Answered step by step

Verified Expert Solution

Question

1 Approved Answer

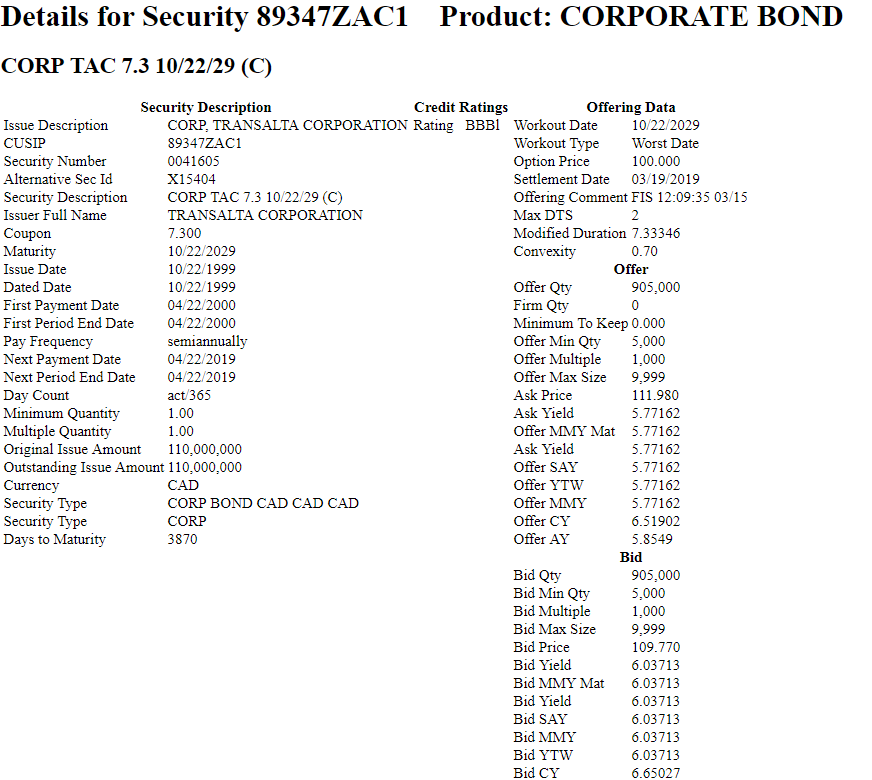

how much would you pay for five $1000 face value bonds and what interest rate will you earn if you hold this to bond to

how much would you pay for five $1000 face value bonds and what interest rate will you earn if you hold this to bond to maturity?

Details for Security 89347ZAC1 Product: CORPORATE BOND CORP TAC 7.3 10/22/29 (C) Security Description Credit Ratings Offering Data Issue Description CORP, TRANSALTA CORPORATION Rating BBB1 Workout Date 10/22/2029 CUSIP 89347ZACI Workout Type Worst Date Security Number 0041605 Option Price 100.000 Alternative Sec Id X15404 Settlement Date 03/19/2019 Security Description CORP TAC 7.3 10/22/29 (C) Offering Comment FIS 12:09:35 03/15 Issuer Full Name TRANSALTA CORPORATION Max DTS 2 Coupon 7.300 Modified Duration 7.33346 Maturity 10/22 2029 Convexity 0.70 Issue Date 10/22/1999 Offer Dated Date 10/22/1999 Offer Qty 905,000 First Payment Date 04/22/2000 Firm Qty First Period End Date 04/22/2000 Minimum To Keep 0.000 Pay Frequency semiannually Offer Min Qty 5.000 Next Payment Date 04/22/2019 Offer Multiple 1,000 Next Period End Date 04/22/2019 Offer Max Size 9.999 Day Count act/365 Ask Price 111.980 Minimum Quantity 1.00 Ask Yield 5.77162 Multiple Quantity 1.00 Offer MMY Mat 5.77162 Original Issue Amount 110,000,000 Ask Yield 5.77162 Outstanding Issue Amount 110,000,000 Offer SAY 5.77162 Currency CAD Offer YTW 5.77162 Security Type CORP BOND CAD CAD CAD Offer MMY 5.77162 Security Type CORP Offer CY 6.51902 Days to Maturity 3870 Offer AY 5.8549 Bid Bid Qty 905,000 Bid Min Qty 5,000 Bid Multiple 1,000 Bid Max Size 9,999 Bid Price 109.770 Bid Yield 6.03713 Bid MMY Mat 6.03713 Bid Yield 6.03713 Bid SAY 6.03713 Bid MMY 6.03713 Bid YTW 6.03713 Bid CY 6.65027Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started