Answered step by step

Verified Expert Solution

Question

1 Approved Answer

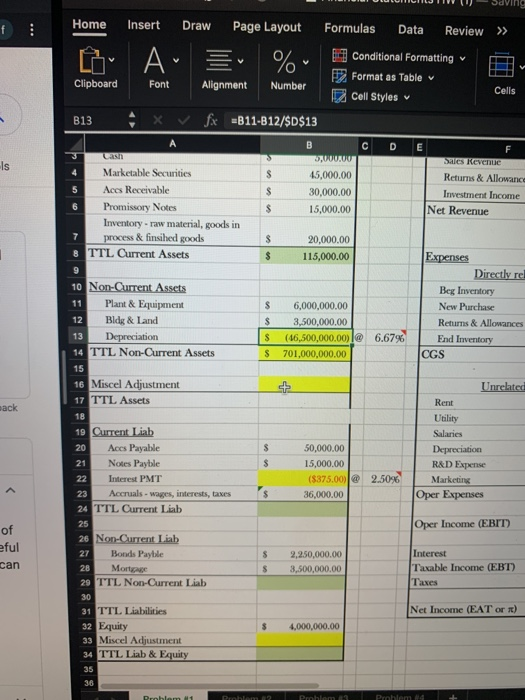

how to calculated depreciation in excel depreciation method Home Insert Draw Page Layout Formulas Data Review >> L A - % - conditional Formatting y

how to calculated depreciation in excel

depreciation method

Home Insert Draw Page Layout Formulas Data Review >> L A - % - conditional Formatting y Conditional Formatting Format as Table Cell Styles Clipboard Font Alignment Number Cells B13 X fx =B11-B12/$D$13 A Marketable Securities Aces Receivable Promissory Notes Inventory raw material, goods in process & finsshed goods 8 TTL Current Assets 45,000.00 30,000.00 15,000.00 Sacs Roche Returns & Allowano Investment Income Net Revenue 20,000.00 115,000.00 $ 10 Non-Current Assets 11 Plant & Equipment Bldg & Land 13 Depreciation 14 TTL Non-Current Assets 6,000,000.00 3,500,000.00 (16,500,000.00) @ 701,000,000.00 Expenses Directly re Be Inventory New Purchase Returns & Allowances End Inventory CGS 6.67% $ $ 16 Miscel Adjustment 17 TTL Assets Unrelated Rent Utility Salaries Depreciation R&D Expense Marketing Oper Expenses 19 Current Liab Accs Payable Notes Payble Interest PMT Aconials wages, interests, taxes 24 TTL Current Liab 21 50,000.00 15,000.00 (5375.00 36,000.00 @ 2.50%6 Oper Income (EBIT) 26 Non-Current Liab 27 Boods Paytile 28 More 29 TTL Non-Current Liab 2,250,000.00 3,500,000.00 $ Interest Taxable income (EBT) Taxes Net Income (EAT or ) 4,000,000.00 31 TTL Liabilities 32 Equity 33 Miscel Adjustment 34 TTL Liab & Equity Home Insert Draw Page Layout Formulas Data Review >> L A - % - conditional Formatting y Conditional Formatting Format as Table Cell Styles Clipboard Font Alignment Number Cells B13 X fx =B11-B12/$D$13 A Marketable Securities Aces Receivable Promissory Notes Inventory raw material, goods in process & finsshed goods 8 TTL Current Assets 45,000.00 30,000.00 15,000.00 Sacs Roche Returns & Allowano Investment Income Net Revenue 20,000.00 115,000.00 $ 10 Non-Current Assets 11 Plant & Equipment Bldg & Land 13 Depreciation 14 TTL Non-Current Assets 6,000,000.00 3,500,000.00 (16,500,000.00) @ 701,000,000.00 Expenses Directly re Be Inventory New Purchase Returns & Allowances End Inventory CGS 6.67% $ $ 16 Miscel Adjustment 17 TTL Assets Unrelated Rent Utility Salaries Depreciation R&D Expense Marketing Oper Expenses 19 Current Liab Accs Payable Notes Payble Interest PMT Aconials wages, interests, taxes 24 TTL Current Liab 21 50,000.00 15,000.00 (5375.00 36,000.00 @ 2.50%6 Oper Income (EBIT) 26 Non-Current Liab 27 Boods Paytile 28 More 29 TTL Non-Current Liab 2,250,000.00 3,500,000.00 $ Interest Taxable income (EBT) Taxes Net Income (EAT or ) 4,000,000.00 31 TTL Liabilities 32 Equity 33 Miscel Adjustment 34 TTL Liab & Equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started