 23,000 20,000 17,000 15,000 EBIT 248,700 238,400 320,860 278,574 Interest Expense 85,000 80,000 75,000 75,000 70,000 Earnings Before Taxes 163,700 158,400 245,860 203,574 302,717 Taxes 65,480 63,360 86,051 61,072 90,815 Net Income 98,220 95,040 159,809 142,502 211,902 372,717 Notes: Tax Rate 40% 40% 35% 30% 30% The Sophisticated Touch, Co. Balance Sheet As of Dec. 31, 2017 Assets 2017 2016 2015 2014 2013 2012 Cash and Equivalents 123,000 108,000 91,500 78,000 67,500 54,000 Accounts Receivable 350,000 330,000 320,000 300,000 270,000 250,000 Inventory 654,000 538,500 445,500 375,000 334,500 276,000 Total Current Assets 1.127.000 976,500 857,000 753,000 672,000 580,000 Land and buildings 770.250 672,000 589,500 485,250 430,500 380,250 Machinery and Equipment 593,125 462,000 379,750 290,625 224,250 190,625 Furniture and fixtures 154.050 134,400 117.900 97,050 86,100 76,050 Vehicles 123,240 107,520 94,320 77,640 68,880 60,840 Other Fixed Assets 107.835 94,080 82,530 67,935 60,270 53,235 Accumulated Depreciation 549,000 486,000 420.000 355,500 318,000 258,000 Net Fixed Assets 1.199,500 984,000 844,000 663,000 552,000 503,000 Total Assets 2,326,500 1,960,500 1,701,000 1,416,000 1,224,000 1,083,000 Liabilities and Owners' Equity Accounts Payable 262,500 234,000 204,000 183,000 153,000 135,000 Short-term Notes Payable 110,000 100,000 70,000 80,000 90,000 70,000 Other Current Liabilities 210,000 180,000 159.000 133,500 115.500 96,000 Total Current Liabilities 582,500 514,000 433,000 396,500 358,500 301,000 Long-term Debt 715,000 551,000 510.500 352,000 301,500 285,500 Total Liabilities 1,297,500 1,065,000 943,500 748,500 660,000 586,500 Common Stock 460,000 414.000 346,000 309,000 254,000 222,000 Pain-in capital 343,000 298,500 252,500 222,500 188,000 165,500 Retained Earnings 226,000 183,000 159,000 136,000 122,000 109,000 Total Shareholder's Equity 1,029,000 895,500 757,500 667,500 564,000 496,500 Total Liabilities and Owners' Equity 2,326,500 1,960,500 1,701,000 1,416,000 1,224,000 1,083,000 a) Set up a ratio worksheet similar to Exhibit 3-6, page 92, and calculate all of the ratios for The Sophisticated Touch, Co. b) Verify the change in 2017 Sophisticated Touch, Co.'s ROE using the Du Pont method. c) Using the Altman's model for privately held firms and public ones, calculate the Z-score for The Sophisticated Touch, Co. Assume that the market value of equity is $1,500,000; $1,250,000; $1,000,000; $850,000; and $700,000 for the years 2017, 2016, 2015, 2014, and 2013 respectively. d) Calculate the economic profit for these years and compare it to net income. Assume that the WACC is 12% each year. e) The staff at The Sophisticated Touch, Co. wants to perform a trend analysis with the data generated in the previous sections of this problem. Create a line chart showing each category of ratios from 2013 to 2017. Make sure to title the chart and label the axes. Also make a line chart of the Altman's model for private and public firms from 2013 to 2017