Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to calculate net working capital requirement and decide whether revolving credit facilty should be granted to the firm? CHING WHA PTY LTD. BRISBANE Date:

How to calculate net working capital requirement and decide whether revolving credit facilty should be granted to the firm?

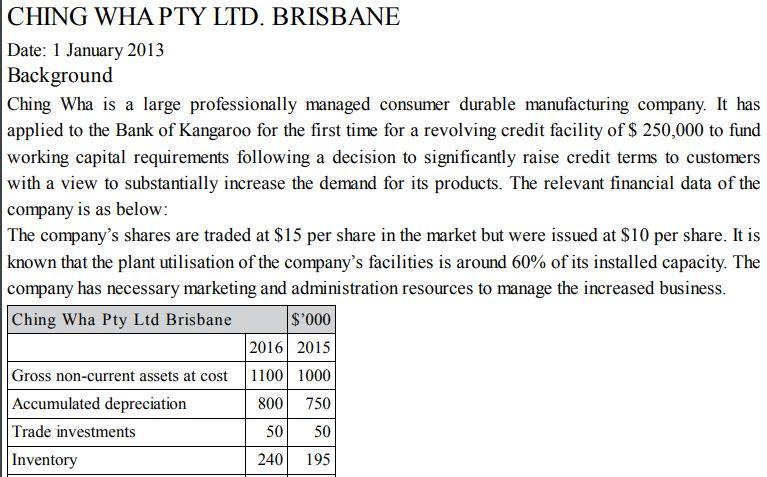

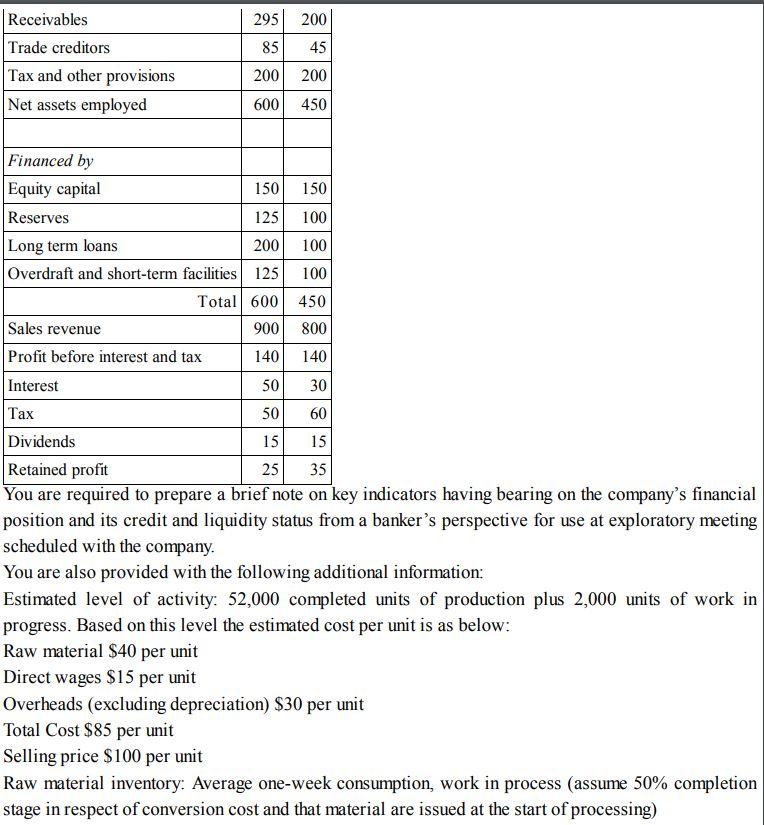

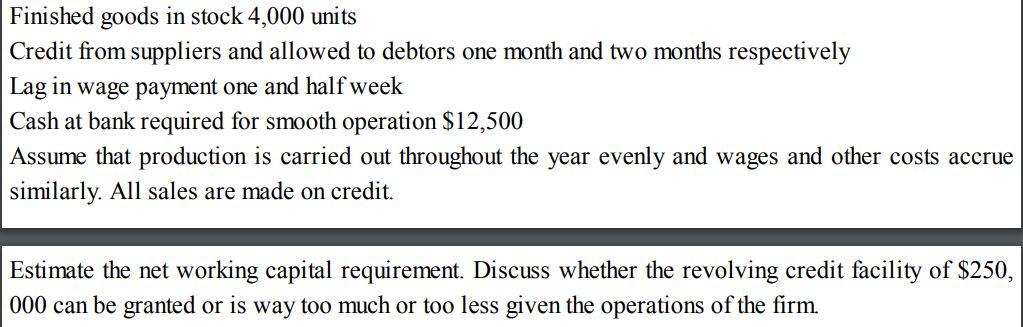

CHING WHA PTY LTD. BRISBANE Date: 1 January 2013 Background Ching Wha is a large professionally managed consumer durable manufacturing company. It has applied to the Bank of Kangaroo for the first time for a revolving credit facility of $250,000 to fund working capital requirements following a decision to significantly raise credit terms to customers with a view to substantially increase the demand for its products. The relevant financial data of the company is as below: The company's shares are traded at $15 per share in the market but were issued at $10 per share. It is known that the plant utilisation of the company's facilities is around 60% of its installed capacity. The company has necessary marketing and administration resources to manage the increased business. You are required to prepare a brief note on key indicators having bearing on the company's financial position and its credit and liquidity status from a banker's perspective for use at exploratory meeting scheduled with the company. You are also provided with the following additional information: Estimated level of activity: 52,000 completed units of production plus 2,000 units of work in progress. Based on this level the estimated cost per unit is as below: Raw material $40 per unit Direct wages $15 per unit Overheads (excluding depreciation) $30 per unit Total Cost $85 per unit Selling price $100 per unit Raw material inventory: Average one-week consumption, work in process (assume 50% completion stage in respect of conversion cost and that material are issued at the start of processing) Finished goods in stock 4,000 units Credit from suppliers and allowed to debtors one month and two months respectively Lag in wage payment one and half week Cash at bank required for smooth operation $12,500 Assume that production is carried out throughout the year evenly and wages and other costs accrue similarly. All sales are made on credit. Estimate the net working capital requirement. Discuss whether the revolving credit facility of $250, 000 can be granted or is way too much or too less given the operations of the firm. CHING WHA PTY LTD. BRISBANE Date: 1 January 2013 Background Ching Wha is a large professionally managed consumer durable manufacturing company. It has applied to the Bank of Kangaroo for the first time for a revolving credit facility of $250,000 to fund working capital requirements following a decision to significantly raise credit terms to customers with a view to substantially increase the demand for its products. The relevant financial data of the company is as below: The company's shares are traded at $15 per share in the market but were issued at $10 per share. It is known that the plant utilisation of the company's facilities is around 60% of its installed capacity. The company has necessary marketing and administration resources to manage the increased business. You are required to prepare a brief note on key indicators having bearing on the company's financial position and its credit and liquidity status from a banker's perspective for use at exploratory meeting scheduled with the company. You are also provided with the following additional information: Estimated level of activity: 52,000 completed units of production plus 2,000 units of work in progress. Based on this level the estimated cost per unit is as below: Raw material $40 per unit Direct wages $15 per unit Overheads (excluding depreciation) $30 per unit Total Cost $85 per unit Selling price $100 per unit Raw material inventory: Average one-week consumption, work in process (assume 50% completion stage in respect of conversion cost and that material are issued at the start of processing) Finished goods in stock 4,000 units Credit from suppliers and allowed to debtors one month and two months respectively Lag in wage payment one and half week Cash at bank required for smooth operation $12,500 Assume that production is carried out throughout the year evenly and wages and other costs accrue similarly. All sales are made on credit. Estimate the net working capital requirement. Discuss whether the revolving credit facility of $250, 000 can be granted or is way too much or too less given the operations of the firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started