Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taxation law On 1 July 2019 Mary Jackson was relocated to Brisbane for her job. On 1 August 2019 she signed a contract to buy

Taxation law

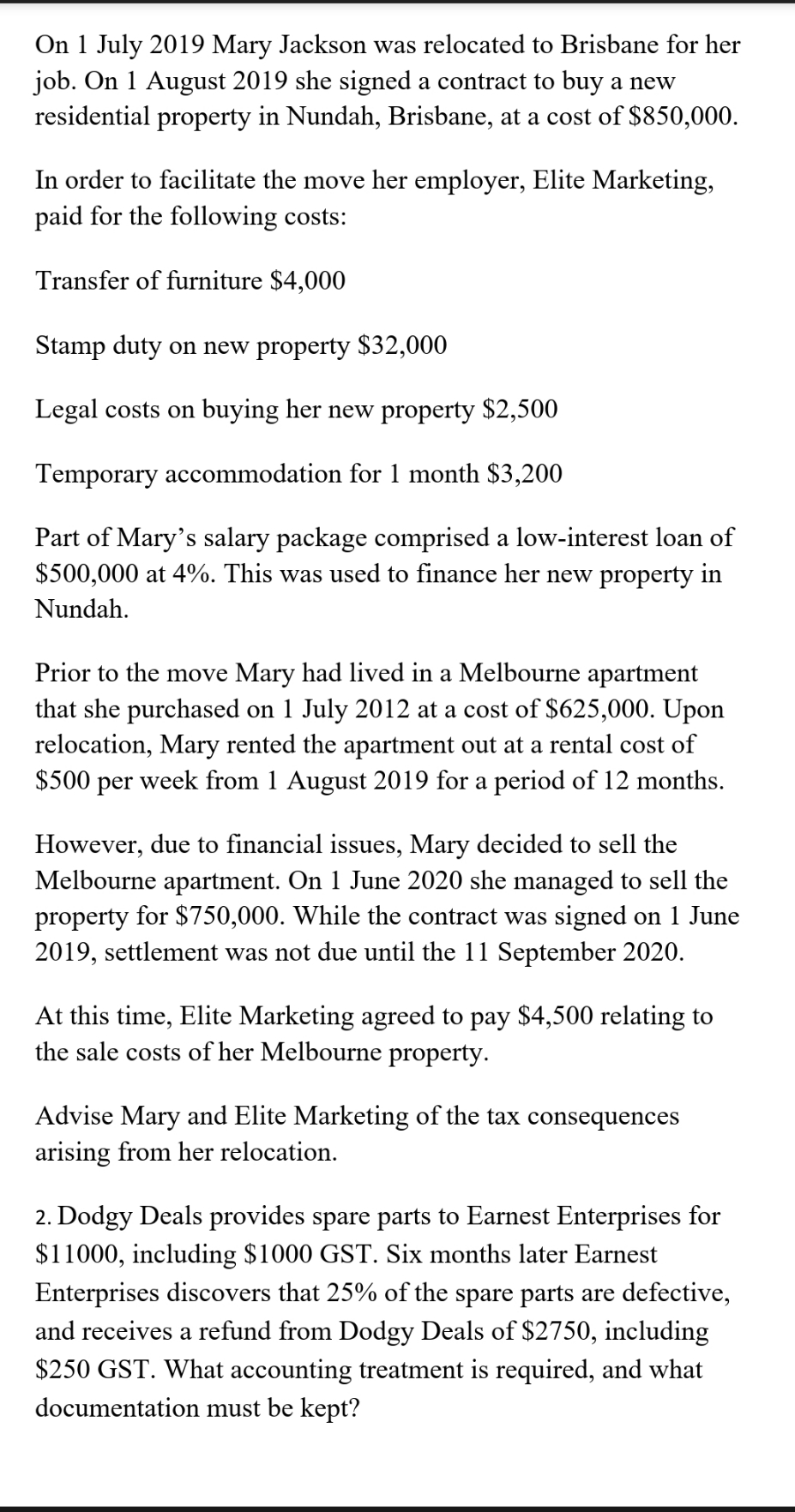

On 1 July 2019 Mary Jackson was relocated to Brisbane for her job. On 1 August 2019 she signed a contract to buy a new residential property in Nundah, Brisbane, at a cost of $850,000. In order to facilitate the move her employer, Elite Marketing, paid for the following costs: Transfer of furniture $4,000 Stamp duty on new property $32,000 Legal costs on buying her new property $2,500 Temporary accommodation for 1 month $3,200 Part of Mary's salary package comprised a low-interest loan of $500,000 at 4%. This was used to finance her new property in Nundah. Prior to the move Mary had lived in a Melbourne apartment that she purchased on 1 July 2012 at a cost of $625,000. Upon relocation, Mary rented the apartment out at a rental cost of $500 per week from 1 August 2019 for a period of 12 months. However, due to financial issues, Mary decided to sell the Melbourne apartment. On 1 June 2020 she managed to sell the property for $750,000. While the contract was signed on 1 June 2019, settlement was not due until the 11 September 2020. At this time, Elite Marketing agreed to pay $4,500 relating to the sale costs of her Melbourne property. Advise Mary and Elite Marketing of the tax consequences arising from her relocation. 2. Dodgy Deals provides spare parts to Earnest Enterprises for $11000, including $1000 GST. Six months later Earnest Enterprises discovers that 25% of the spare parts are defective, and receives a refund from Dodgy Deals of $2750, including $250 GST. What accounting treatment is required, and what documentation must be kept?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Tax Consequences of Mary Jacksons Relocation 1 Mary Relocation Expenses Paid by Employer The transfer of furniture stamp duty legal costs and temporar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started