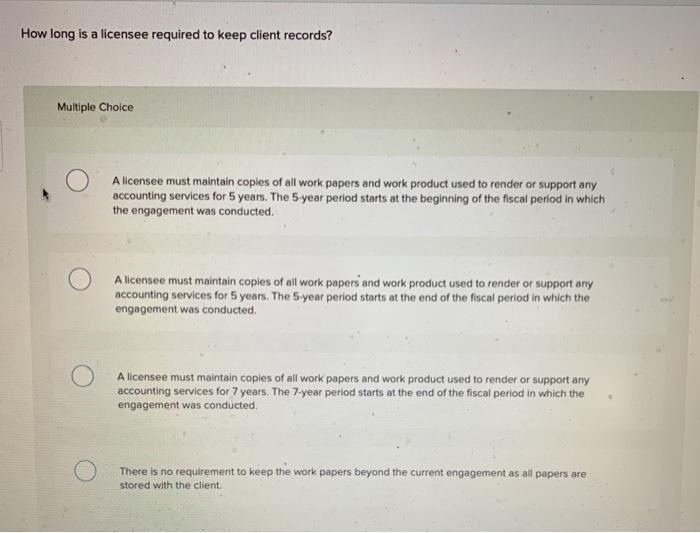

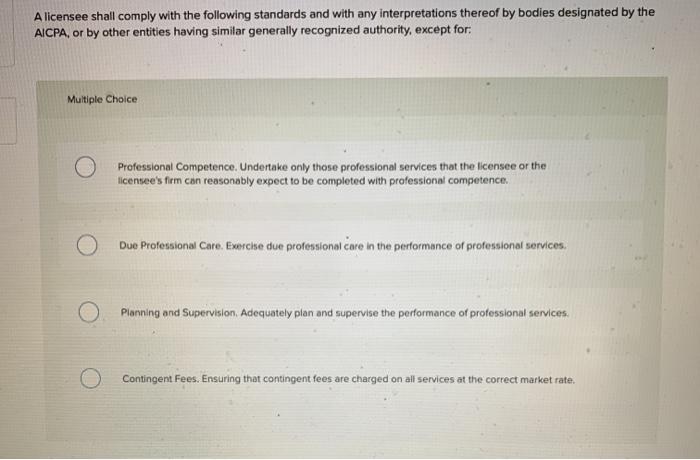

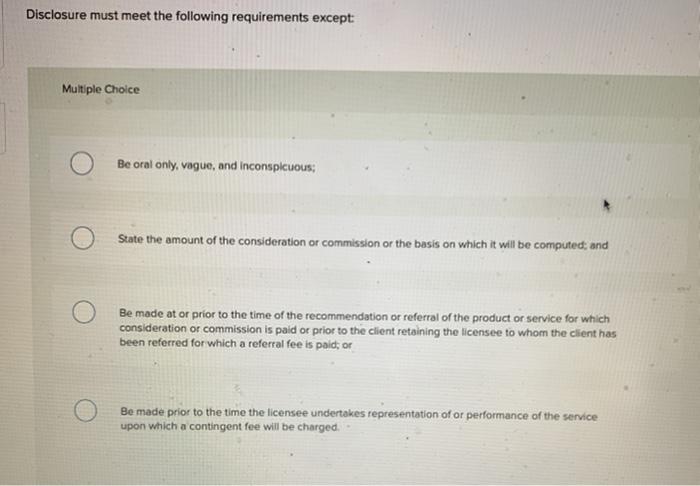

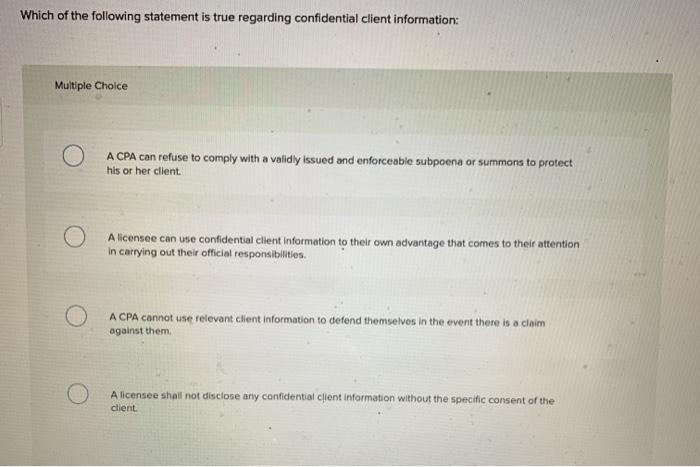

How long is a licensee required to keep client records? Multiple Choice A licensee must maintain coples of all work papers and work product used to render or support any accounting services for 5 years. The 5 year period starts at the beginning of the fiscal period in which the engagement was conducted. A licensee must maintain copies of all work papers and work product used to render or support any accounting services for 5 years. The 5-year period starts at the end of the fiscal period in which the engagement was conducted A licensee must maintain copies of all work papers and work product used to render or support any accounting services for 7 years. The 7-year period starts at the end of the fiscal period in which the engagement was conducted There is no requirement to keep the work papers beyond the current engagement as all papers are stored with the client. A licensee shall comply with the following standards and with any interpretations thereof by bodies designated by the AICPA, or by other entities having similar generally recognized authority, except for: Multiple Choice Professional Competence. Undertake only those professional services that the licensee or the licensee's firm can reasonably expect to be completed with professional competence Due Professional Care. Exerche due professional core in the performance of professional services. Planning and Supervision. Adequately plan and supervise the performance of professional services. Contingent Fees. Ensuring that contingent fees are charged on all services at the correct market rate. Disclosure must meet the following requirements except: Multiple Choice Be oral only, vague, and inconspicuous; State the amount of the consideration or commission or the basis on which it will be computed, and Be made at or prior to the time of the recommendation or referral of the product or service for which consideration or commission is paid or prior to the client retaining the license to whom the client has been referred for which a referral fee is paid, or Be made prior to the time the licensee undertakes representation of or performance of the service upon which a contingent fee will be charged Which of the following statement is true regarding confidential client information: Multiple Choice A CPA can refuse to comply with a validly issued and enforceable subpoena or summons to protect his or her client A licensee can use confidential ellent information to their own advantage that comes to their attention In carrying out their official responsibilities A CPA cannot use relevant client Information to defend themselves in the event there is a claim against them A licensee shall not disclose any confidential client information without the specific consent of the client