Answered step by step

Verified Expert Solution

Question

1 Approved Answer

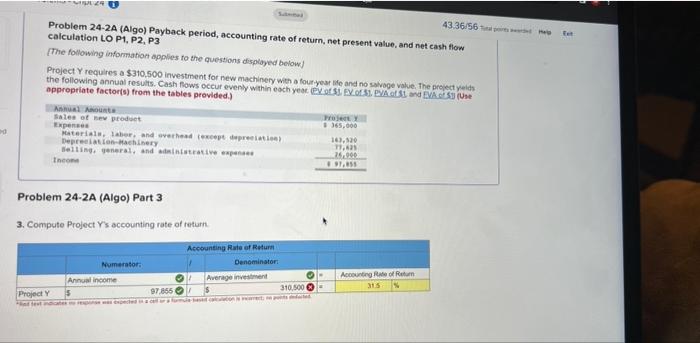

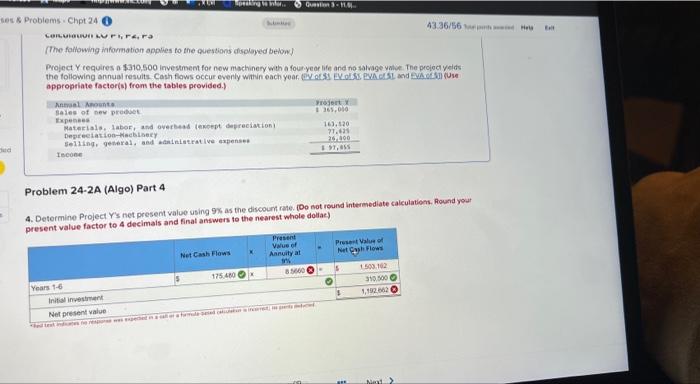

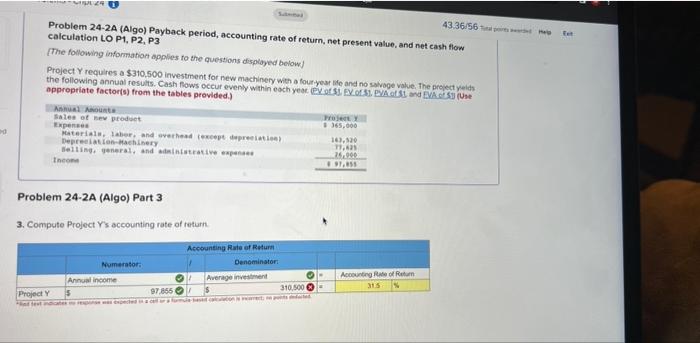

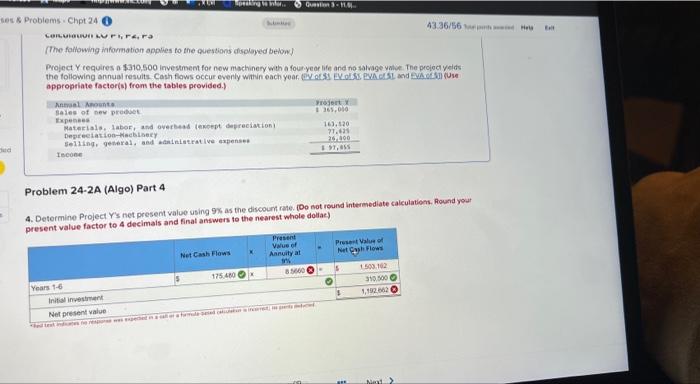

how this wrong 43.36/56 Problem 24-2A (Algo) Payback period, accounting rate of return, net present value, and net cash flow calculation LO P1, P2, P3

how this wrong

43.36/56 Problem 24-2A (Algo) Payback period, accounting rate of return, net present value, and net cash flow calculation LO P1, P2, P3 The following information applies to the questions displayed below) Project requires a $310.500 Investment for new machinery with a four year ife and no savage value. The projects the following annual results. Cash flows occur evenly within each yet ex S. EX.03. PVACISL and EVA ESSUS appropriate factors) from the tables provided.) Y Sales et new product 365,000 Expenses Material, labor and overhead teept depreciatio) 16.120 Deprecation-achinery 79,621 Beiling general and deep 26.900 Income #97,50 Problem 24-2A (Algo) Part 3 3. Compute Project Y's accounting rate of return Numerator Annual income Accounting Rate of Return Denominator Average invest 97.866 : $ 310.500 Q Accounting Rate of Return 315 Project Y sot & Problems.Chpt 24 43.36/66 CORVILIVIU Prera The following information applies to the questions colayed below) Project Y requires a $310,500 Investment for new machinery with a four year life and no salvage i The projectes the following annual results Cash flows occur evenly within each year, VASI EV OSS EVALSI and EOSU appropriate factors) from the tables provided.) Antal sales of new pro 165.000 Expenses Materiale, labor, and over de depreciation 143.120 Deprecation-biety 77.63 Selling geral, and strative expenses 25.000 Incone 57,5 Problem 24-2A (Algo) Part 4 4. Determine Project Y's not present Value using 9% as the discount rate (Do not round intermediate calculations. Round your present value factor to 4 decimals and final answers to the nearest whole dollar) Present Valus of Annuity at Net Cash Flows 3560 PressValue Net Cash Flows 50.102 310.00 150.000 175.400 Years 51-6 Initial investment Net present value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started