Answered step by step

Verified Expert Solution

Question

1 Approved Answer

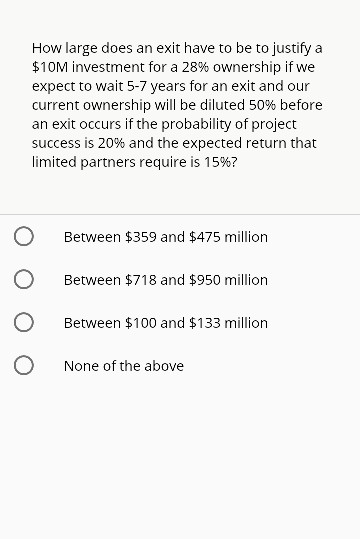

How large does an exit have to be to justify a $10M investment for a 28% ownership if we expect to wait 5-7 years for

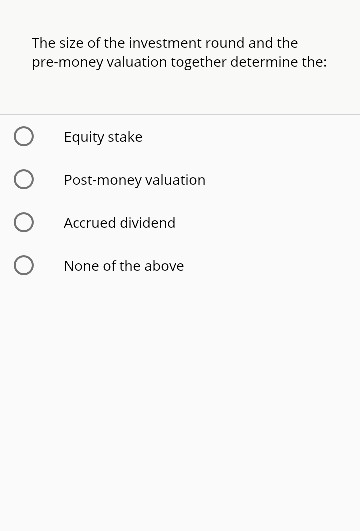

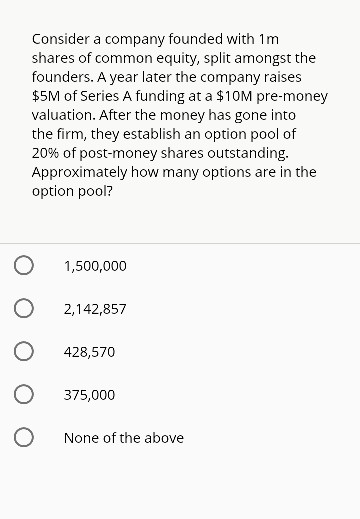

How large does an exit have to be to justify a $10M investment for a 28% ownership if we expect to wait 5-7 years for an exit and our current ownership will be diluted 50% before an exit occurs if the probability of project success is 20% and the expected return that limited partners require is 15%? Between $359 and $475 million O Between $718 and $950 million Between $100 and $133 million None of the above The size of the investment round and the pre-money valuation together determine the: Equity stake Post-money valuation Accrued dividend None of the above Consider a company founded with 1m shares of common equity, split amongst the founders. A year later the company raises $5M of Series A funding at a $10M pre-money valuation. After the money has gone into the firm, they establish an option pool of 20% of post-money shares outstanding. Approximately how many options are in the option pool? 1,500,000 O 2,142,857 428,570 375,000 O None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started