Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How should you use operating costs when calculating incremental cash flows? Subtract taxes as though operating costs were not tax - deductible. Then subtract operating

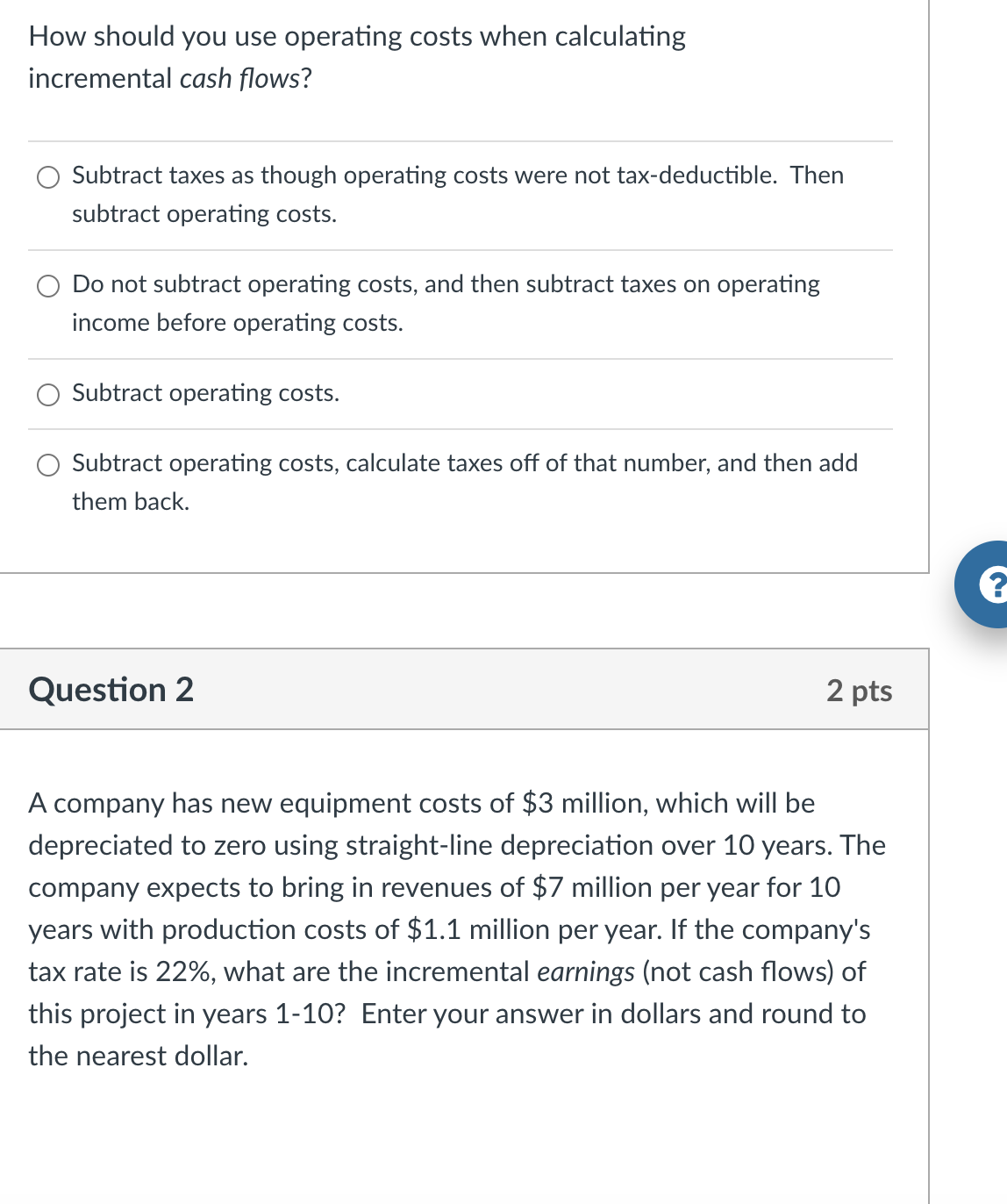

How should you use operating costs when calculating

incremental cash flows?

Subtract taxes as though operating costs were not taxdeductible. Then

subtract operating costs.

Do not subtract operating costs, and then subtract taxes on operating

income before operating costs.

Subtract operating costs.

Subtract operating costs, calculate taxes off of that number, and then add

them back.

Question

A company has new equipment costs of $ million, which will be

depreciated to zero using straightline depreciation over years. The

company expects to bring in revenues of $ million per year for

years with production costs of $ million per year. If the company's

tax rate is what are the incremental earnings not cash flows of

this project in years Enter your answer in dollars and round to

the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started