Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How much was the 2016 net income under or overstated? Include if understated or overstated? How much was the balance of retained earnings as of

How much was the 2016 net income under or overstated? Include if understated or overstated?

How much was the balance of retained earnings as of December 31, 2016 understated or overstated? Include if understated or overstated.

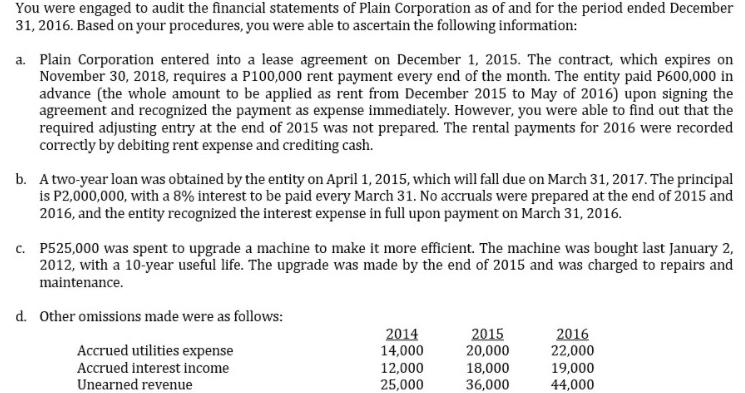

You were engaged to audit the financial statements of Plain Corporation as of and for the period ended December 31, 2016. Based on your procedures, you were able to ascertain the following information: a. Plain Corporation entered into a lease agreement on December 1, 2015. The contract, which expires on November 30, 2018, requires a P100,000 rent payment every end of the month. The entity paid P600,000 in advance (the whole amount to be applied as rent from December 2015 to May of 2016) upon signing the agreement and recognized the payment as expense immediately. However, you were able to find out that the required adjusting entry at the end of 2015 was not prepared. The rental payments for 2016 were recorded correctly by debiting rent expense and crediting cash. b. A two-year loan was obtained by the entity on April 1, 2015, which will fall due on March 31, 2017. The principal is P2,000,000, with a 8% interest to be paid every March 31. No accruals were prepared at the end of 2015 and 2016, and the entity recognized the interest expense in full upon payment on March 31, 2016. c. P525,000 was spent to upgrade a machine to make it more efficient. The machine was bought last January 2, 2012, with a 10-year useful life. The upgrade was made by the end of 2015 and was charged to repairs and maintenance. d. Other omissions made were as follows: Accrued utilities expense Accrued interest income Unearned revenue 2014 14,000 12,000 25,000 2015 20,000 18,000 36,000 2016 22,000 19,000 44,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Understated 1 Lease Agreement The advance rental payment of P600000 was not properly accounted for i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started