Answered step by step

Verified Expert Solution

Question

1 Approved Answer

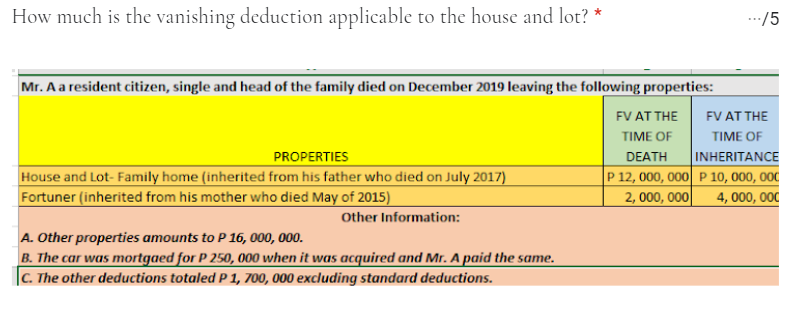

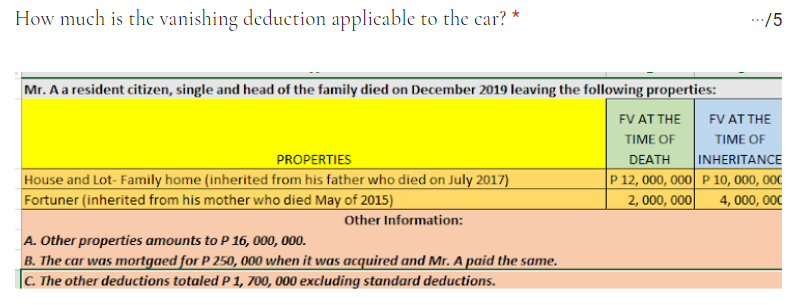

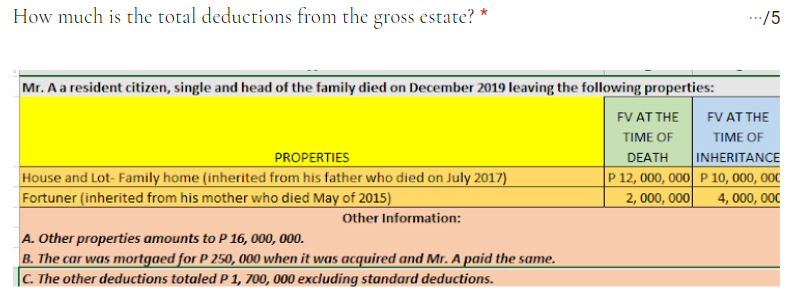

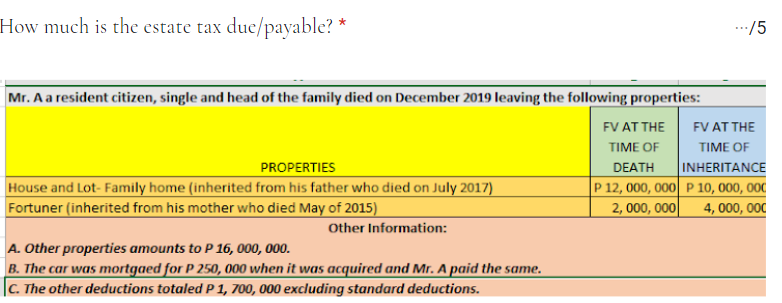

How much is the vanishing deduction applicable to the house and lot? * Mr. A a resident citizen, single and head of the family

How much is the vanishing deduction applicable to the house and lot? * Mr. A a resident citizen, single and head of the family died on December 2019 leaving the following properties: FV AT THE TIME OF INHERITANCE P 12, 000, 000 P 10, 000, 000 FV AT THE TIME OF DEATH 2,000,000 4,000,000 PROPERTIES House and Lot- Family home (inherited from his father who died on July 2017) Fortuner (inherited from his mother who died May of 2015) Other Information: .../5 A. Other properties amounts to P 16,000,000. B. The car was mortgaed for P 250, 000 when it was acquired and Mr. A paid the same. C. The other deductions totaled P 1, 700, 000 excluding standard deductions. How much is the vanishing deduction applicable to the car? * Mr. A a resident citizen, single and head of the family died on December 2019 leaving the following properties: FV AT THE TIME OF DEATH P 12, 000, 000 P 10,000,000 2,000,000 4,000,000 FV AT THE TIME OF INHERITANCE PROPERTIES House and Lot- Family home (inherited from his father who died on July 2017) Fortuner (inherited from his mother who died May of 2015) Other Information: .../5 A. Other properties amounts to P 16,000,000. B. The car was mortgaed for P 250, 000 when it was acquired and Mr. A paid the same. |C. The other deductions totaled P 1, 700, 000 excluding standard deductions. How much is the total deductions from the gross estate? Mr. A a resident citizen, single and head of the family died on December 2019 leaving the following properties: FV AT THE TIME OF DEATH P 12, 000, 000 P 10,000,000 2,000,000 4,000,000 PROPERTIES House and Lot- Family home (inherited from his father who died on July 2017) Fortuner (inherited from his mother who died May of 2015) Other Information: .../5 A. Other properties amounts to P 16,000,000. B. The car was mortgaed for P 250, 000 when it was acquired and Mr. A paid the same. C. The other deductions totaled P 1, 700, 000 excluding standard deductions. FV AT THE TIME OF INHERITANCE How much is the estate tax due/payable? * Mr. A a resident citizen, single and head of the family died on December 2019 leaving the following properties: FV AT THE TIME OF DEATH P 12, 000, 000 P 10,000,000 2,000,000 4,000,000 PROPERTIES House and Lot- Family home (inherited from his father who died on July 2017) Fortuner (inherited from his mother who died May of 2015) Other Information: .../5 A. Other properties amounts to P 16, 000, 000. B. The car was mortgaed for P 250, 000 when it was acquired and Mr. A paid the same. C. The other deductions totaled P 1, 700, 000 excluding standard deductions. FV AT THE TIME OF INHERITANCE

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the vanishing deduction applicable to the house and lot we need to determine the adjusted net estate ANE and the adjusted net share ANS o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started