Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to calculate Re & fill out the remainder of the question? Cement LTD, a private contracting and construction company, is issuing public capital for

How to calculate Re & fill out the remainder of the question?

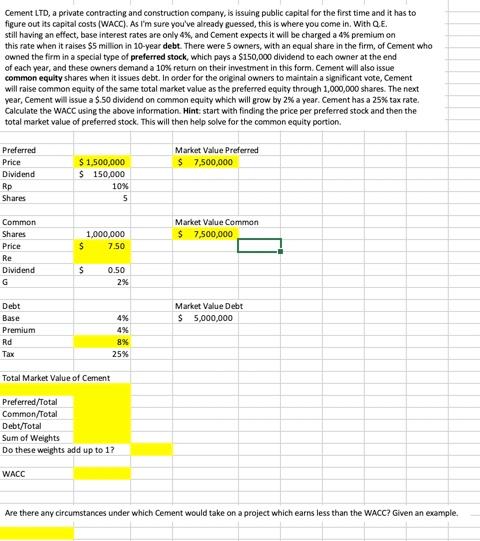

Cement LTD, a private contracting and construction company, is issuing public capital for the first time and it has to figure out its capital costs (WACC). As I'm sure you've already guessed, this is where you come in. With Q.E. still having an effect, base interest rates are only 4%, and Cement expects it will be charged a 4% premium on this rate when it raises $5 million in 10-year debt. There were 5 owners, with an equal share in the firm, of Cement who owned the firm in a special type of preferred stock, which pays a $150,000 dividend to each owner at the end of each year, and these owners demand a 10% return on their investment in this form. Cement will also issue common equity shares when it issues debt. In order for the original owners to maintain a significant vote, Cement will raise common equity of the same total market value as the preferred equity through 1,000,000 shares. The next year, Cement will issue a 6.50 dividend on common equity which will grow by 2% a year. Cement has a 25% tax rate. Calculate the WACC using the above information. Hint: start with finding the price per preferred stock and then the total market value of preferred stock. This will then help solve for the common equity portion Market Value Preferred $ 7,500,000 Preferred Price Dividend Rp Shares $1,500,000 $ 150,000 10% 5 Market Value Common $ 7,500,000 Common Shares Price Re Dividend G 1,000,000 $ 7.50 $ 0.50 2% Debt Base Premium Rd Tax Market Value Debt $ 5,000,000 4% 4% 8% 25% Total Market Value of Cement Preferred/Total Common/Total Debt/Total Sum of Weights Do these weights add up to 1? WACC Are there any circumstances under which Cement would take on a project which earns less than the WACC? Given an exampleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started