Answered step by step

Verified Expert Solution

Question

1 Approved Answer

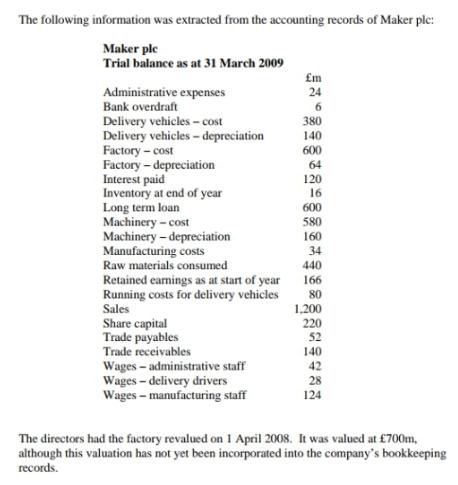

The following information was extracted from the accounting records of Maker plc: Maker ple Trial balance as at 31 March 2009 Administrative expenses Bank

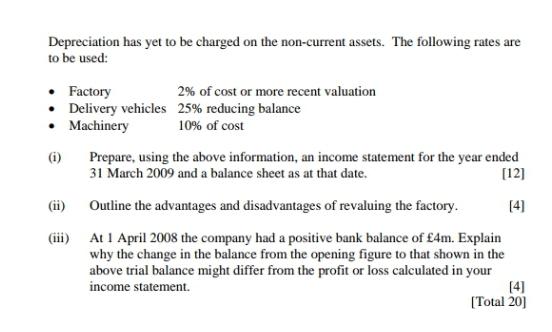

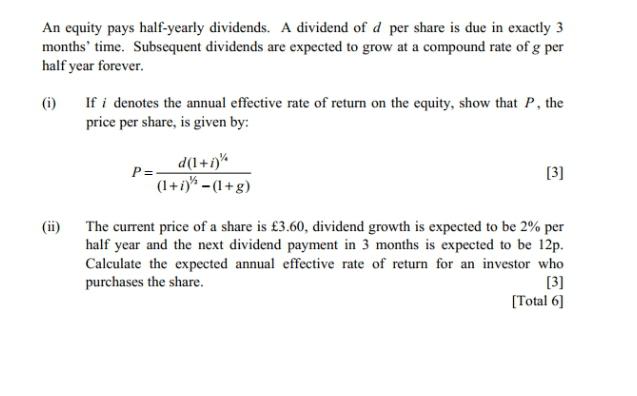

The following information was extracted from the accounting records of Maker plc: Maker ple Trial balance as at 31 March 2009 Administrative expenses Bank overdraft Delivery vehicles - cost Delivery vehicles - depreciation Factory - cost Factory - depreciation Interest paid Inventory at end of year Long term loan Machinery - cost Machinery - depreciation Manufacturing costs Raw materials consumed Retained earnings as at start of year Running costs for delivery vehicles Sales Share capital Trade payables Trade receivables Wages - administrative staff Wages - delivery drivers Wages - manufacturing staff m 24 6 380 140 600 64 120 16 600 580 160 34 440 166 80 1,200 220 52 140 42 28 124 The directors had the factory revalued on 1 April 2008. It was valued at 700m, although this valuation has not yet been incorporated into the company's bookkeeping records. Depreciation has yet to be charged on the non-current assets. The following rates are to be used: Factory Delivery vehicles Machinery (i) (ii) (iii) 2% of cost or more recent valuation 25% reducing balance 10% of cost Prepare, using the above information, an income statement for the year ended 31 March 2009 and a balance sheet as at that date. [12] [4] Outline the advantages and disadvantages of revaluing the factory. At 1 April 2008 the company had a positive bank balance of 4m. Explain why the change in the balance from the opening figure to that shown in the above trial balance might differ from the profit or loss calculated in your income statement. [4] [Total 20] An equity pays half-yearly dividends. A dividend of d per share is due in exactly 3 months' time. Subsequent dividends are expected to grow at a compound rate of g per half year forever. (i) (ii) If i denotes the annual effective rate of return on the equity, show that P, the price per share, is given by: P= d(1+i)% (1+i)"-(1+g) [3] The current price of a share is 3.60, dividend growth is expected to be 2% per half year and the next dividend payment in 3 months is expected to be 12p. Calculate the expected annual effective rate of return for an investor who purchases the share. [3] [Total 6]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Income Statement for the year ended 31 March 2009 Revenue Sales 1200m Expenses Administrative expenses 24m Manufacturing costs 34m Wagesadministrati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started