Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How much interest would Aleem save if he paid off his mortgage over 15 years instead of 30 years? His mortgage is $100 000

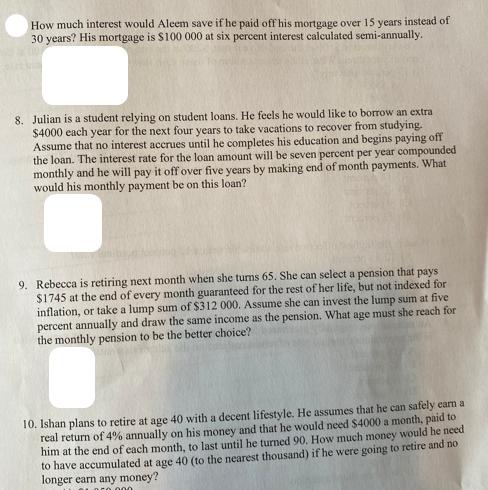

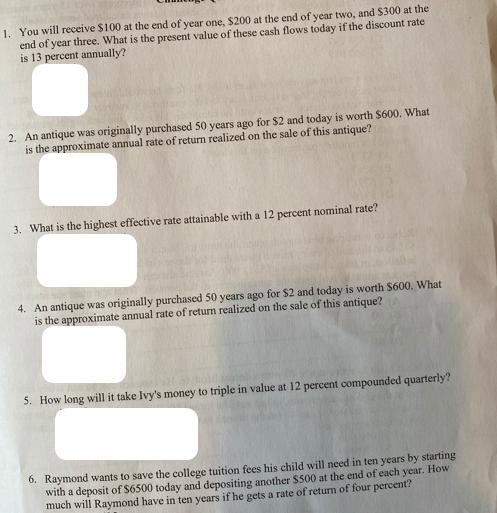

How much interest would Aleem save if he paid off his mortgage over 15 years instead of 30 years? His mortgage is $100 000 at six percent interest calculated semi-annually. 8. Julian is a student relying on student loans. He feels he would like to borrow an extra $4000 each year for the next four years to take vacations to recover from studying. Assume that no interest accrues until he completes his education and begins paying off the loan. The interest rate for the loan amount will be seven percent per year compounded monthly and he will pay it off over five years by making end of month payments. What would his monthly payment be on this loan? 9. Rebecca is retiring next month when she turns 65. She can select a pension that pays $1745 at the end of every month guaranteed for the rest of her life, but not indexed for inflation, or take a lump sum of $312 000. Assume she can invest the lump sum at five percent annually and draw the same income as the pension. What age must she reach for the monthly pension to be the better choice? 10. Ishan plans to retire at age 40 with a decent lifestyle. He assumes that he can safely earn a real return of 4% annually on his money and that he would need $4000 a month, paid to him at the end of each month, to last until he turned 90. How much money would he need to have accumulated at age 40 (to the nearest thousand) if he were going to retire and no longer earn any money? 1. You will receive $100 at the end of year one, $200 at the end of year two, and $300 at the end of year three. What is the present value of these cash flows today if the discount rate is 13 percent annually? 2. An antique was originally purchased 50 years ago for $2 and today is worth $600. What is the approximate annual rate of return realized on the sale of this antique? 3. What is the highest effective rate attainable with a 12 percent nominal rate? 4. An antique was originally purchased 50 years ago for $2 and today is worth $600. What is the approximate annual rate of return realized on the sale of this antique? 5. How long will it take Ivy's money to triple in value at 12 percent compounded quarterly? 6. Raymond wants to save the college tuition fees his child will need in ten years by starting with a deposit of $6500 today and depositing another $500 at the end of each year. How much will Raymond have in ten years if he gets a rate of return of four percent?

Step by Step Solution

★★★★★

3.55 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

8 To calculate the monthly payment on Julians loan we can use the loan amortization formula Loan Amount 4000 per year for 4 years 16000 Interest Rate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started