How much is the market value of Infinitus?

How much is the average cost of debt?

How much is the WACC?

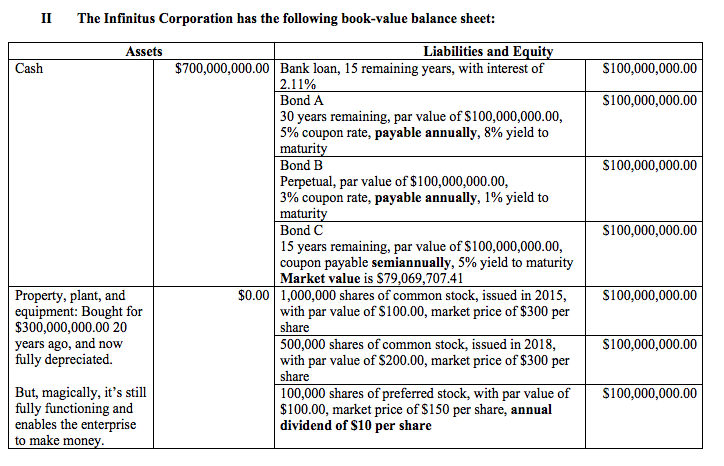

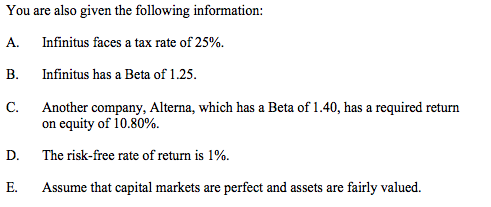

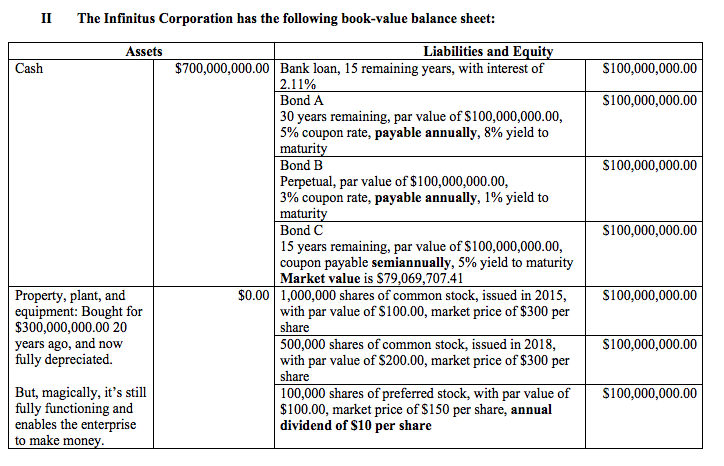

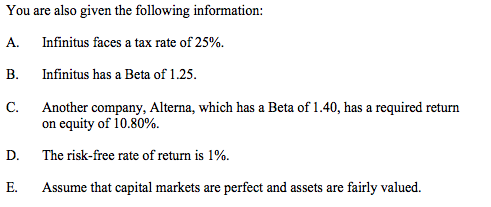

The Infinitus Corporation has the following book-value balance sheet: Liabilities and Equity $700,000,000.00| Bank loan, 15 remaining years, with interest of Assets Cash S100,000,000.00 2.11% Bond A S100,000,000.00 30 years remaining, par value of S100,000,000.00, 5% coupon rate, payable annually, 8% yield to maturity Bond B S100,000,000.00 Perpetual, par value of $100,000,000.00, 3% coupon rate, payable annually, 1% yield to maturity Bond C S100,000,000.00 15 years remaining, par value of $100,000,000.00, coupon payable semiannually, 5% yield to maturity Market value is S79,069,707.41 $0.00 1,000,000 shares of common stock, issued in 2015, with par value of S100.00, market price of $300 per share S100,000,000.00 Property, plant, and equipment: Bought for $300,000,000.00 20 500,000 shares of common stock, issued in 2018, with par value of S200.00, market price of $300 per share S100,000,000.00 years ago, and now fully depreciated. S100,000,000.00 But, magically, it's still fully functioning and enables the enterprise to make money. 100,000 shares of preferred stock, with par value of $100.00, market price of S150 per share, annual dividend of $10 per share You are also given the following information: A. Infinitus faces a tax rate of 25%. B. Infinitus has a Beta of 1.25. C. Another company, Alterna, which has a Beta of 1.40, has a required return on equity of 10.80%. D. The risk-free rate of return is 1%. E. Assume that capital markets are perfect and assets are fairly valued. The Infinitus Corporation has the following book-value balance sheet: Liabilities and Equity $700,000,000.00| Bank loan, 15 remaining years, with interest of Assets Cash S100,000,000.00 2.11% Bond A S100,000,000.00 30 years remaining, par value of S100,000,000.00, 5% coupon rate, payable annually, 8% yield to maturity Bond B S100,000,000.00 Perpetual, par value of $100,000,000.00, 3% coupon rate, payable annually, 1% yield to maturity Bond C S100,000,000.00 15 years remaining, par value of $100,000,000.00, coupon payable semiannually, 5% yield to maturity Market value is S79,069,707.41 $0.00 1,000,000 shares of common stock, issued in 2015, with par value of S100.00, market price of $300 per share S100,000,000.00 Property, plant, and equipment: Bought for $300,000,000.00 20 500,000 shares of common stock, issued in 2018, with par value of S200.00, market price of $300 per share S100,000,000.00 years ago, and now fully depreciated. S100,000,000.00 But, magically, it's still fully functioning and enables the enterprise to make money. 100,000 shares of preferred stock, with par value of $100.00, market price of S150 per share, annual dividend of $10 per share You are also given the following information: A. Infinitus faces a tax rate of 25%. B. Infinitus has a Beta of 1.25. C. Another company, Alterna, which has a Beta of 1.40, has a required return on equity of 10.80%. D. The risk-free rate of return is 1%. E. Assume that capital markets are perfect and assets are fairly valued