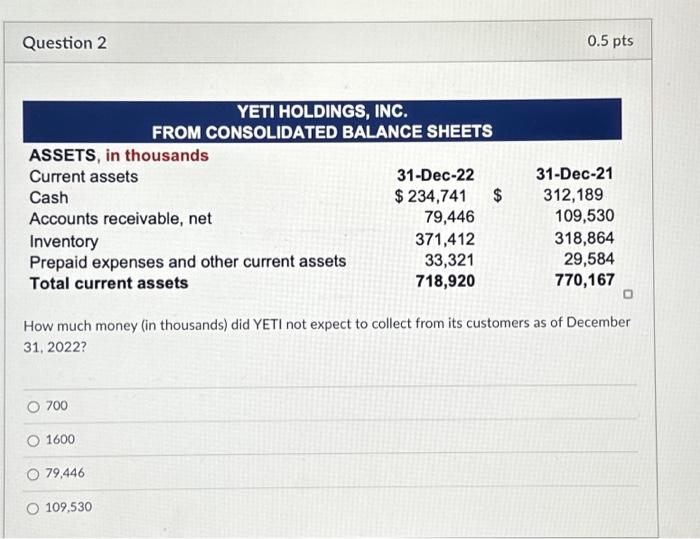

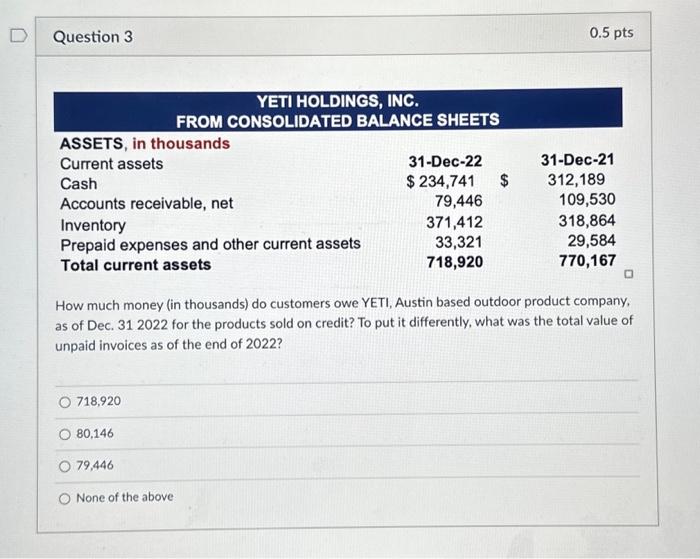

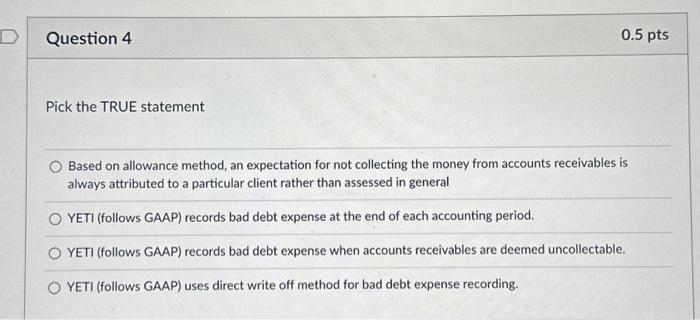

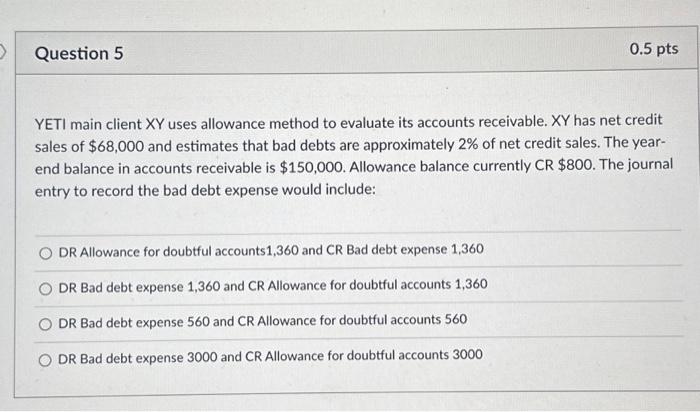

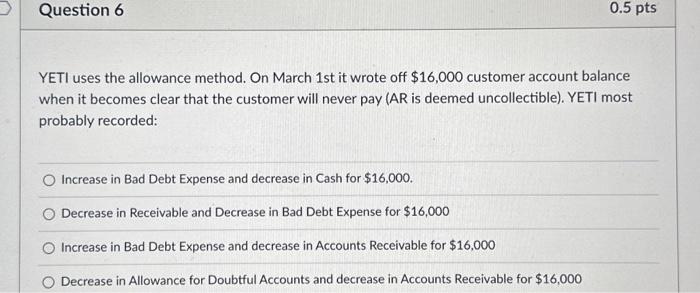

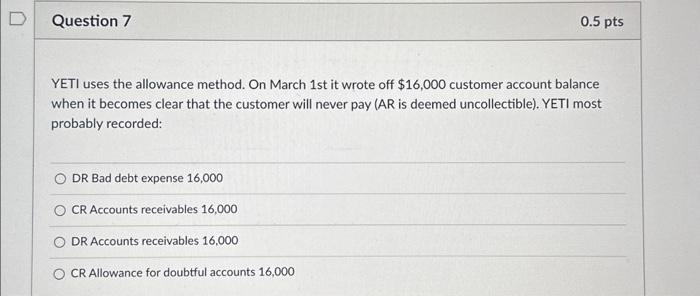

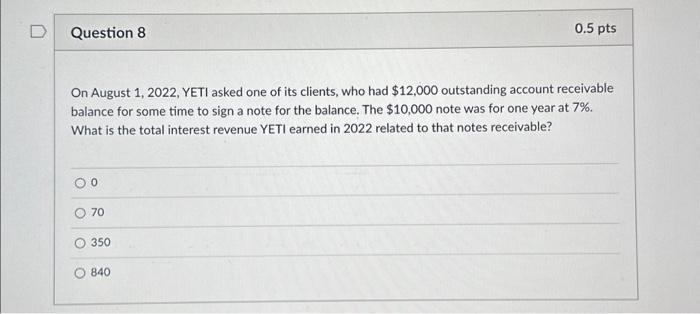

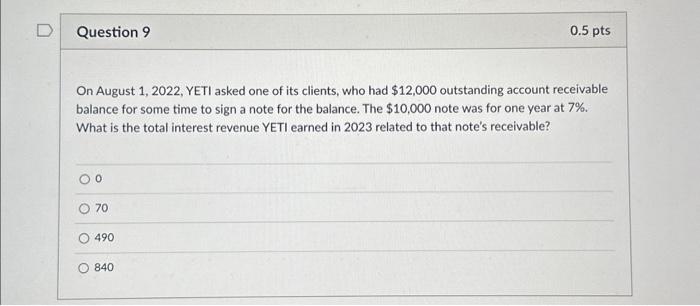

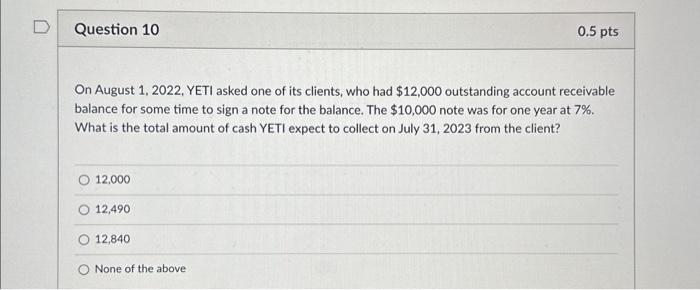

How much money (in thousands) did YETI not expect to collect from its customers as of December 31,2022 ? 700 1600 79,446 109,530 Question 3 0.5pts How much money (in thousands) do customers owe YETI, Austin based outdoor product company, as of Dec. 312022 for the products sold on credit? To put it differently, what was the total value of unpaid invoices as of the end of 2022 ? 718,920 80.146 79,446 None of the above Pick the TRUE statement Based on allowance method, an expectation for not collecting the money from accounts receivables is always attributed to a particular client rather than assessed in general YETI (follows GAAP) records bad debt expense at the end of each accounting period. YETI (follows GAAP) records bad debt expense when accounts receivables are deemed uncollectable. YETI (follows GAAP) uses direct write off method for bad debt expense recording. YETI main client XY uses allowance method to evaluate its accounts receivable. XY has net credit sales of $68,000 and estimates that bad debts are approximately 2% of net credit sales. The yearend balance in accounts receivable is $150,000. Allowance balance currently CR $800. The journal entry to record the bad debt expense would include: DR Allowance for doubtful accounts 1,360 and CR Bad debt expense 1,360 DR Bad debt expense 1,360 and CR Allowance for doubtful accounts 1,360 DR Bad debt expense 560 and CR Allowance for doubtful accounts 560 DR Bad debt expense 3000 and CR Allowance for doubtful accounts 3000 YETI uses the allowance method. On March 1st it wrote off $16,000 customer account balance when it becomes clear that the customer will never pay (AR is deemed uncollectible). YETI most probably recorded: Increase in Bad Debt Expense and decrease in Cash for $16,000. Decrease in Receivable and Decrease in Bad Debt Expense for $16,000 Increase in Bad Debt Expense and decrease in Accounts Receivable for \$16,000 Decrease in Allowance for Doubtful Accounts and decrease in Accounts Receivable for $16,000 YETI uses the allowance method. On March 1st it wrote off $16,000 customer account balance when it becomes clear that the customer will never pay (AR is deemed uncollectible). YETI most probably recorded: DR Bad debt expense 16,000 CR Accounts receivables 16,000 DR Accounts receivables 16,000 CR Allowance for doubtful accounts 16,000 On August 1, 2022, YETI asked one of its clients, who had $12,000 outstanding account receivable balance for some time to sign a note for the balance. The $10,000 note was for one year at 7%. What is the total interest revenue YETI earned in 2022 related to that notes receivable? 0 70 350 840 On August 1, 2022, YETI asked one of its clients, who had $12,000 outstanding account receivable balance for some time to sign a note for the balance. The $10,000 note was for one year at 7%. What is the total interest revenue YETI earned in 2023 related to that note's receivable? 0 70 490 840 On August 1, 2022, YETI asked one of its clients, who had $12,000 outstanding account receivable balance for some time to sign a note for the balance. The $10,000 note was for one year at 7%. What is the total amount of cash YETI expect to collect on July 31, 2023 from the client? 12,000 12,490 12,840 None of the above