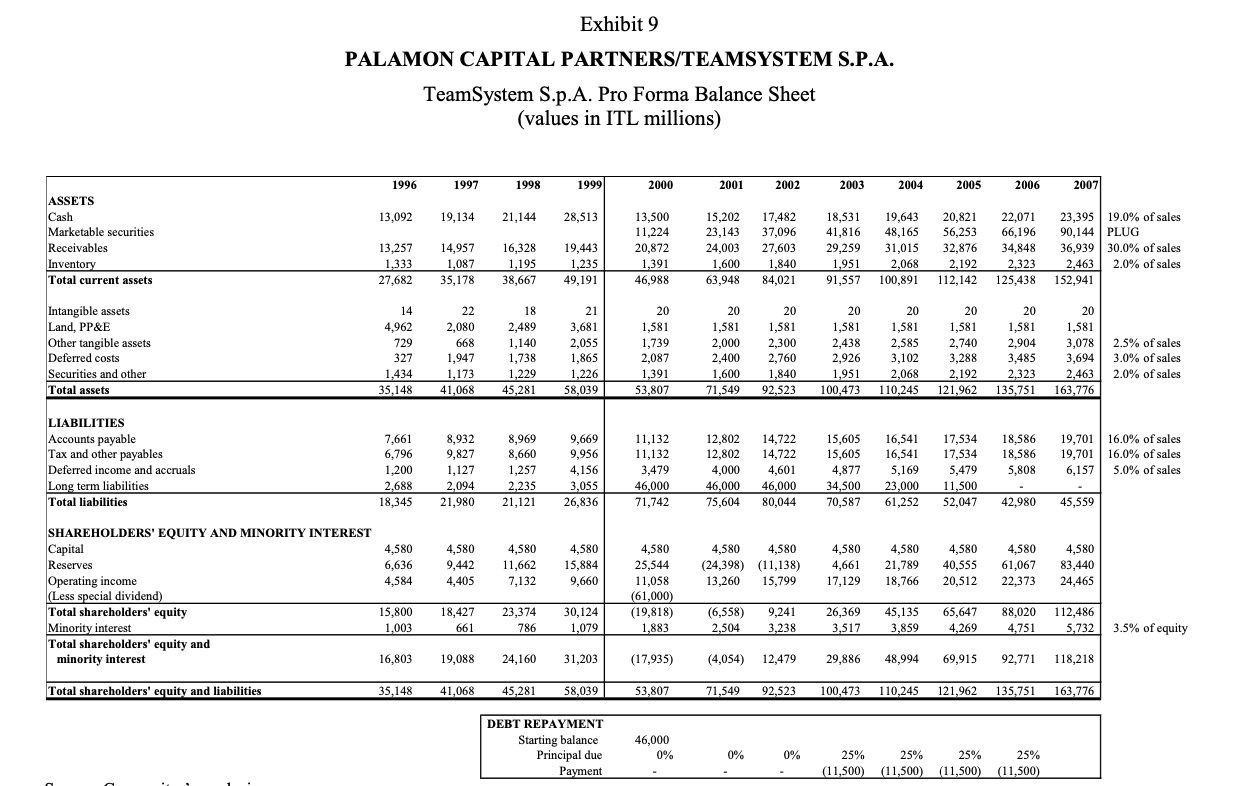

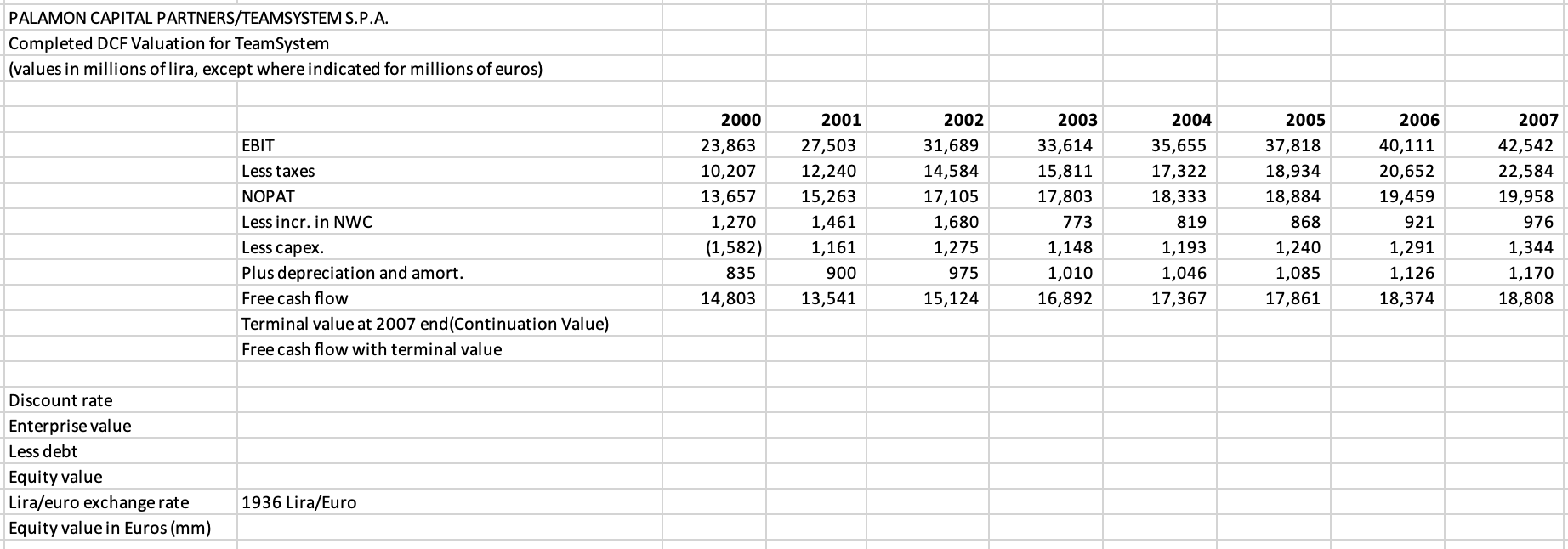

How much is 51% of TeamSystems common equity worth? Use both a discounted cash flow and a multiple-based valuation to justify your recommendation.

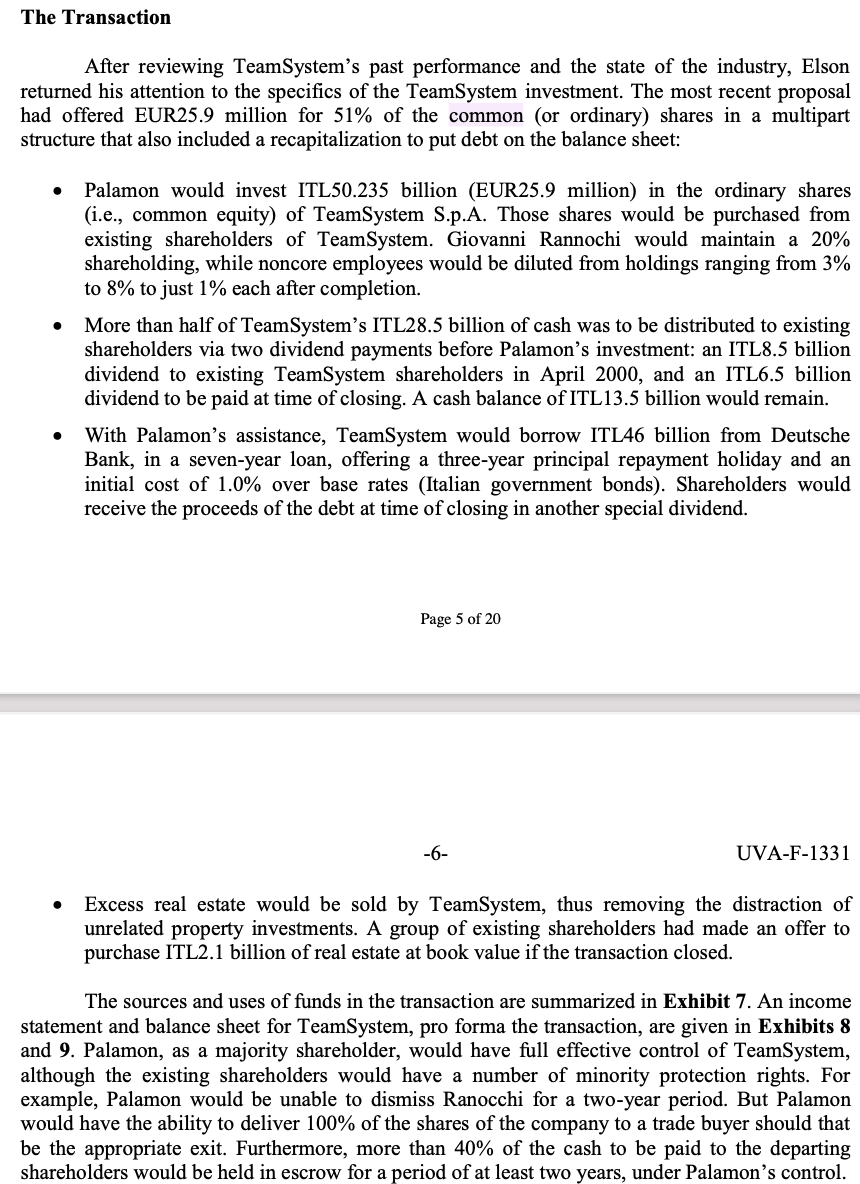

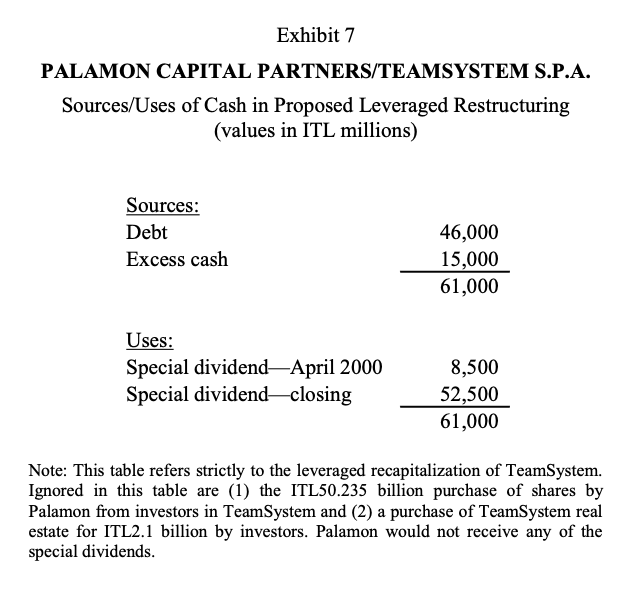

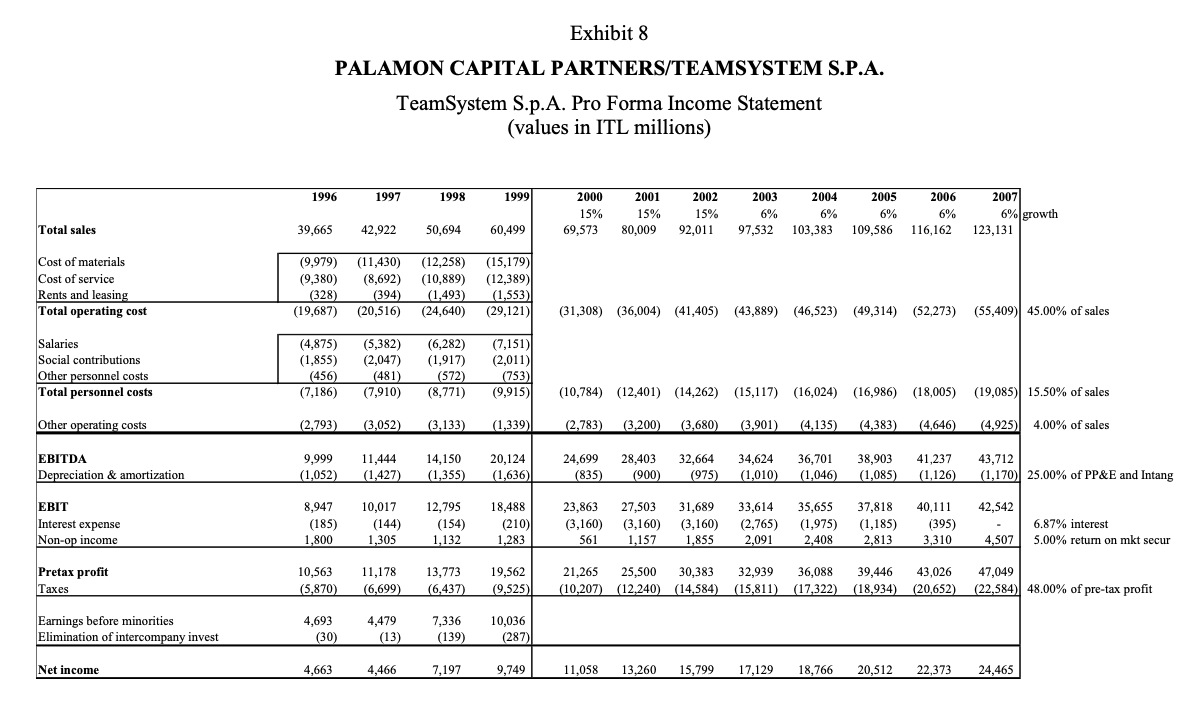

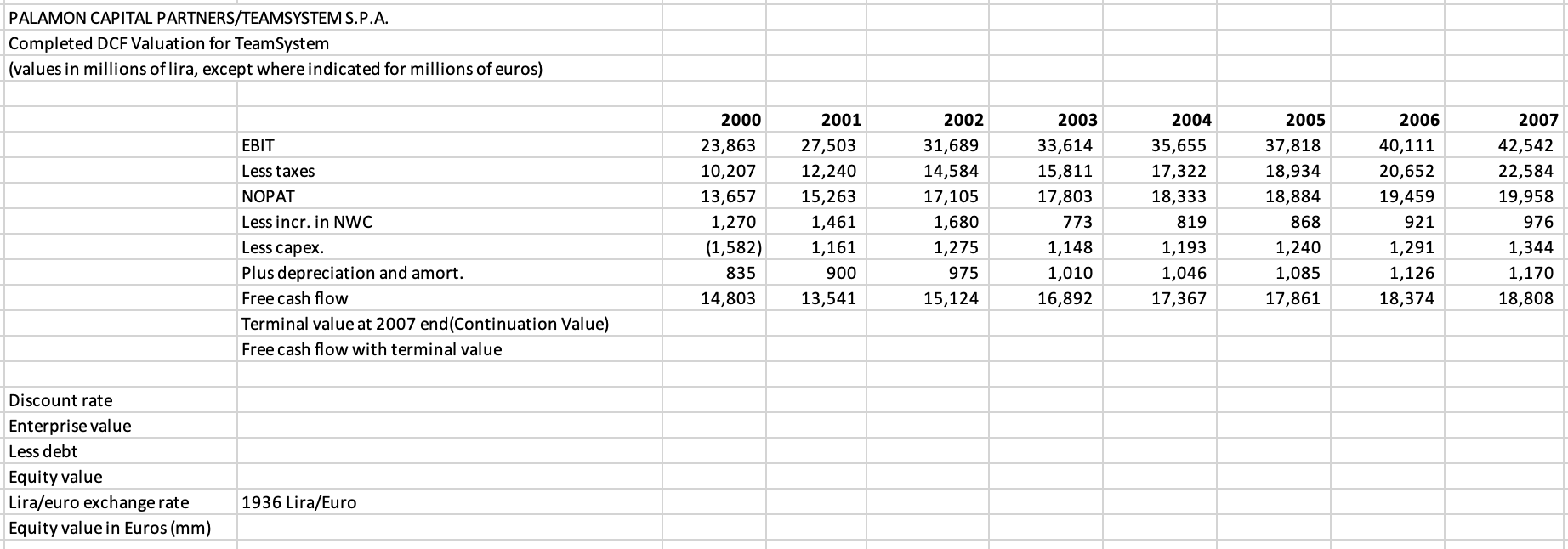

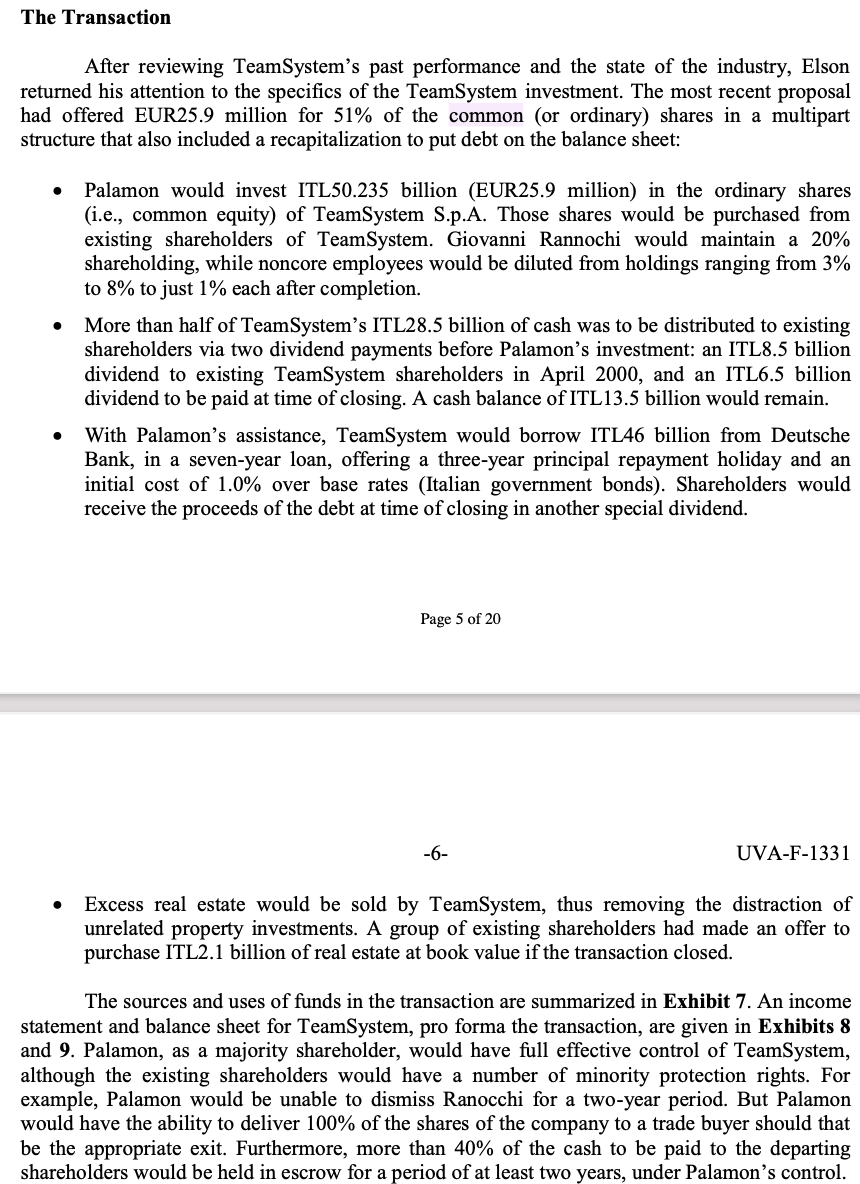

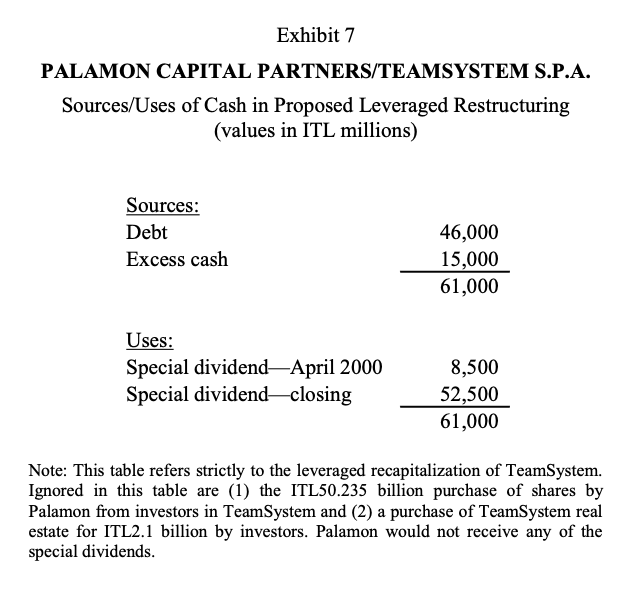

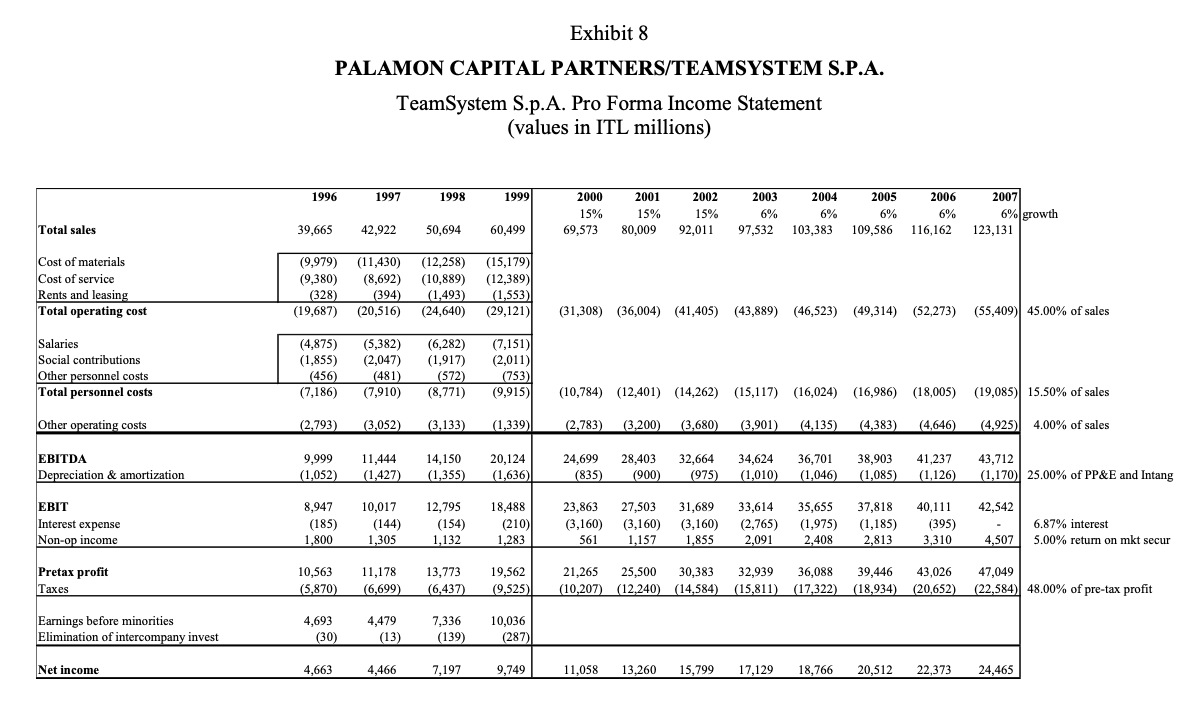

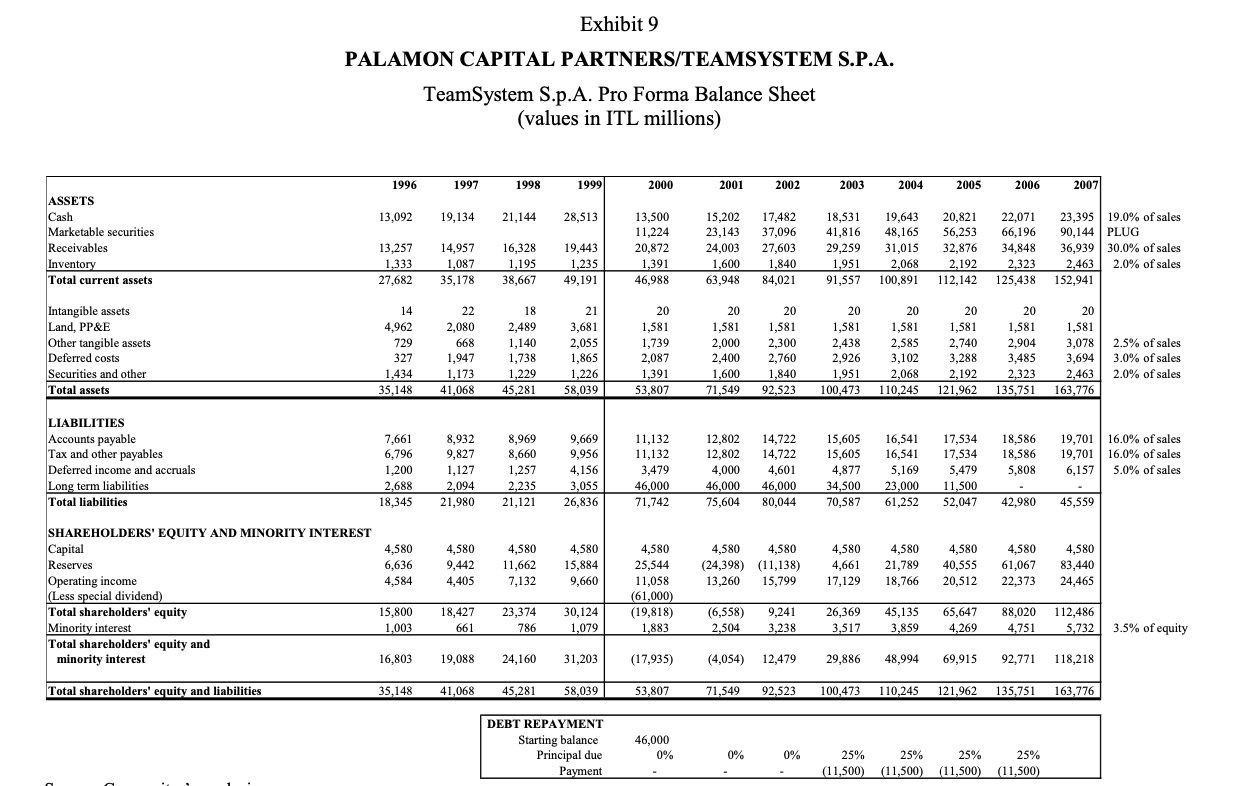

The Transaction After reviewing TeamSystem's past performance and the state of the industry, Elson returned his attention to the specifics of the TeamSystem investment. The most recent proposal had offered EUR25.9 million for 51% of the common (or ordinary) shares in a multipart structure that also included a recapitalization to put debt on the balance sheet: . Palamon would invest ITL50.235 billion (EUR25.9 million) in the ordinary shares (i.e., common equity) of TeamSystem S.p.A. Those shares would be purchased from existing shareholders of TeamSystem. Giovanni Rannochi would maintain a 20% shareholding, while noncore employees would be diluted from holdings ranging from 3% to 8% to just 1% each after completion. More than half of TeamSystem's ITL28.5 billion of cash was to be distributed to existing shareholders via two dividend payments before Palamon's investment: an ITL8.5 billion dividend to existing TeamSystem shareholders in April 2000, and an ITL6.5 billion dividend to be paid at time of closing. A cash balance of ITL 13.5 billion would remain. With Palamon's assistance, TeamSystem would borrow ITL46 billion from Deutsche Bank, in a seven-year loan, offering a three-year principal repaymen holiday and an initial cost of 1.0% over base rates (Italian government bonds). Shareholders would receive the proceeds of the debt at time of closing in another special dividend. Page 5 of 20 -6- UVA-F-1331 Excess real estate would be sold by TeamSystem, thus removing the distraction of unrelated property investments. A group of existing shareholders had made an offer to purchase ITL2.1 billion of real estate at book value if the transaction closed. The sources and uses of funds in the transaction are summarized in Exhibit 7. An income statement and balance sheet for TeamSystem, pro forma the transaction, are given in Exhibits 8 and 9. Palamon, as a majority shareholder, would have full effective control of TeamSystem, although the existing shareholders would have a number of minority protection rights. For example, Palamon would be unable to dismiss Ranocchi for a two-year period. But Palamon would have the ability to deliver 100% of the shares of the company to a trade buyer should that be the appropriate exit. Furthermore, more than 40% of the cash to be paid to the departing shareholders would be held in escrow for a period of at least two years, under Palamon's control. Exhibit 7 PALAMON CAPITAL PARTNERS/TEAMSYSTEM S.P.A. Sources/Uses of Cash in Proposed Leveraged Restructuring (values in ITL millions) Sources: Debt Excess cash 46,000 15,000 61,000 Uses: Special dividend-April 2000 Special dividend closing 8,500 52,500 61,000 Note: This table refers strictly to the leveraged recapitalization of TeamSystem. Ignored in this table are (1) the ITL50.235 billion purchase of shares by Palamon from investors in TeamSystem and (2) a purchase of TeamSystem real estate for ITL2.1 billion by investors. Palamon would not receive any of the special dividends. Exhibit 8 PALAMON CAPITAL PARTNERS/TEAMSYSTEM S.P.A. TeamSystem S.p.A. Pro Forma Income Statement (values in ITL millions) 1996 1997 1998 1999 2000 15% 69,573 2001 15% 80,009 2002 15% 92,011 2003 6% 97,532 2004 6% 103,383 2005 6% 2006 6% 116,162 2007) 6% growth 123,131 Total sales 39,665 42,922 50,694 60,499 109,586 Cost of materials Cost of service Rents and leasing Total operating cost (9,979) (9,380) (328) (19,687) (11,430) (8,692) (394) (20,516) (12,258) (15,179) (10,889) (12,389) (1,493) (1,553) (24,640) (29,121) (31,308) (36,004) (41,405) (43,889) (46,523) (49,314) (52,273) (55,409) 45.00% of sales Salaries Social contributions Other personnel costs Total personnel costs (4,875) (1,855) (456) (7,186) (5,382) (2,047) (481) (7,910) (6,282) (1,917) (572) (8,771) (7,151) (2,011) (753) (9,915) (10,784) (12,401) (14,262) (15,117) (16,024) (16,986) (18,005) (19,085) 15.50% of sales Other operating costs (2,793) (3,052) (3,133) (1,339) (2,783) (3,200) (3,680) (3,901) (4,135) (4,383) (4,646) (4,925) 4.00% of sales EBITDA Depreciation & amortization 9,999 (1,052) 11,444 (1,427) 14,150 (1,355) 20,124 (1,636) 24,699 (835) 28,403 (900) 32,664 (975) 34,624 (1,010) ) 36,701 (1,046) 38,903 (1,085) 41,237 (1,126) 43,712 (1,170) 25.00% of PP&E and Intang 35,655 37,818 40,111 EBIT Interest expense Non-op income 8,947 (185) 1,800 10.017 (144) 1,305 12,795 (154) 1,132 18,488 (210) 1,283 23,863 (3,160) 561 27,503 (3,160 1,157 31,689 (3,160) 1,855 33,614 (2,765) 2,091 (1,975) (1,185) (395) 42,542 6.87% interest 4,507 5.00% return on mkt secur 2,408 2,813 3,310 10,563 25,500 Pretax profit Taxes 11,178 (6,699) 13,773 (6,437) 19,562 (9,525) (5,870) 21,265 30,383 32,939 36,088 39,446 43,026 47,049 (10,207) (12,240) (14,584) (15,811) (17,322) (18,934) (20,652) (22,584) 48.00% of pre-tax profit Earnings before minorities Elimination of intercompany invest 4,693 (30) 4,479 (13) 7,336 (139) 10,036 (287) Net income 4,663 4,466 7,197 9,749 11,058 13,260 15,799 17,129 18,766 20,512 22,373 24,465 Exhibit 9 PALAMON CAPITAL PARTNERS/TEAMSYSTEM S.P.A. TeamSystem S.p.A. Pro Forma Balance Sheet (values in ITL millions) 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 13,092 19,134 21,144 28,513 ASSETS Cash Marketable securities Receivables Inventory Total current assets 13,257 1,333 27,682 14,957 1,087 35,178 16,328 1,195 38,667 13,500 11,224 20,872 1,391 46,988 19,443 1,235 15,202 23,143 24,003 1,600 63,948 20,821 56,253 32.876 17,482 37,096 27,603 1,840 84,021 18,531 41,816 29,259 1,951 91,557 19.643 48,165 31,015 2,068 100,891 22,071 66,196 34,848 2,323 125,438 23,395 19.0% of sales 90,144 PLUG 36,939 30.0% of sales 2,463 2.0% of sales 152,941 2,192 49,191 112,142 Intangible assets Land, PP&E Other tangible assets Deferred costs Securities and other Total assets 14 4,962 729 327 1,434 35,148 22 2,080 668 1,947 1,173 41,068 18 2,489 1,140 1,738 1,229 45,281 21 3,681 2,055 1,865 1,226 58,039 20 1,581 1,739 2,087 1,391 53,807 20 1,581 2,000 2,400 1.600 71,549 20 1,581 2.300 2.760 1,840 92,523 20 20 20 1,581 1,581 1,581 2,438 2,585 2,740 2,926 3,102 3,288 1,951 2,068 2,192 100,473 110,245 121,962 20 1,581 2,904 3,485 2,323 135,751 20 1,581 3,078 2.5% of sales 3,694 3.0% of sales 2,463 2.0% of sales 163,776 LIABILITIES Accounts payable Tax and other payables Deferred income and accruals Long term liabilities Total liabilities 7,661 6,796 1,200 2.688 18,345 8,932 9,827 1,127 2,094 21,980 8,969 8,660 1,257 2,235 21,121 9,669 9,956 4,156 3,055 26,836 11,132 11,132 3,479 46,000 71,742 12,802 12.802 4,000 46,000 75,604 14,722 14,722 4,601 46,000 80,044 15,605 15,605 4,877 34,500 70,587 16,541 16,541 5,169 23.000 61,252 17.534 17,534 5,479 11,500 52,047 18,586 18,586 5,808 19,701 16.0% of sales 19,701 | 16.0% of sales 6,157 5.0% of sales 42,980 45,559 4,580 6,636 4,584 4,580 9,442 4,580 11,662 7,132 4,580 15,884 9,660 4,580 4,580 (24,398) (11,138) 13,260 15,799 4,580 4,661 17,129 4,580 21,789 18,766 4,580 40,555 20,512 4,580 61,067 22,373 4,580 25,544 11,058 (61,000) (19,818) 1,883 4,580 83,440 24,465 4,405 SHAREHOLDERS' EQUITY AND MINORITY INTEREST Capital Reserves Operating income (Less special dividend) Total shareholders' equity Minority interest Total shareholders' equity and minority interest 15,800 1,003 18,427 661 30,124 23,374 786 (6,558) 2,504 9,241 3,238 26,369 3,517 45,135 3,859 65,647 4.269 88,020 4.751 1,079 112,486 5,732 3.5% of equity 16,803 19,088 24,160 31,203 (17,935) (4,054) 12,479 29,886 48,994 69.915 92,771 118,218 Total shareholders' equity and liabilities 35.148 41,068 45,281 58,039 53,807 71,549 92.523 100,478 110.245 121,962 135,751 163,776 DEBT REPAYMENT Starting balance Principal due Payment 46,000 0% 0% 0% 25% 25% 25% 25% (11,500 (11,500) (11,500 (11,500) PALAMON CAPITAL PARTNERS/TEAMSYSTEM S.P.A. Completed DCF Valuation for TeamSystem (values in millions of lira, except where indicated for millions of euros) 2003 2005 EBIT Less taxes NOPAT Less incr. in NWC 2000 23,863 10,207 13,657 1,270 (1,582) 835 14,803 2001 27,503 12,240 15,263 1,461 1,161 900 13,541 2002 31,689 14,584 17,105 1,680 1,275 975 15,124 33,614 15,811 17,803 773 1,148 1,010 16,892 2004 35,655 17,322 18,333 819 1,193 1,046 17,367 37,818 18,934 18,884 868 1,240 1,085 17,861 2006 40,111 20,652 19,459 921 1,291 1,126 18,374 2007 42,542 22,584 19,958 976 1,344 1,170 18,808 Less capex. Plus depreciation and amort. Free cash flow Terminal value at 2007 end(Continuation Value) Free cash flow with terminal value Discount rate Enterprise value Less debt Equity value Lira/euro exchange rate Equity value in Euros (mm) 1936 Lira/Euro The Transaction After reviewing TeamSystem's past performance and the state of the industry, Elson returned his attention to the specifics of the TeamSystem investment. The most recent proposal had offered EUR25.9 million for 51% of the common (or ordinary) shares in a multipart structure that also included a recapitalization to put debt on the balance sheet: . Palamon would invest ITL50.235 billion (EUR25.9 million) in the ordinary shares (i.e., common equity) of TeamSystem S.p.A. Those shares would be purchased from existing shareholders of TeamSystem. Giovanni Rannochi would maintain a 20% shareholding, while noncore employees would be diluted from holdings ranging from 3% to 8% to just 1% each after completion. More than half of TeamSystem's ITL28.5 billion of cash was to be distributed to existing shareholders via two dividend payments before Palamon's investment: an ITL8.5 billion dividend to existing TeamSystem shareholders in April 2000, and an ITL6.5 billion dividend to be paid at time of closing. A cash balance of ITL 13.5 billion would remain. With Palamon's assistance, TeamSystem would borrow ITL46 billion from Deutsche Bank, in a seven-year loan, offering a three-year principal repaymen holiday and an initial cost of 1.0% over base rates (Italian government bonds). Shareholders would receive the proceeds of the debt at time of closing in another special dividend. Page 5 of 20 -6- UVA-F-1331 Excess real estate would be sold by TeamSystem, thus removing the distraction of unrelated property investments. A group of existing shareholders had made an offer to purchase ITL2.1 billion of real estate at book value if the transaction closed. The sources and uses of funds in the transaction are summarized in Exhibit 7. An income statement and balance sheet for TeamSystem, pro forma the transaction, are given in Exhibits 8 and 9. Palamon, as a majority shareholder, would have full effective control of TeamSystem, although the existing shareholders would have a number of minority protection rights. For example, Palamon would be unable to dismiss Ranocchi for a two-year period. But Palamon would have the ability to deliver 100% of the shares of the company to a trade buyer should that be the appropriate exit. Furthermore, more than 40% of the cash to be paid to the departing shareholders would be held in escrow for a period of at least two years, under Palamon's control. Exhibit 7 PALAMON CAPITAL PARTNERS/TEAMSYSTEM S.P.A. Sources/Uses of Cash in Proposed Leveraged Restructuring (values in ITL millions) Sources: Debt Excess cash 46,000 15,000 61,000 Uses: Special dividend-April 2000 Special dividend closing 8,500 52,500 61,000 Note: This table refers strictly to the leveraged recapitalization of TeamSystem. Ignored in this table are (1) the ITL50.235 billion purchase of shares by Palamon from investors in TeamSystem and (2) a purchase of TeamSystem real estate for ITL2.1 billion by investors. Palamon would not receive any of the special dividends. Exhibit 8 PALAMON CAPITAL PARTNERS/TEAMSYSTEM S.P.A. TeamSystem S.p.A. Pro Forma Income Statement (values in ITL millions) 1996 1997 1998 1999 2000 15% 69,573 2001 15% 80,009 2002 15% 92,011 2003 6% 97,532 2004 6% 103,383 2005 6% 2006 6% 116,162 2007) 6% growth 123,131 Total sales 39,665 42,922 50,694 60,499 109,586 Cost of materials Cost of service Rents and leasing Total operating cost (9,979) (9,380) (328) (19,687) (11,430) (8,692) (394) (20,516) (12,258) (15,179) (10,889) (12,389) (1,493) (1,553) (24,640) (29,121) (31,308) (36,004) (41,405) (43,889) (46,523) (49,314) (52,273) (55,409) 45.00% of sales Salaries Social contributions Other personnel costs Total personnel costs (4,875) (1,855) (456) (7,186) (5,382) (2,047) (481) (7,910) (6,282) (1,917) (572) (8,771) (7,151) (2,011) (753) (9,915) (10,784) (12,401) (14,262) (15,117) (16,024) (16,986) (18,005) (19,085) 15.50% of sales Other operating costs (2,793) (3,052) (3,133) (1,339) (2,783) (3,200) (3,680) (3,901) (4,135) (4,383) (4,646) (4,925) 4.00% of sales EBITDA Depreciation & amortization 9,999 (1,052) 11,444 (1,427) 14,150 (1,355) 20,124 (1,636) 24,699 (835) 28,403 (900) 32,664 (975) 34,624 (1,010) ) 36,701 (1,046) 38,903 (1,085) 41,237 (1,126) 43,712 (1,170) 25.00% of PP&E and Intang 35,655 37,818 40,111 EBIT Interest expense Non-op income 8,947 (185) 1,800 10.017 (144) 1,305 12,795 (154) 1,132 18,488 (210) 1,283 23,863 (3,160) 561 27,503 (3,160 1,157 31,689 (3,160) 1,855 33,614 (2,765) 2,091 (1,975) (1,185) (395) 42,542 6.87% interest 4,507 5.00% return on mkt secur 2,408 2,813 3,310 10,563 25,500 Pretax profit Taxes 11,178 (6,699) 13,773 (6,437) 19,562 (9,525) (5,870) 21,265 30,383 32,939 36,088 39,446 43,026 47,049 (10,207) (12,240) (14,584) (15,811) (17,322) (18,934) (20,652) (22,584) 48.00% of pre-tax profit Earnings before minorities Elimination of intercompany invest 4,693 (30) 4,479 (13) 7,336 (139) 10,036 (287) Net income 4,663 4,466 7,197 9,749 11,058 13,260 15,799 17,129 18,766 20,512 22,373 24,465 Exhibit 9 PALAMON CAPITAL PARTNERS/TEAMSYSTEM S.P.A. TeamSystem S.p.A. Pro Forma Balance Sheet (values in ITL millions) 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 13,092 19,134 21,144 28,513 ASSETS Cash Marketable securities Receivables Inventory Total current assets 13,257 1,333 27,682 14,957 1,087 35,178 16,328 1,195 38,667 13,500 11,224 20,872 1,391 46,988 19,443 1,235 15,202 23,143 24,003 1,600 63,948 20,821 56,253 32.876 17,482 37,096 27,603 1,840 84,021 18,531 41,816 29,259 1,951 91,557 19.643 48,165 31,015 2,068 100,891 22,071 66,196 34,848 2,323 125,438 23,395 19.0% of sales 90,144 PLUG 36,939 30.0% of sales 2,463 2.0% of sales 152,941 2,192 49,191 112,142 Intangible assets Land, PP&E Other tangible assets Deferred costs Securities and other Total assets 14 4,962 729 327 1,434 35,148 22 2,080 668 1,947 1,173 41,068 18 2,489 1,140 1,738 1,229 45,281 21 3,681 2,055 1,865 1,226 58,039 20 1,581 1,739 2,087 1,391 53,807 20 1,581 2,000 2,400 1.600 71,549 20 1,581 2.300 2.760 1,840 92,523 20 20 20 1,581 1,581 1,581 2,438 2,585 2,740 2,926 3,102 3,288 1,951 2,068 2,192 100,473 110,245 121,962 20 1,581 2,904 3,485 2,323 135,751 20 1,581 3,078 2.5% of sales 3,694 3.0% of sales 2,463 2.0% of sales 163,776 LIABILITIES Accounts payable Tax and other payables Deferred income and accruals Long term liabilities Total liabilities 7,661 6,796 1,200 2.688 18,345 8,932 9,827 1,127 2,094 21,980 8,969 8,660 1,257 2,235 21,121 9,669 9,956 4,156 3,055 26,836 11,132 11,132 3,479 46,000 71,742 12,802 12.802 4,000 46,000 75,604 14,722 14,722 4,601 46,000 80,044 15,605 15,605 4,877 34,500 70,587 16,541 16,541 5,169 23.000 61,252 17.534 17,534 5,479 11,500 52,047 18,586 18,586 5,808 19,701 16.0% of sales 19,701 | 16.0% of sales 6,157 5.0% of sales 42,980 45,559 4,580 6,636 4,584 4,580 9,442 4,580 11,662 7,132 4,580 15,884 9,660 4,580 4,580 (24,398) (11,138) 13,260 15,799 4,580 4,661 17,129 4,580 21,789 18,766 4,580 40,555 20,512 4,580 61,067 22,373 4,580 25,544 11,058 (61,000) (19,818) 1,883 4,580 83,440 24,465 4,405 SHAREHOLDERS' EQUITY AND MINORITY INTEREST Capital Reserves Operating income (Less special dividend) Total shareholders' equity Minority interest Total shareholders' equity and minority interest 15,800 1,003 18,427 661 30,124 23,374 786 (6,558) 2,504 9,241 3,238 26,369 3,517 45,135 3,859 65,647 4.269 88,020 4.751 1,079 112,486 5,732 3.5% of equity 16,803 19,088 24,160 31,203 (17,935) (4,054) 12,479 29,886 48,994 69.915 92,771 118,218 Total shareholders' equity and liabilities 35.148 41,068 45,281 58,039 53,807 71,549 92.523 100,478 110.245 121,962 135,751 163,776 DEBT REPAYMENT Starting balance Principal due Payment 46,000 0% 0% 0% 25% 25% 25% 25% (11,500 (11,500) (11,500 (11,500) PALAMON CAPITAL PARTNERS/TEAMSYSTEM S.P.A. Completed DCF Valuation for TeamSystem (values in millions of lira, except where indicated for millions of euros) 2003 2005 EBIT Less taxes NOPAT Less incr. in NWC 2000 23,863 10,207 13,657 1,270 (1,582) 835 14,803 2001 27,503 12,240 15,263 1,461 1,161 900 13,541 2002 31,689 14,584 17,105 1,680 1,275 975 15,124 33,614 15,811 17,803 773 1,148 1,010 16,892 2004 35,655 17,322 18,333 819 1,193 1,046 17,367 37,818 18,934 18,884 868 1,240 1,085 17,861 2006 40,111 20,652 19,459 921 1,291 1,126 18,374 2007 42,542 22,584 19,958 976 1,344 1,170 18,808 Less capex. Plus depreciation and amort. Free cash flow Terminal value at 2007 end(Continuation Value) Free cash flow with terminal value Discount rate Enterprise value Less debt Equity value Lira/euro exchange rate Equity value in Euros (mm) 1936 Lira/Euro