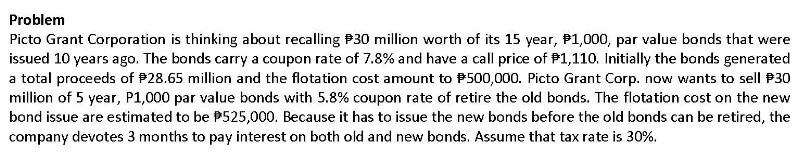

How much is the net advantage of bond refunding? Problem Picto Grant Corporation is thinking about recalling $30 million worth of its 15 year, $1,000,

How much is the net advantage of bond refunding?

Problem Picto Grant Corporation is thinking about recalling $30 million worth of its 15 year, $1,000, par value bonds that were issued 10 years ago. The bonds carry a coupon rate of 7.8% and have a call price of $1,110. Initially the bonds generated a total proceeds of $28.65 million and the flotation cost amount to $500,000. Picto Grant Corp. now wants to sell P30 million of 5 year, P1,000 par value bonds with 5.8% coupon rate of retire the old bonds. The flotation cost on the new bond issue are estimated to be P525,000. Because it has to issue the new bonds before the old bonds can be retired, the company devotes 3 months to pay interest on both old and new bonds. Assume that tax rate is 30%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the net advantage of bond refunding we need to analyze both the cash outflows and savings involved in recalling the old bonds and issuing new ones Lets break it down step by step Step 1 C...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started