Question

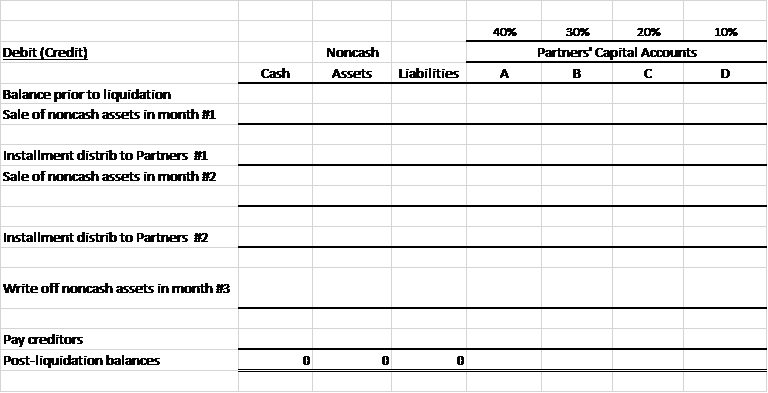

How should the following information be presented in the table below?: Partners in the ABCD Partnership decided to dissolve their partnership. On that date, the

How should the following information be presented in the table below?:

Partners in the ABCD Partnership decided to dissolve their partnership.

On that date, the partners had the following pre-liquidation capital balances:

Partner A $28,000

Partner B 41,000

Partner C 18,000

Partner D 12,000

A, B, C, and D share residual profits and losses in a 4:3:2:1 ratio.

Liabilities at the date of dissolution total $100,000, and noncash assets equal $105,000.

During the first month of liquidation, assets having a book value of $55,000 were sold for $31,000.

During the second month, assets having a book value of $32,000, were sold for $28,000.

During the third month, the remaining unsold assets were determined to be worthless.

The partners receive the maximum allowable payment at the end of each month.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started