Question

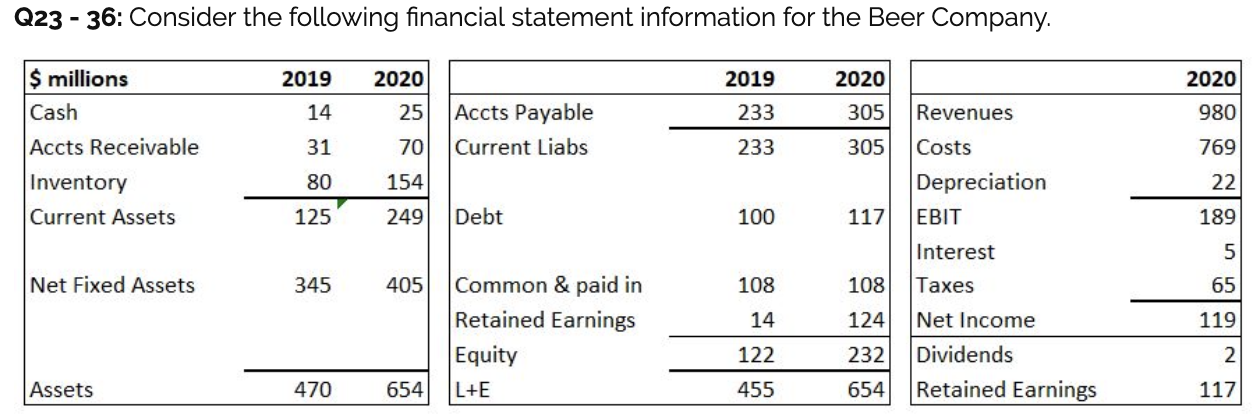

How much did the firm receive from operating cash flows in 2020? A. $151m B. $119m C. $146m How would you calculate Operating Cash Flows?

How much did the firm receive from operating cash flows in 2020?

| A. | $151m | |

| B. | $119m | |

| C. | $146m |

How would you calculate Operating Cash Flows?

| A. | OCF = EBIT + Taxes - Depreciation | |

| B. | OCF = EBIT Taxes Depreciation | |

| C. | OCF = EBIT Taxes + Depreciation |

What is the change in Net Working Capital from 2019 to 2020?

| A. | $65m | |

| B. | $52m | |

| C. | $56m |

How much did the firm spend in 2020 on Capital Expenditures?

| A. | $82m | |

| B. | $117m | |

| C. | $65m |

How do you calculate CAPEX?

| A. | CAPEX =2019 NFA 2020 NFA Depreciation | |

| B. | CAPEX = 2020 NFA 2019 NFA + Depreciation | |

| C. | CAPEX = 2019 NFA 2020 NFA + Depreciation |

Why do you add back depreciation when calculating FCF?

| A. | Depreciation is an accounting principle/theory that doesnt happen in real life | |

| B. | Depreciation is a noncash expense | |

| C. | Accountants do this to make the books look good to please shareholders |

Calculate the firms Free Cash Flows from assets

| A. | $4m | |

| B. | $12m | |

| C. | -12m |

What is the operating cycle calculation?

| A. | 74.34 days | |

| B. | 78.42 days | |

| C. | 89.71 days |

What is the accounts payable days calculation?

| A. | 127.68 days | |

| B. | 131.11 days | |

| C. | 104.23 days |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started