Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How much cash was received by A at the end of partnership liquidation? IV On December 31, 2020, the Statement of Financial Position of ABC

How much cash was received by A at the end of partnership liquidation?

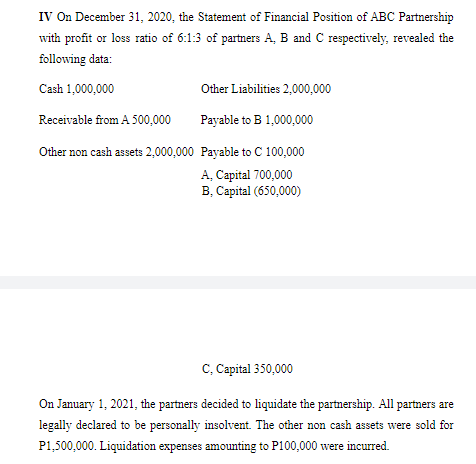

IV On December 31, 2020, the Statement of Financial Position of ABC Partnership with profit or loss ratio of 6:1-3 of partners A, B and C respectively, revealed the following data: Cash 1,000,000 Other Liabilities 2,000,000 Receivable from A 500.000 Payable to B 1.000.000 Other non cash assets 2.000.000 Payable to C 100,000 A, Capital 700,000 B, Capital (650.000) C, Capital 350.000 On January 1, 2021, the partners decided to liquidate the partnership. All partners are legally declared to be personally insolvent. The other non cash assets were sold for P1,500,000. Liquidation expenses amounting to P100,000 were incurredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started