Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How much money does Jim have left over each month to spend on food and other needs or wants? Jim has just graduated from college

How much money does Jim have left over each month to spend on food and other needs or wants?

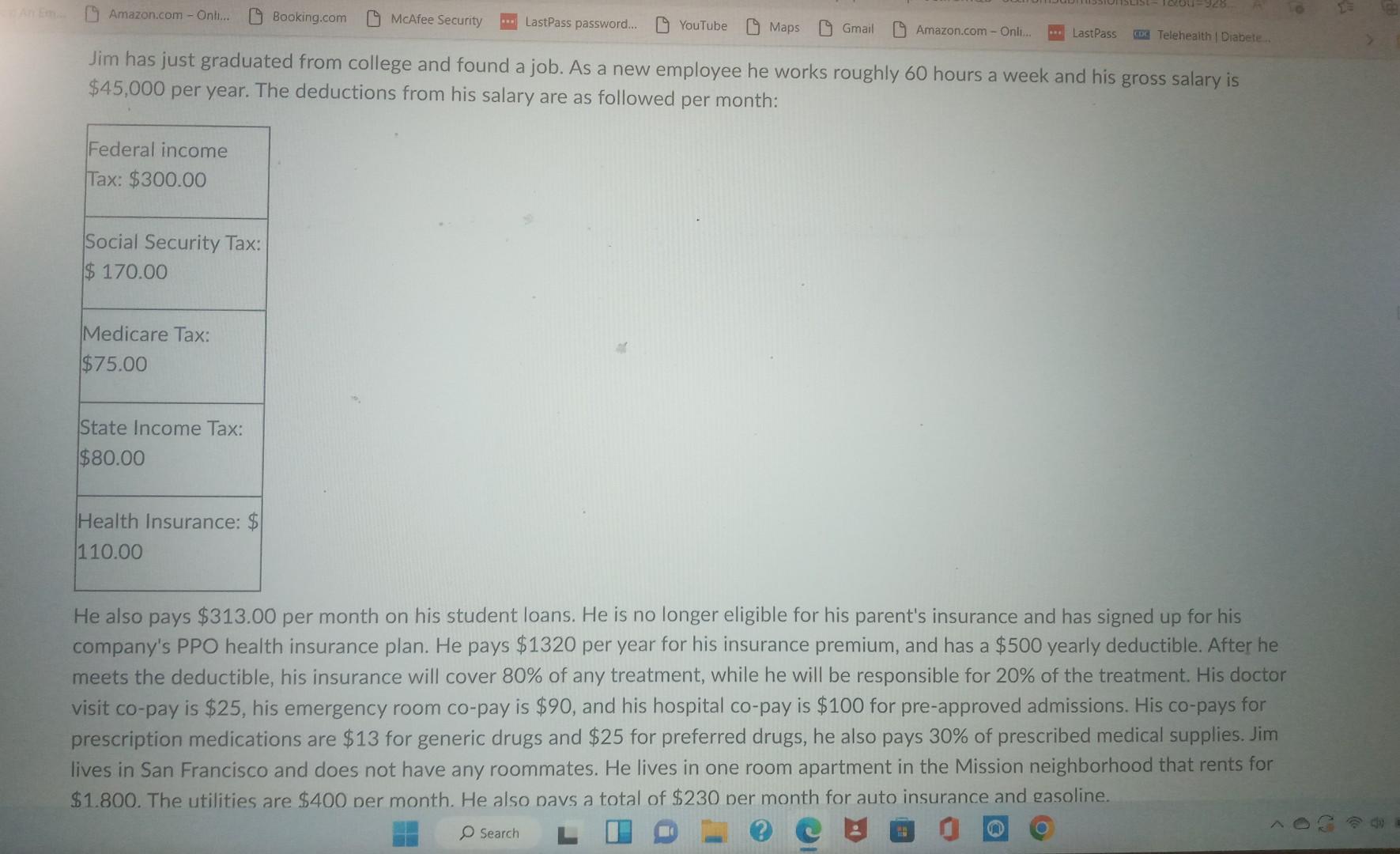

Jim has just graduated from college and found a job. As a new employee he works roughly 60 hours a week and his gross salary is $45,000 per year. The deductions from his salary are as followed per month: He also pays $313.00 per month on his student loans. He is no longer eligible for his parent's insurance and has signed up for his company's PPO health insurance plan. He pays $1320 per year for his insurance premium, and has a $500 yearly deductible. After he meets the deductible, his insurance will cover 80% of any treatment, while he will be responsible for 20% of the treatment. His doctor visit co-pay is $25, his emergency room co-pay is $90, and his hospital co-pay is $100 for pre-approved admissions. His co-pays for prescription medications are $13 for generic drugs and $25 for preferred drugs, he also pays 30% of prescribed medical supplies. Jim lives in San Francisco and does not have any roommates. He lives in one room apartment in the Mission neighborhood that rents for $1.800. The utilities are $400 ner month. He also navs a total of $230 per month for auto insurance and gasolineStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started