Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to Calculate ROIC(Financing) and ROIC (assets) and {Pref Stock Coupon). YELP Income Statement and Balance Sheet Income Statement: Balance Sheet $ Sales Costs except

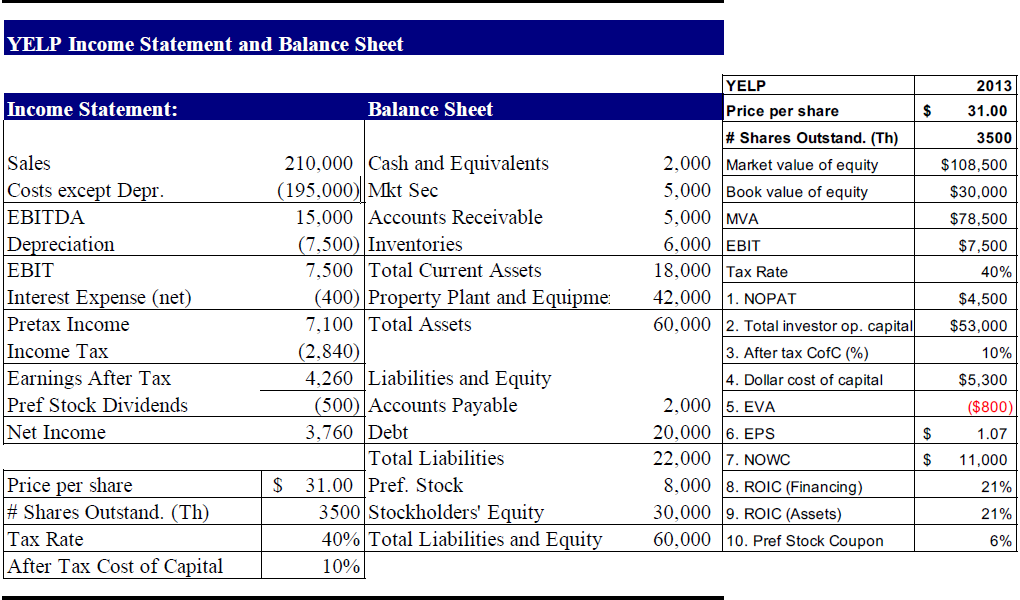

How to Calculate ROIC(Financing) and ROIC (assets) and {Pref Stock Coupon).

YELP Income Statement and Balance Sheet Income Statement: Balance Sheet $ Sales Costs except Depr. EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Earnings After Tax Pref Stock Dividends Net Income YELP Price per share # Shares Outstand. (Th) Market value of equity 5.000 Book value of equity 5.000 MVA 6,000 EBIT 18,000 Tax Rate 42.000 1. NOPAT 60,000 2. Total investor op. capital 3. After tax CofC (%) 4. Dollar cost of capital 2,000 5. EVA 20,000 6. EPS 22,000 7. NOWC 8.000 8. ROIC (Financing) 30.000 9. ROIC (Assets) 60.000 10. Pref Stock Coupon 2013 31.00 3500 $108,500 $30,000 $78,500 $7,500 40% $4,500 $53,000 210,000 Cash and Equivalents (195,000)|| Mkt Sec 15,000 Accounts Receivable (7,500) Inventories 7,500 Total Current Assets (400) Property Plant and Equipme 7,100 Total Assets (2.840) 4.260 Liabilities and Equity (500) Accounts Payable 3,760 Debt Total Liabilities $ 31.00 Pref. Stock 3500 Stockholders' Equity 40% Total Liabilities and Equity 10% $ $ $5,300 ($800) 1.07 11,000 21% 21% 6% Price per share # Shares Outstand. (Th) Tax Rate After Tax Cost of Capital 10%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started