How much cash did the company pay for taxes?:

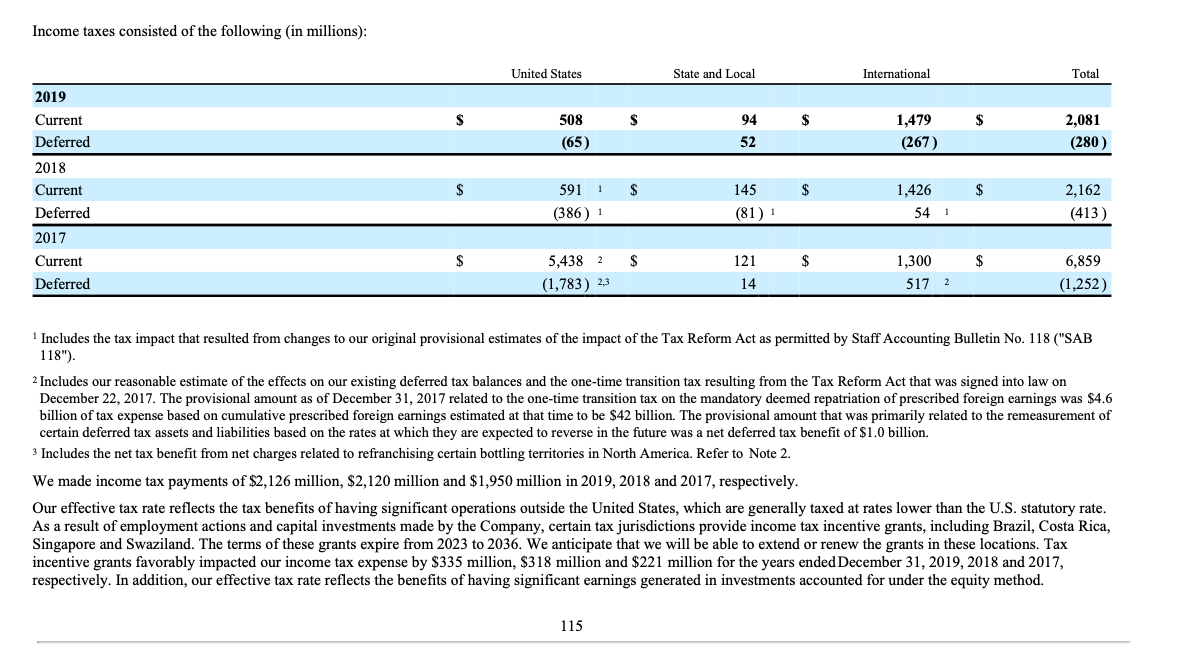

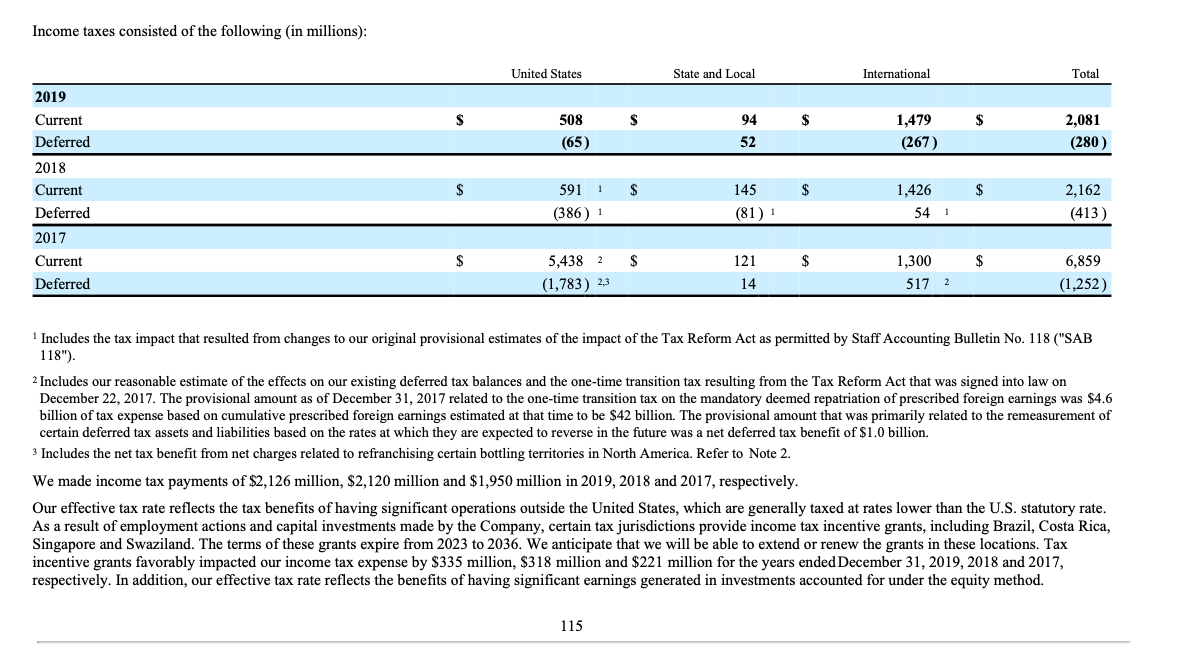

Income taxes consisted of the following (in millions): United States State and Local International Total $ 508 $ $ $ 94 52 1,479 (267) 2,081 (280) (65) 2019 Current Deferred 2018 Current Deferred 2017 Current Deferred $ $ $ 591 1 $ (386) 145 (81) 1,426 54 1 2,162 (413) ( $ $ $ $ 5,438 2 (1,783) 23 121 14 1,300 517 2 6,859 (1,252) 1 Includes the tax impact that resulted from changes to our original provisional estimates of the impact of the Tax Reform Act as permitted by Staff Accounting Bulletin No. 118 ("SAB 118"). 2 Includes our reasonable estimate of the effects on our existing deferred tax balances and the one-time transition tax resulting from the Tax Reform Act that was signed into law on December 22, 2017. The provisional amount as of December 31, 2017 related to the one-time transition tax on the mandatory deemed repatriation of prescribed foreign earnings was $4.6 billion of tax expense based on cumulative prescribed foreign earnings estimated at that time to be $42 billion. The provisional amount that was primarily related to the remeasurement of certain deferred tax assets and liabilities based on the rates at which they are expected to reverse in the future was a net deferred tax benefit of $1.0 billion. 3 Includes the net tax benefit from net charges related to refranchising certain bottling territories in North America. Refer to Note 2. We made income tax payments of $2,126 million, $2,120 million and $1,950 million in 2019, 2018 and 2017, respectively. Our effective tax rate reflects the tax benefits of having significant operations outside the United States, which are generally taxed at rates lower than the U.S. statutory rate. As a result of employment actions and capital investments made by the Company, certain tax jurisdictions provide income tax incentive grants, including Brazil, Costa Rica, Singapore and Swaziland. The terms of these grants expire from 2023 to 2036. We anticipate that we will be able to extend or renew the grants in these locations. Tax incentive grants favorably impacted our income tax expense by $335 million, $318 million and $221 million for the years ended December 31, 2019, 2018 and 2017, respectively. In addition, our effective tax rate reflects the benefits of having significant earnings generated in investments accounted for under the equity method. 115 Income taxes consisted of the following (in millions): United States State and Local International Total $ 508 $ $ $ 94 52 1,479 (267) 2,081 (280) (65) 2019 Current Deferred 2018 Current Deferred 2017 Current Deferred $ $ $ 591 1 $ (386) 145 (81) 1,426 54 1 2,162 (413) ( $ $ $ $ 5,438 2 (1,783) 23 121 14 1,300 517 2 6,859 (1,252) 1 Includes the tax impact that resulted from changes to our original provisional estimates of the impact of the Tax Reform Act as permitted by Staff Accounting Bulletin No. 118 ("SAB 118"). 2 Includes our reasonable estimate of the effects on our existing deferred tax balances and the one-time transition tax resulting from the Tax Reform Act that was signed into law on December 22, 2017. The provisional amount as of December 31, 2017 related to the one-time transition tax on the mandatory deemed repatriation of prescribed foreign earnings was $4.6 billion of tax expense based on cumulative prescribed foreign earnings estimated at that time to be $42 billion. The provisional amount that was primarily related to the remeasurement of certain deferred tax assets and liabilities based on the rates at which they are expected to reverse in the future was a net deferred tax benefit of $1.0 billion. 3 Includes the net tax benefit from net charges related to refranchising certain bottling territories in North America. Refer to Note 2. We made income tax payments of $2,126 million, $2,120 million and $1,950 million in 2019, 2018 and 2017, respectively. Our effective tax rate reflects the tax benefits of having significant operations outside the United States, which are generally taxed at rates lower than the U.S. statutory rate. As a result of employment actions and capital investments made by the Company, certain tax jurisdictions provide income tax incentive grants, including Brazil, Costa Rica, Singapore and Swaziland. The terms of these grants expire from 2023 to 2036. We anticipate that we will be able to extend or renew the grants in these locations. Tax incentive grants favorably impacted our income tax expense by $335 million, $318 million and $221 million for the years ended December 31, 2019, 2018 and 2017, respectively. In addition, our effective tax rate reflects the benefits of having significant earnings generated in investments accounted for under the equity method. 115