Answered step by step

Verified Expert Solution

Question

1 Approved Answer

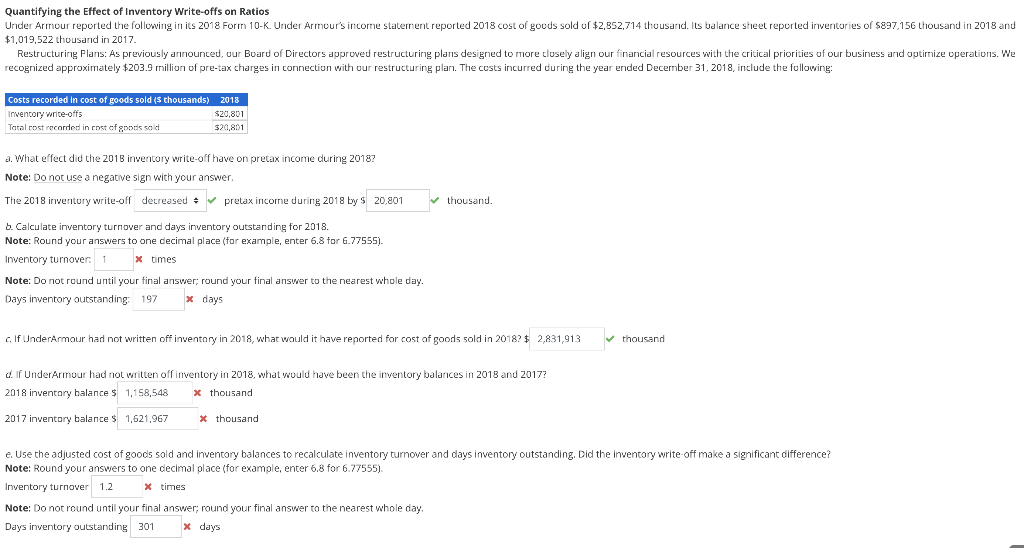

How to calculate the following? Quantifying the Effect of Inventory Write-offs on Ratios $1,019,522 thousand in 2017 . recognized approximately $203.9 million of pre-tax charges

How to calculate the following?

Quantifying the Effect of Inventory Write-offs on Ratios $1,019,522 thousand in 2017 . recognized approximately $203.9 million of pre-tax charges in connection with our restructuring plan. The costs incurred during the year ended Decernber 31,2018 , include the following: a. What effect did the 2018 inwentory write-off have on pretax income during 2018 ? Note: Do not use a negative sign with your answer. The 2018 inventory write-off / pretax income during 2018 by $ thousand. b. Calculate inventory turnover and days inventory outstanding for 2018. Note: Round your answers to one decimal place (for example, enter 6.8 far 6.77555). Inventory turnover: x times Note: Do not round until your final answer; round your final answer to the nearest whole day. Days inventory outstanding: x days c. If UnderArmour had not written off inventory in 2018, what would it have reported for cost of goods sold in 2018?! d. If Underarmour had not written off inventory in 2018, what would have been the inventory balances in 2018 and 2017 ? 2018 inventary balance $ thousand 2017 inventary balance $ thousand e. Use the adjusted cost of goods sold and inventory balances to recalculate inventory turnover and days inventory outstanding. Did the inventory write-off make a significant difference? Note: Round your answers to one decimal place (for example, enter 6.8 for 6.77555 ). Inventory turnover times Note: Do not round until your final answer; round your final answer to the nearest whole day. Days inventory outstanding x daysStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started