How to calculate the net income

?

?

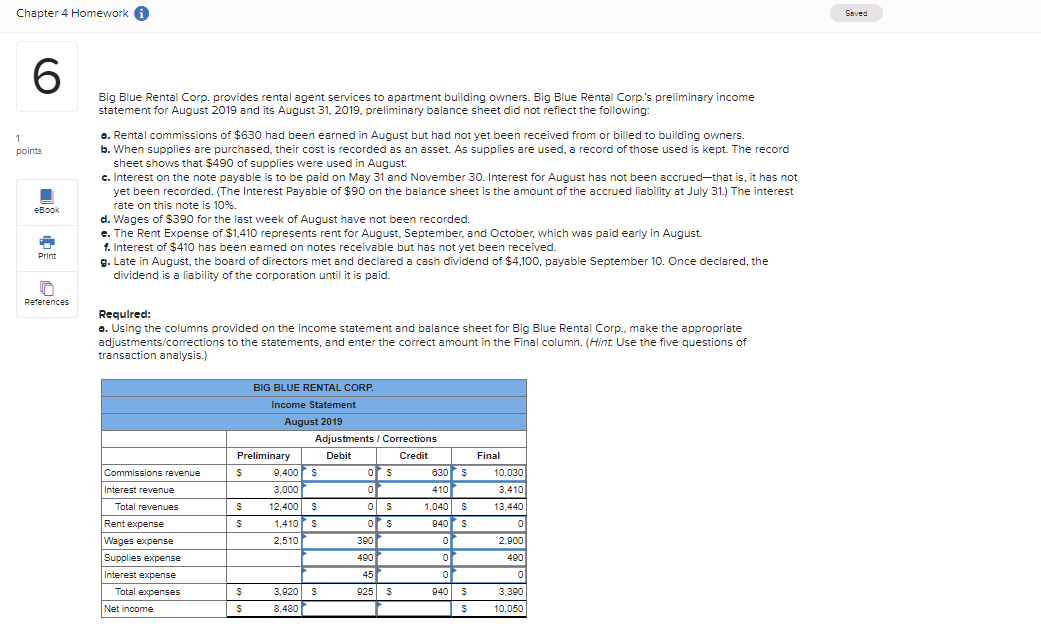

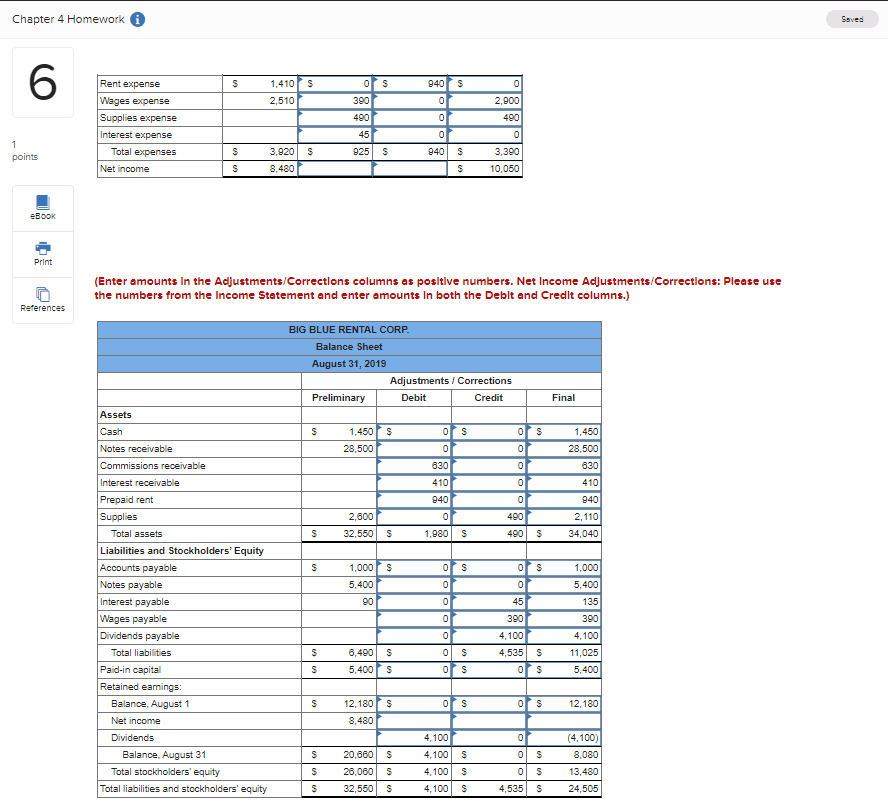

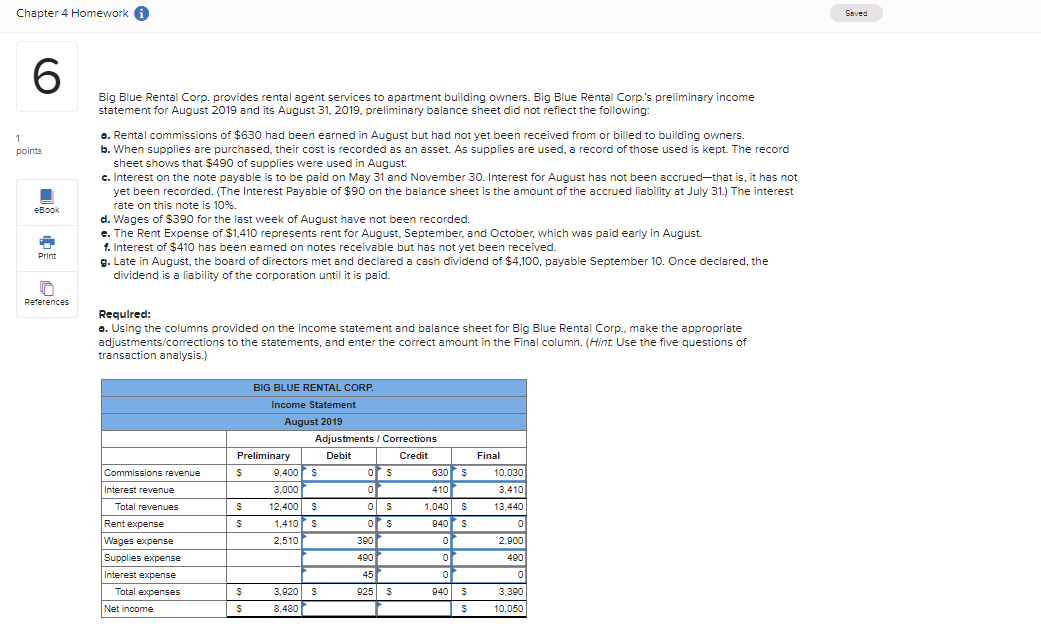

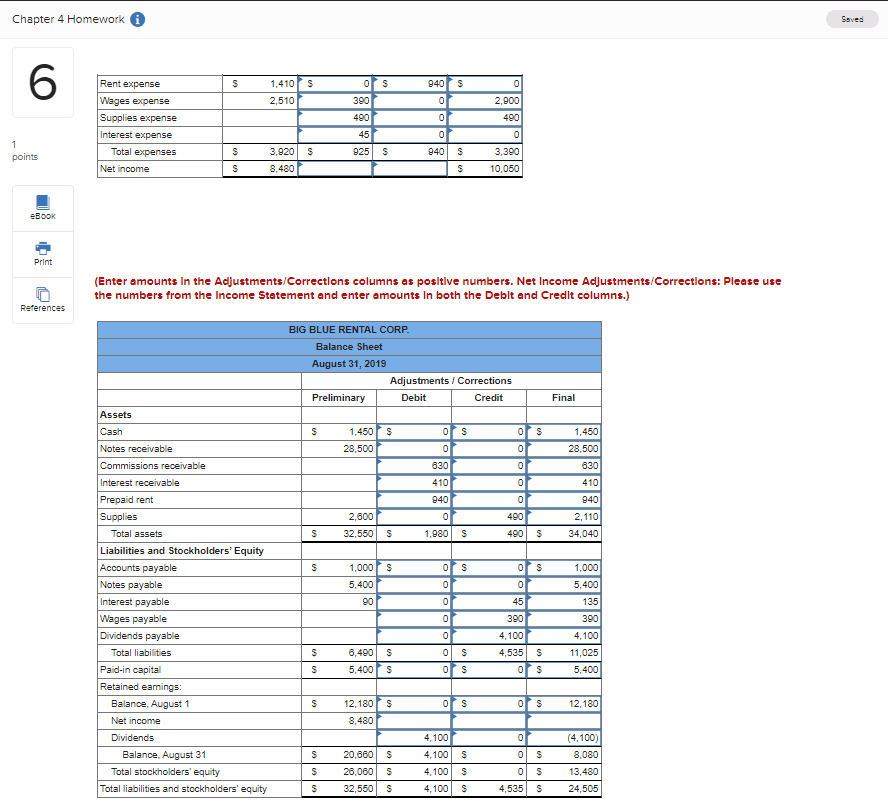

Chapter 4 Homework a Saved 6 1 points Big Blue Rental Corp. provides rental agent services to apartment building owners. Big Blue Rental Corp.'s preliminary income statement for August 2019 and its August 31, 2019. preliminary balance sheet did not reflect the following: a. Rental commissions of $630 had been earned in August but had not yet been received from or billed to building owners. b. When supplies are purchased their cost is recorded as an asset. As supplies are used, a record of those used is kept. The record sheet shows that $490 of supplies were used in August. c. Interest on the note payable is to be paid on May 31 and November 30. Interest for August has not been accrued-that is, it has not yet been recorded. (The Interest Payable of $90 on the balance sheet is the amount of the accrued liability at July 31.) The interest rate on this note is 10%. d. Wages of $390 for the last week of August have not been recorded. e. The Rent Expense of $1.410 represents rent for August September, and October, which was paid early in August. f. Interest of $410 has been eamed on notes receivable but has not yet been received. Late in August, the board of directors met and declared a cash dividend of $4,100. payable September 10. Once declared, the dividend is a liability of the corporation until it is paid. eBook Print References Requlred: a. Using the columns provided on the income statement and balance sheet for Big Blue Rental Corp., make the appropriate adjustments/corrections to the statements, and enter the correct amount in the Final column. (Hint. Use the five questions of transaction analysis.) Commissions revenue Interest revenue BIG BLUE RENTAL CORP. Income Statement August 2019 Adjustments / Corrections Preliminary Debit Credit S 9,400 s 0 S 6303 3,000 0 0 410 S 12,400 $ ols 1,040 $ S 1,410 S os 940 s 2,510 390 0 490 of 45 07 S 3,920 S 925 $ 940 $ $ 8.480 S Total revenues Rent expense Wages expense Supplies expense Interest expense Total expenses Net Income Final 10.030 3,410 13,440 0 2.900 490 0 3,390 10,050 Chapter 4 Homework Saved 6 S 0 S 940 s 0 1,410 | s 2,510 0 390 490 0 Rent expense Wages expense Supplies expense Interest expense Total expenses Net income 2.900 490 0 45 0 1 points S S 925 S 940 3,920 8.480 S s 3,390 10,050 S eBook Print (Enter amounts In the Adjustments/Corrections columns as positive numbers. Net Income Adjustments/Corrections: Please use the numbers from the Income Statement and enter amounts In both the Deblt and Credit columns.) References BIG BLUE RENTAL CORP Balance Sheet August 31, 2019 Adjustments / Corrections Preliminary Debit Credit Final S S S 0 S 1,450 28.500 0 0 0 1,450 28,500 630 630 410 0 0 410 940 940 0 0 400 2,600 2,110 S 32,550 S 1,980 S 490 S 34,040 S S S 0 $ 1.000 5.400 90 0 Assets Cash Notes receivable Commissions receivable Interest receivable Prepaid rent Supplies Total assets Liabilities and Stockholders' Equity Accounts payable Notes payable Interest payable Wages payable Dividends payable Total liabilities Paid-in capital Retained earnings Balance, August 1 Net income Dividends Balance, August 31 Total stockholders' equity Total liabilities and stockholders' equity 0 1.000 5.400 135 390 0 45 390 0 0 S 6.490 S S 4,100 4,535 0 S 4,100 11,025 5,400 S 5,400 S 0 S S S S 0 S 0 12,180 12,180 8,480 0 (4.100) S S S 0 S 8,080 4,100 4,100 4,100 4,100 20,660 26,080 32.550 S S 0 S S S 13,480 24,505 S S 4,535 S

?

?