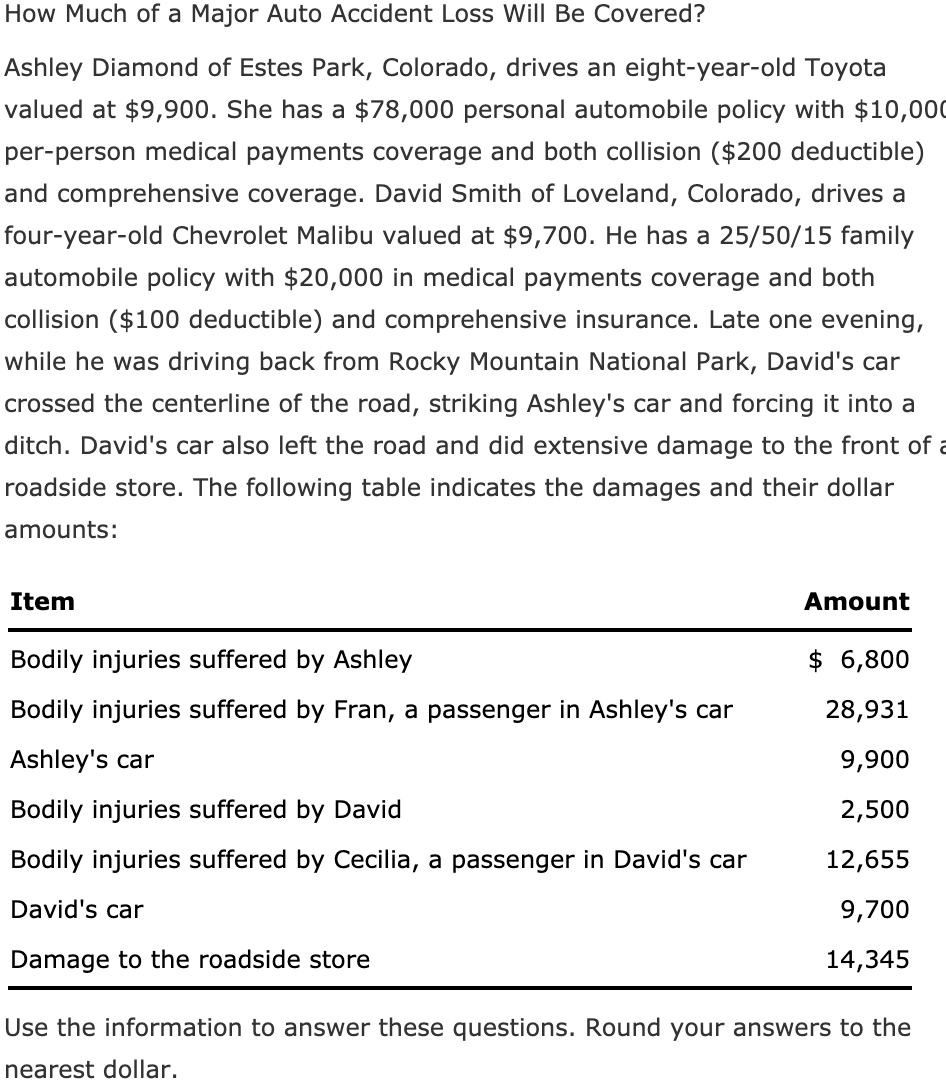

How Much of a Major Auto Accident Loss Will Be Covered?

Ashley Diamond of Estes Park, Colorado, drives an eight-year-old Toyota valued at $9,900. She has a $78,000 personal automobile policy with $10,000 per-person medical payments coverage and both collision ($200 deductible) and comprehensive coverage. David Smith of Loveland, Colorado, drives a four-year-old Chevrolet Malibu valued at $9,700. He has a 25/50/15 family automobile policy with $20,000 in medical payments coverage and both collision ($100 deductible) and comprehensive insurance. Late one evening, while he was driving back from Rocky Mountain National Park, David's car crossed the centerline of the road, striking Ashley's car and forcing it into a ditch. David's car also left the road and did extensive damage to the front of a roadside store. The following table indicates the damages and their dollar amounts:

| Item | | Amount |

| |

| Bodily injuries suffered by Ashley | | $ 6,800 |

| Bodily injuries suffered by Fran, a passenger in Ashley's car | | 28,931 |

| Ashley's car | | 9,900 |

| Bodily injuries suffered by David | | 2,500 |

| Bodily injuries suffered by Cecilia, a passenger in David's car | | 12,655 |

| David's car | | 9,700 |

| Damage to the roadside store | | 14,345 |

| |

Use the information to answer these questions. Round your answers to the nearest dollar.

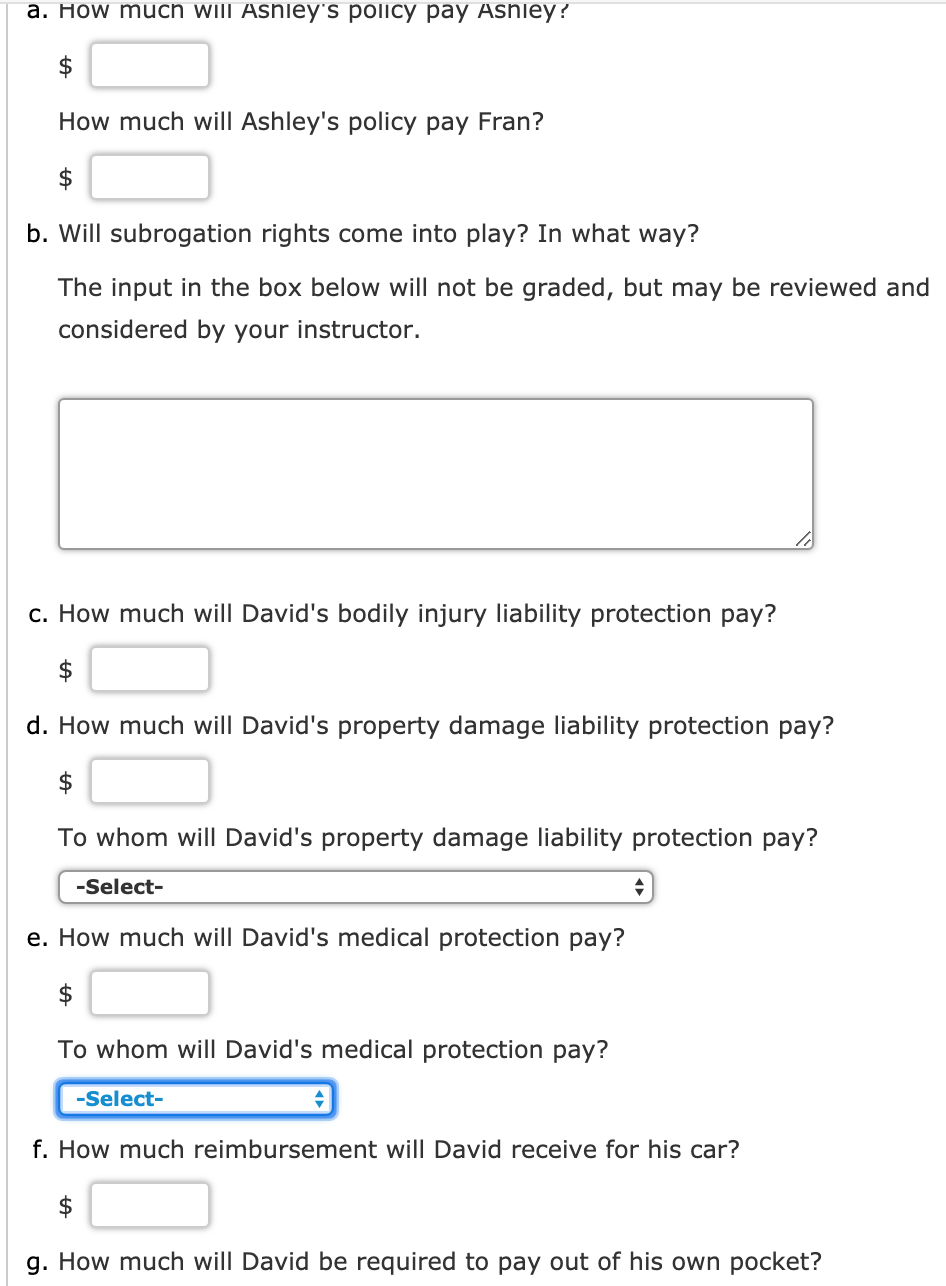

-

How much will Ashley's policy pay Ashley?

$

How much will Ashley's policy pay Fran?

$

-

Will subrogation rights come into play? In what way?

-

How much will David's bodily injury liability protection pay?

-

$

-

How much will David's property damage liability protection pay?

$

To whom will David's property damage liability protection pay?

-

How much will David's medical protection pay?

$

To whom will David's medical protection pay?

-

How much reimbursement will David receive for his car?

$

-

How much will David be required to pay out of his own pocket?

$

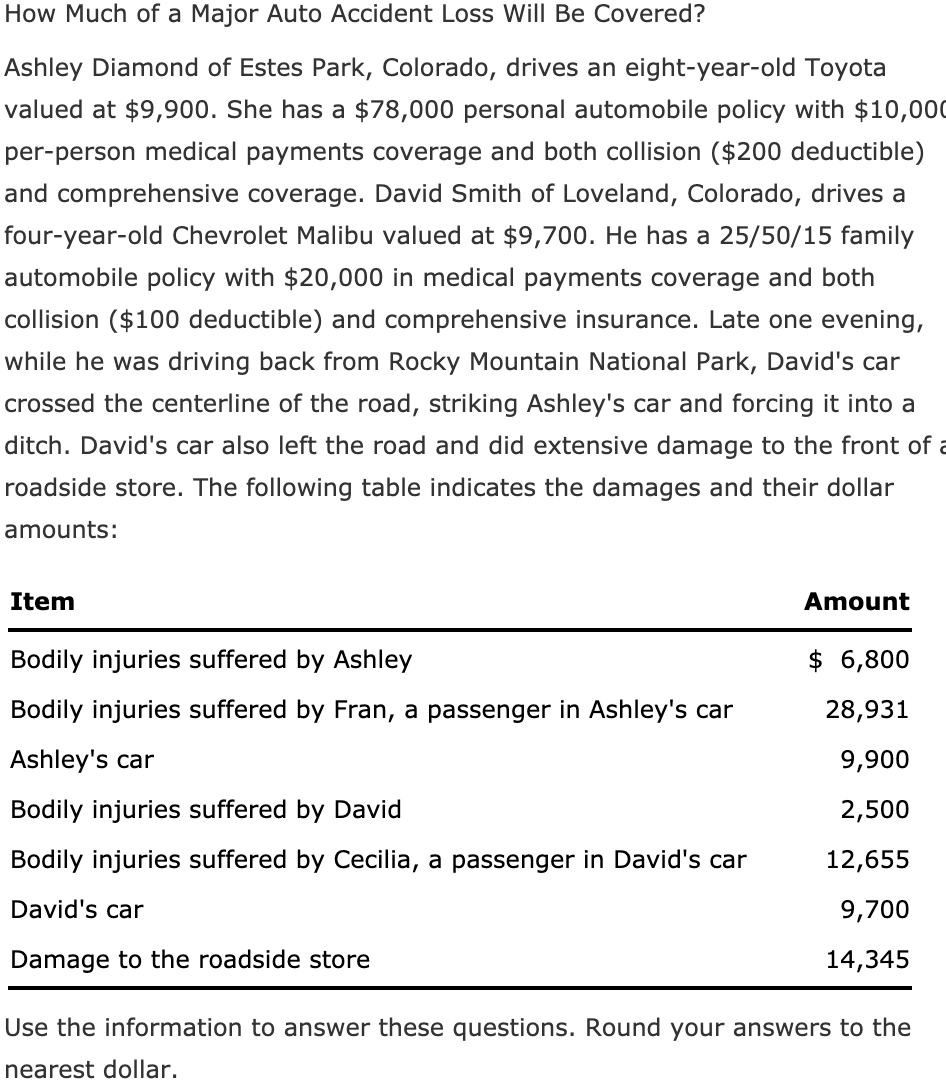

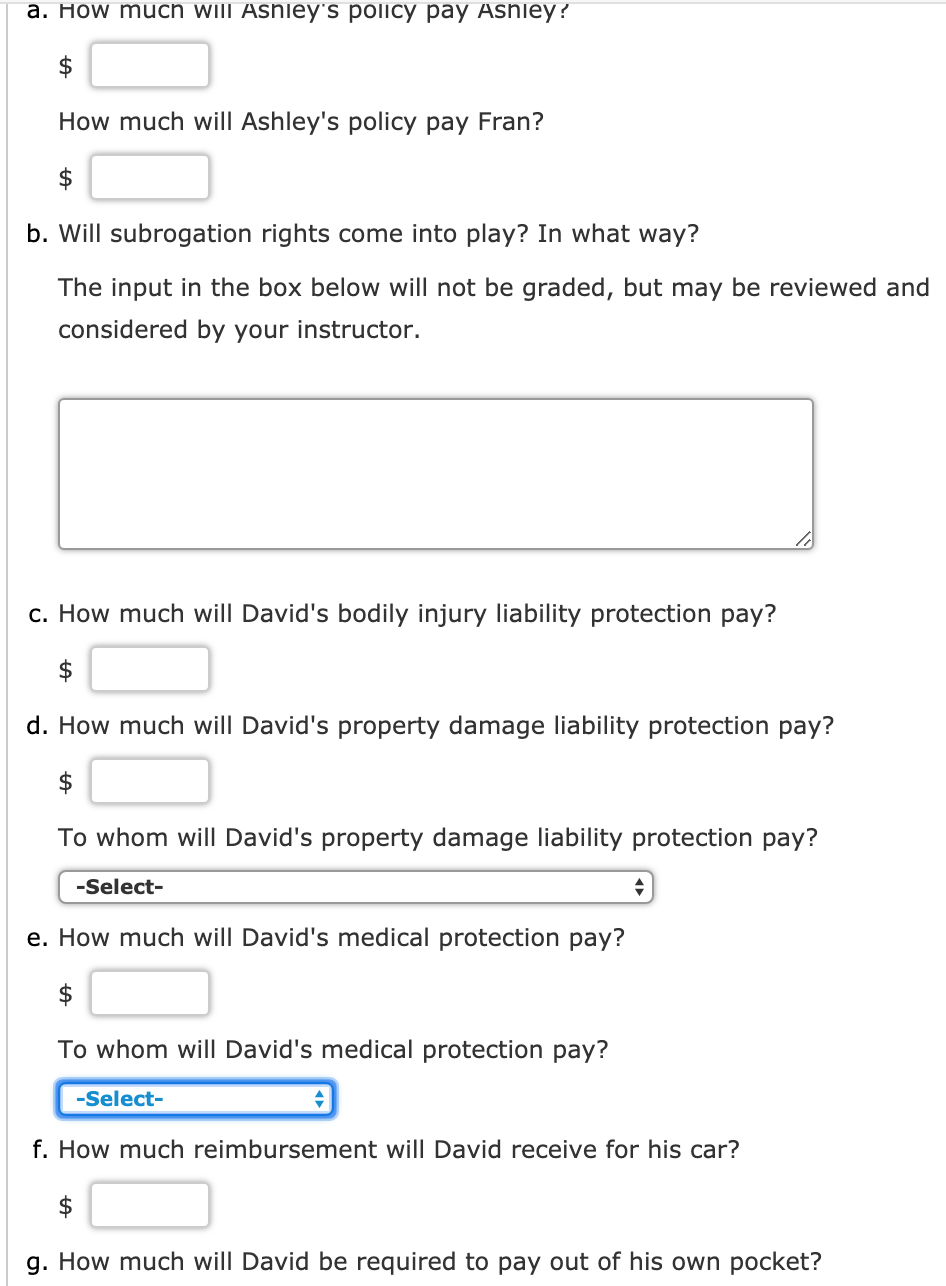

How Much of a Major Auto Accident Loss Will Be Covered? Ashley Diamond of Estes Park, Colorado, drives an eight-year-old Toyota valued at $9,900. She has a $78,000 personal automobile policy with $10,00 per-person medical payments coverage and both collision ($200 deductible) and comprehensive coverage. David Smith of Loveland, Colorado, drives a four-year-old Chevrolet Malibu valued at $9,700. He has a 25/50/15 family automobile policy with $20,000 in medical payments coverage and both collision ($100 deductible) and comprehensive insurance. Late one evening, while he was driving back from Rocky Mountain National Park, David's car crossed the centerline of the road, striking Ashley's car and forcing it into a ditch. David's car also left the road and did extensive damage to the front of a roadside store. The following table indicates the damages and their dollar amounts: Item Amount $ 6,800 Bodily injuries suffered by Ashley Bodily injuries suffered by Fran, a passenger in Ashley's car 28,931 9,900 Ashley's car Bodily injuries suffered by David Bodily injuries suffered by Cecilia, a passenger in David's car 2,500 David's car 12,655 9,700 14,345 Damage to the roadside store Use the information to answer these questions. Round your answers to the nearest dollar. a. How much Will Ashley's policy pay Ashley? How much will Ashley's policy pay Fran? b. Will subrogation rights come into play? In what way? The input in the box below will not be graded, but may be reviewed and considered by your instructor. c. How much will David's bodily injury liability protection pay? d. How much will David's property damage liability protection pay? To whom will David's property damage liability protection pay? -Select- e. How much will David's medical protection pay? To whom will David's medical protection pay? -Select- f. How much reimbursement will David receive for his car? g. How much will David be required to pay out of his own pocket? How Much of a Major Auto Accident Loss Will Be Covered? Ashley Diamond of Estes Park, Colorado, drives an eight-year-old Toyota valued at $9,900. She has a $78,000 personal automobile policy with $10,00 per-person medical payments coverage and both collision ($200 deductible) and comprehensive coverage. David Smith of Loveland, Colorado, drives a four-year-old Chevrolet Malibu valued at $9,700. He has a 25/50/15 family automobile policy with $20,000 in medical payments coverage and both collision ($100 deductible) and comprehensive insurance. Late one evening, while he was driving back from Rocky Mountain National Park, David's car crossed the centerline of the road, striking Ashley's car and forcing it into a ditch. David's car also left the road and did extensive damage to the front of a roadside store. The following table indicates the damages and their dollar amounts: Item Amount $ 6,800 Bodily injuries suffered by Ashley Bodily injuries suffered by Fran, a passenger in Ashley's car 28,931 9,900 Ashley's car Bodily injuries suffered by David Bodily injuries suffered by Cecilia, a passenger in David's car 2,500 David's car 12,655 9,700 14,345 Damage to the roadside store Use the information to answer these questions. Round your answers to the nearest dollar. a. How much Will Ashley's policy pay Ashley? How much will Ashley's policy pay Fran? b. Will subrogation rights come into play? In what way? The input in the box below will not be graded, but may be reviewed and considered by your instructor. c. How much will David's bodily injury liability protection pay? d. How much will David's property damage liability protection pay? To whom will David's property damage liability protection pay? -Select- e. How much will David's medical protection pay? To whom will David's medical protection pay? -Select- f. How much reimbursement will David receive for his car? g. How much will David be required to pay out of his own pocket