Answered step by step

Verified Expert Solution

Question

1 Approved Answer

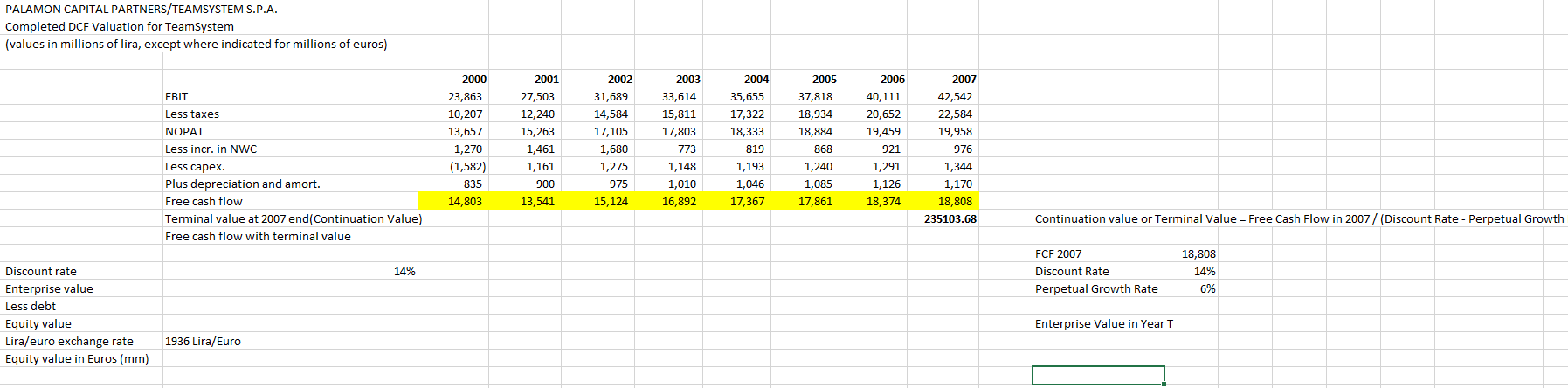

How much is 51% of Team System's common equity worth? Use both a discounted cash flow and a multiple-based valuation, for multiple method, use at

- How much is 51% of Team System's common equity worth? Use both a discounted cash flow and a multiple-based valuation, for multiple method, use at least Sales/EV(enterprise value) ?and EBIT/EV multiples to estimate the equity value.?

PALAMON CAPITAL PARTNERS/TEAMSYSTEM S.P.A. Completed DCF Valuation for TeamSystem (values in millions of lira, except where indicated for millions of euros) Discount rate Enterprise value Less debt Equity value Lira/euro exchange rate Equity value in Euros (mm) EBIT Less taxes NOPAT Less incr. in NWC Less capex. Plus depreciation and amort. Free cash flow Terminal value at 2007 end(Continuation Value) Free cash flow with terminal value 1936 Lira/Euro 14% 2000 23,863 10,207 13,657 1,270 (1,582) 835 14,803 2001 27,503 12,240 15,263 1,461 1,161 900 13,541 2002 31,689 14,584 17,105 1,680 1,275 975 15,124 2003 33,614 15,811 17,803 773 1,148 1,010 16,892 2004 35,655 17,322 18,333 819 1,193 1,046 17,367 2005 37,818 18,934 18,884 868 1,240 1,085 17,861 2006 40,111 20,652 19,459 921 1,291 1,126 18,374 2007 42,542 22,584 19,958 976 1,344 1,170 18,808 235103.68 Continuation value or Terminal Value = Free Cash Flow in 2007/ (Discount Rate - Perpetual Growth FCF 2007 Discount Rate Perpetual Growth Rate Enterprise Value in Year T 18,808 14% 6%

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To calculate the equity value of Team System using both discounted cash flow DCF and multiple...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started