Answered step by step

Verified Expert Solution

Question

1 Approved Answer

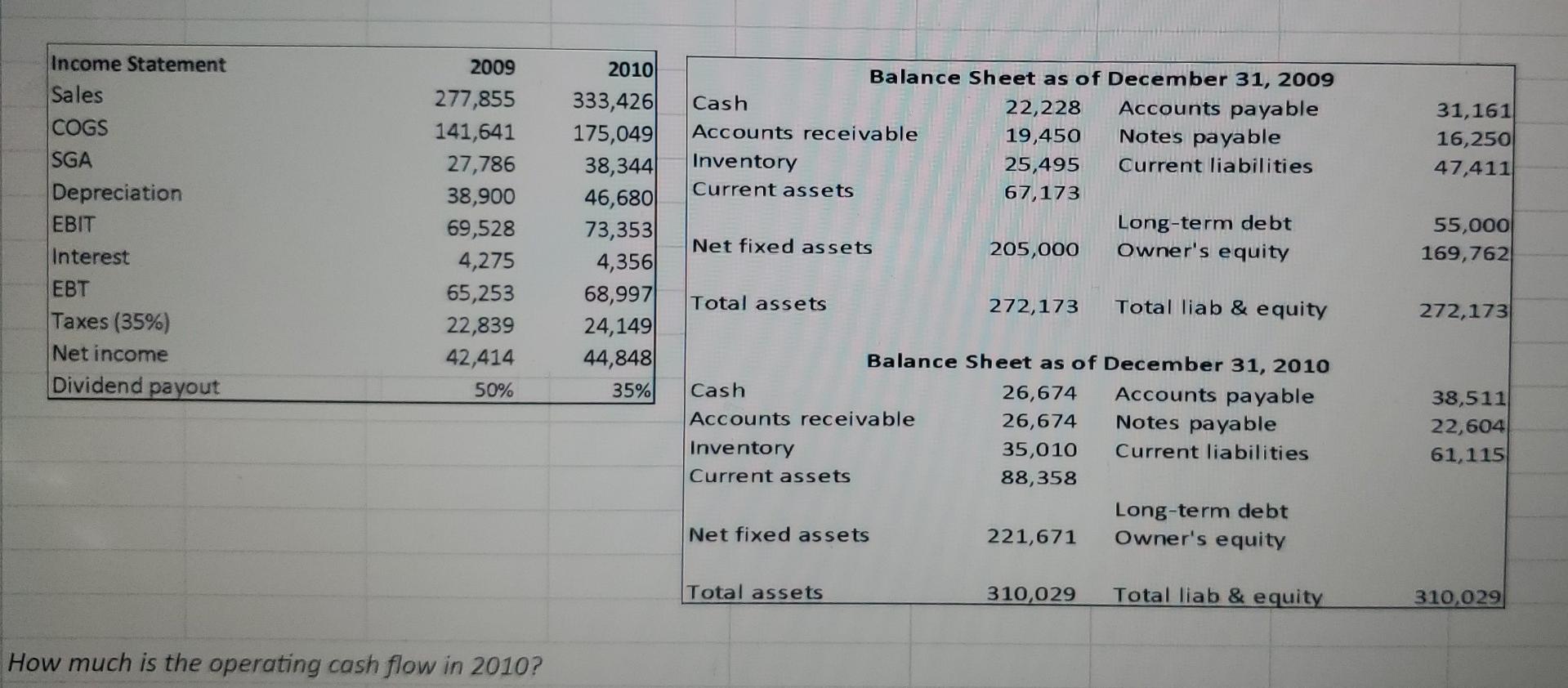

how much is the operating cash flow in 2010? Income Statement Sales COGS SGA Depreciation EBIT Interest EBT Taxes (35%) Net income Dividend payout 31,161

how much is the operating cash flow in 2010?

Income Statement Sales COGS SGA Depreciation EBIT Interest EBT Taxes (35%) Net income Dividend payout 31,161 16,2501 47,411 2009 277,855 141,641 27,786 38,900 69,528 4,275 65,253 22,839 42,414 50% 2010 333,4261 175,049 38,344 46,680 73,3531 4,356 68,997 24,149 44,848 35% Balance Sheet as of December 31, 2009 Cash 22,228 Accounts payable Accounts receivable 19,450 Notes payable Inventory 25,495 Current liabilities Current assets 67,173 Long-term debt Net fixed assets 205,000 Owner's equity 55,000 169,762 Total assets 272,173 Total liab & equity 272,173 Balance Sheet as of December 31, 2010 Cash 26,674 Accounts payable Accounts receivable 26,674 Notes payable Inventory 35,010 Current liabilities Current assets 88,358 Long-term debt Net fixed assets 221,671 Owner's equity 38,511 22,604 61,115 Total assets 310,029 Total liab & equity 310,029 How much is the operating cash flow in 2010

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started