Answered step by step

Verified Expert Solution

Question

1 Approved Answer

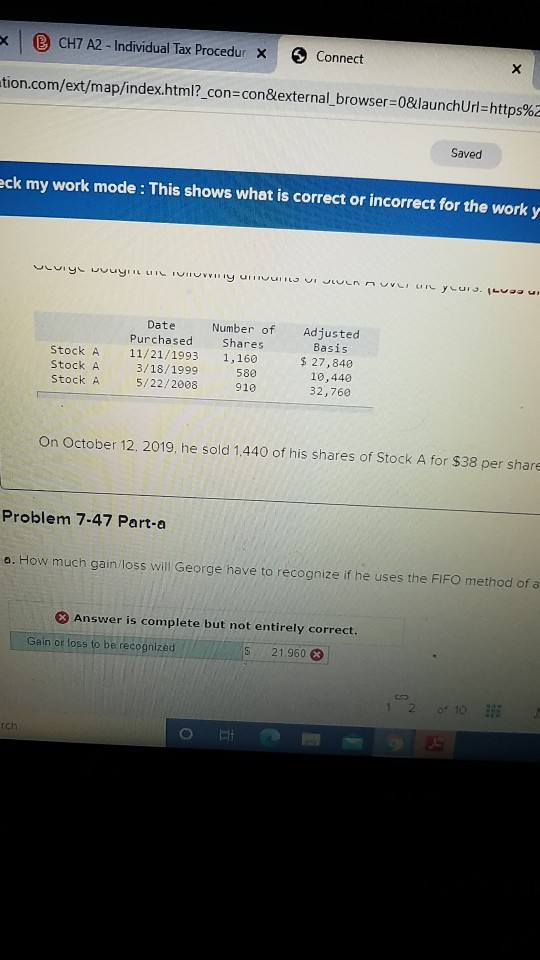

how much gain/loss will George have to recognize if he uses the fifo method of accounting for the shares sold B CH7 A2 - Individual

how much gain/loss will George have to recognize if he uses the fifo method of accounting for the shares sold

B CH7 A2 - Individual Tax Procedur X 5 Connect etion.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https% Saved eck my work mode : This shows what is correct or incorrect for the work y Ulviy uvuyIILLIL TUHUMIY UITVUILS VIJLULNUVLI CIRC y Luis Lour Stock A Stock A Stock A Date Purchased 11/21/1993 3/18/1999 5/22/2008 Number of Shares 1,160 580 910 Adjusted Basis $ 27,840 10,440 32,760 On October 12, 2019, he sold 1,440 of his shares of Stock A for $38 per share Problem 7-47 Part-a a. How much gain loss will George have to recognize if he uses the FIFO method of a Answer is complete but not entirely correct. Gain or loss to be recognized 21.9608 o 10 rch o B CH7 A2 - Individual Tax Procedur X 5 Connect etion.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https% Saved eck my work mode : This shows what is correct or incorrect for the work y Ulviy uvuyIILLIL TUHUMIY UITVUILS VIJLULNUVLI CIRC y Luis Lour Stock A Stock A Stock A Date Purchased 11/21/1993 3/18/1999 5/22/2008 Number of Shares 1,160 580 910 Adjusted Basis $ 27,840 10,440 32,760 On October 12, 2019, he sold 1,440 of his shares of Stock A for $38 per share Problem 7-47 Part-a a. How much gain loss will George have to recognize if he uses the FIFO method of a Answer is complete but not entirely correct. Gain or loss to be recognized 21.9608 o 10 rch o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started