Answered step by step

Verified Expert Solution

Question

1 Approved Answer

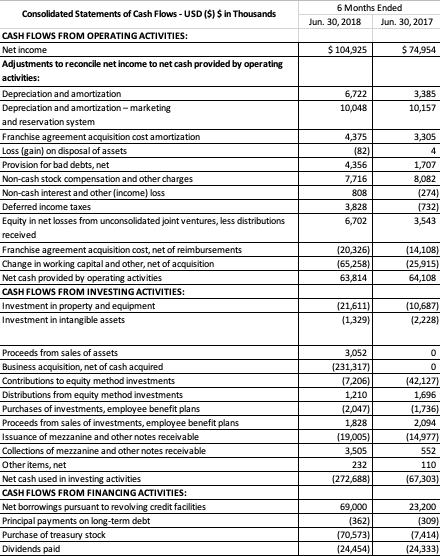

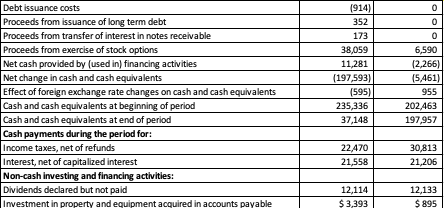

How much did it invest with hotel owners using the contributions to equity method? Investments? 6 Months Ended Consolidated Statements of Cash Flows-USD (S) $

How much did it invest with hotel owners using the contributions to equity method? Investments?

6 Months Ended Consolidated Statements of Cash Flows-USD (S) $ in Thousands Jun. 30, 2018 Jun. 30, 2017 CASH FLOWS FROM OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to net cash provided by operating actvities: Depreciation and amortization Depreciation and amortization-marketing and reservation system Franchise agreement acquisition cost amortization Loss (gain) on disposal of assets Provision for bad debts, net Non-cash stock compensa Non-cash interest and other(income) loss Deferred income taxes Equity in net losses from unconsolidated joint ventures, less distributions received Franchise agreement acquisition cost, net of reimbursements Change in working capital and other, net of acquisition Net cash provided by operating activitles CASH FLOWS FROM INVESTING ACTIVITIES: Investment in property and equipment Investment in intangible assets 104,925 $74,954 6,722 10,048 3,385 10,157 4,375 3,305 4,356 7,716 808 3,828 6,702 1,707 8,082 (274) (732) 3,543 tion and other charges (20,326 (65,258 63,814 14,108) 64,108 (21,611) 1,329) (2,228) 3,052 (231,317) Proceeds from sales of assets Business acquisition, net of cash acquired to equity method investments Distributions from equity method investments Purchases of investments, employee benefit plans Proceeds from sales of investments, employee benefit plans Issuance of mezzanine and other notes receivable Collections of mezzanine and other notes receivable Other items, net Net cash used in investing activitles CASH FLOWS FROM FINANCING ACTIVITIES: Net borrowings pursuant to revolving credit facilities Principal payments on long-term debt Purchase of treasury stock Dividends paid 1,210 (2,047 1,828 (19,005) 3,505 232 1,696 (1,736 2,094 552 110 (67,303) 69,000 23,200 (309) (7414 24,333) (70,573 (24,A54) Debt issuance costs Proceeds from issuance of long term debt Proceeds from transfer of interest in notes receivable Proceeds from exercise of stock options (914) 352 173 38,059 11,281 (197,593) (595) 235,336 6,590 2,266) (5,461 955 202,463 197,957 Cash and cash equivalents at end of period Cash payments during the period for Income taxes, net of refunds Interest, net of capitalized interest Non-cash investing and financing activities Dividends declared but not paid Investment in property and equipment acquired in accounts payable 22,470 21,558 30,813 12,114 3,393 12,133 895Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started