Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How much is Targets contractual obligation for interest payments associated with long-term debt at the end of fiscal 2017? 20. Notes Payable and Long-Term Debt

How much is Targets contractual obligation for interest payments associated with long-term debt at the end of fiscal 2017?

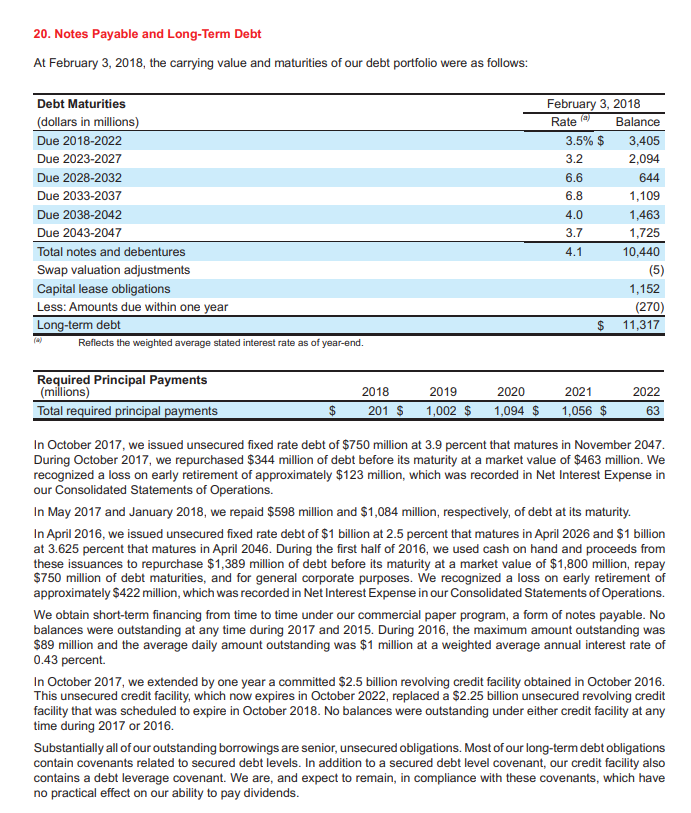

20. Notes Payable and Long-Term Debt At February 3,2018 , the carrying value and maturities of our debt portfolio were as follows: = In October 2017, we issued unsecured fixed rate debt of \$750 million at 3.9 percent that matures in November 2047. During October 2017, we repurchased \$344 million of debt before its maturity at a market value of $463 million. We recognized a loss on early retirement of approximately $123 million, which was recorded in Net Interest Expense in our Consolidated Statements of Operations. In May 2017 and January 2018, we repaid \$598 million and \$1,084 million, respectively, of debt at its maturity. In April 2016, we issued unsecured fixed rate debt of \$1 billion at 2.5 percent that matures in April 2026 and \$1 billion at 3.625 percent that matures in April 2046. During the first half of 2016, we used cash on hand and proceeds from these issuances to repurchase $1,389 million of debt before its maturity at a market value of $1,800 million, repay $750 million of debt maturities, and for general corporate purposes. We recognized a loss on early retirement of approximately \$422 million, which was recorded in Net Interest Expense in our Consolidated Statements of Operations. We obtain short-term financing from time to time under our commercial paper program, a form of notes payable. No balances were outstanding at any time during 2017 and 2015. During 2016, the maximum amount outstanding was $89 million and the average daily amount outstanding was $1 million at a weighted average annual interest rate of 0.43 percent. In October 2017, we extended by one year a committed \$2.5 billion revolving credit facility obtained in October 2016. This unsecured credit facility, which now expires in October 2022, replaced a $2.25 billion unsecured revolving credit facility that was scheduled to expire in October 2018. No balances were outstanding under either credit facility at any time during 2017 or 2016. Substantially all of our outstanding borrowings are senior, unsecured obligations. Most of our long-term debt obligations contain covenants related to secured debt levels. In addition to a secured debt level covenant, our credit facility also contains a debt leverage covenant. We are, and expect to remain, in compliance with these covenants, which have no practical effect on our ability to pay dividendsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started