how to clculate number of out standing common share and how to calculate preferred div?

how to calculate preferred div and number of out standing common share and div per common share

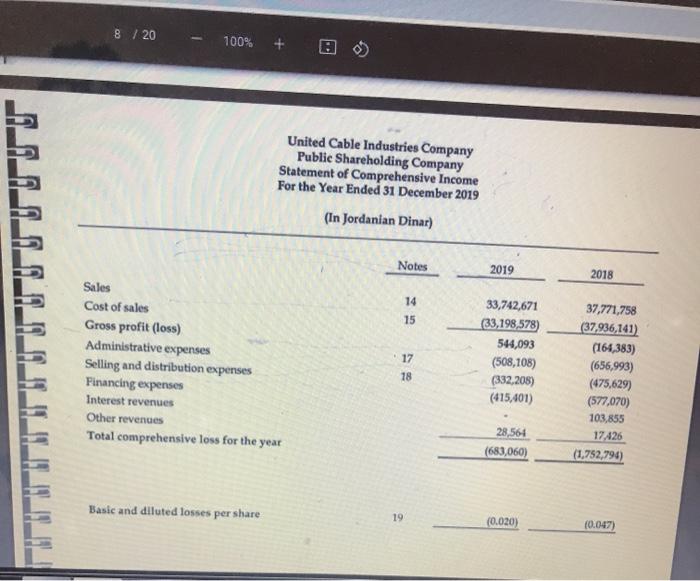

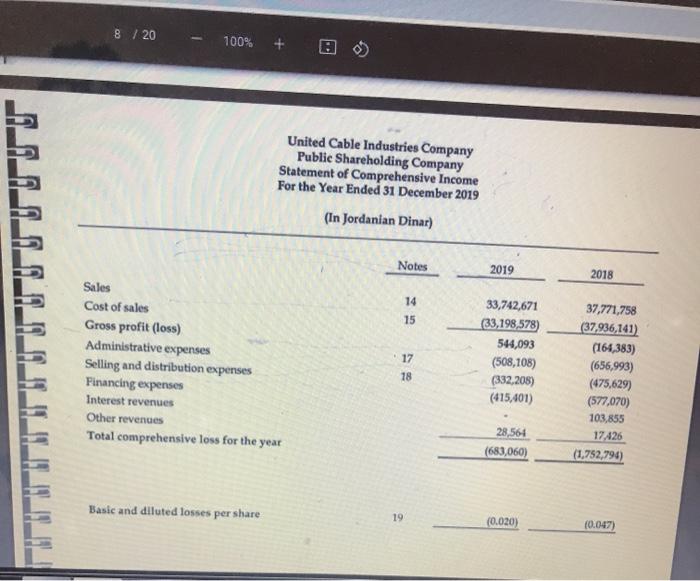

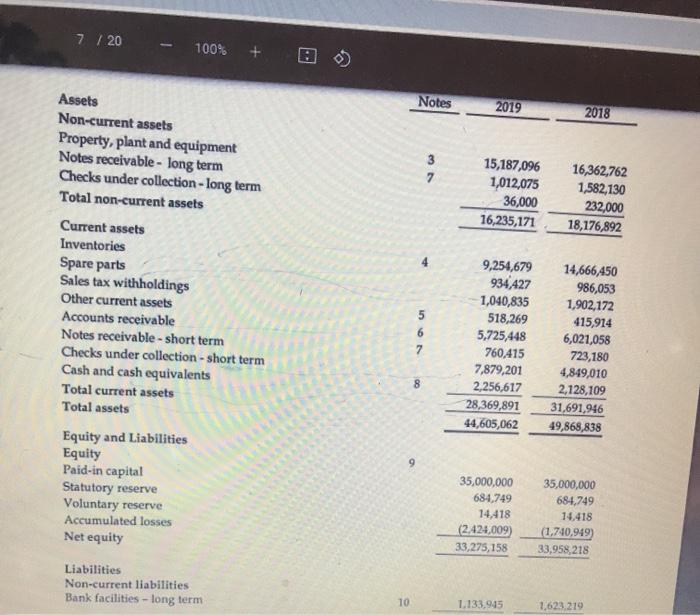

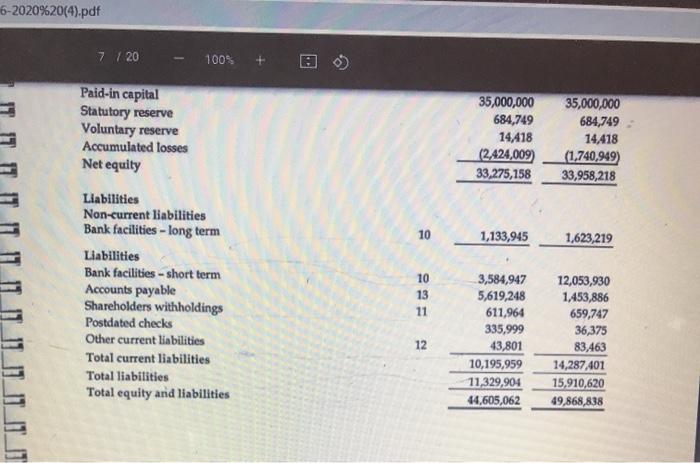

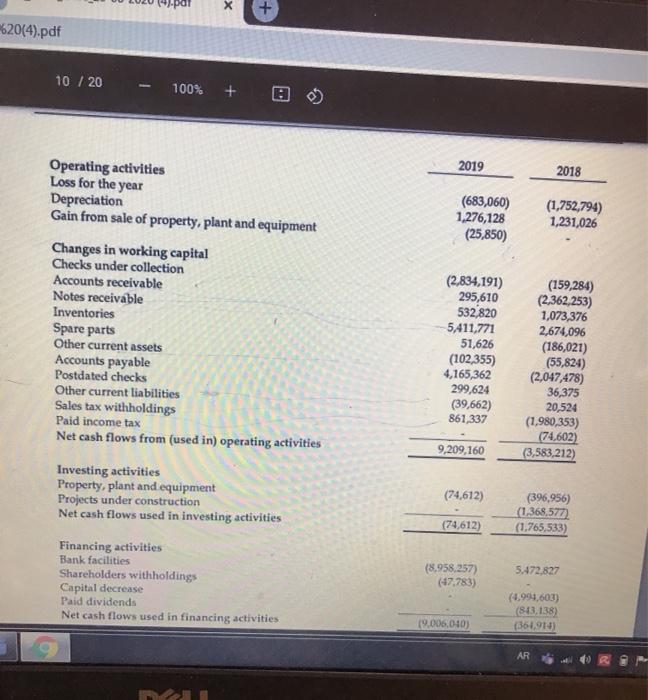

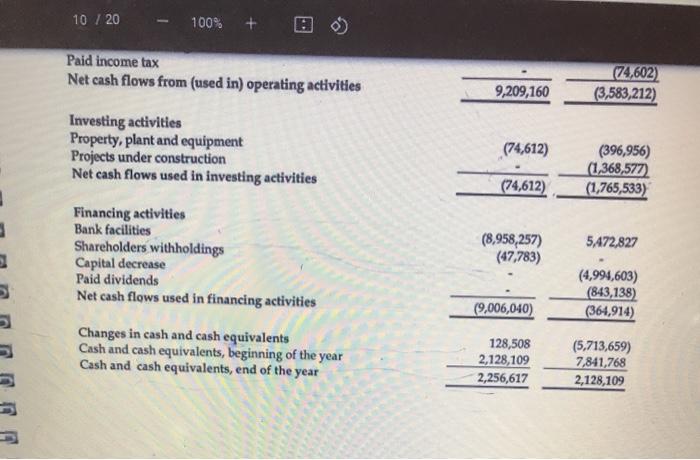

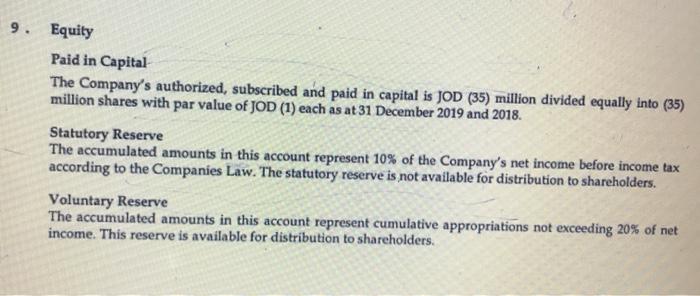

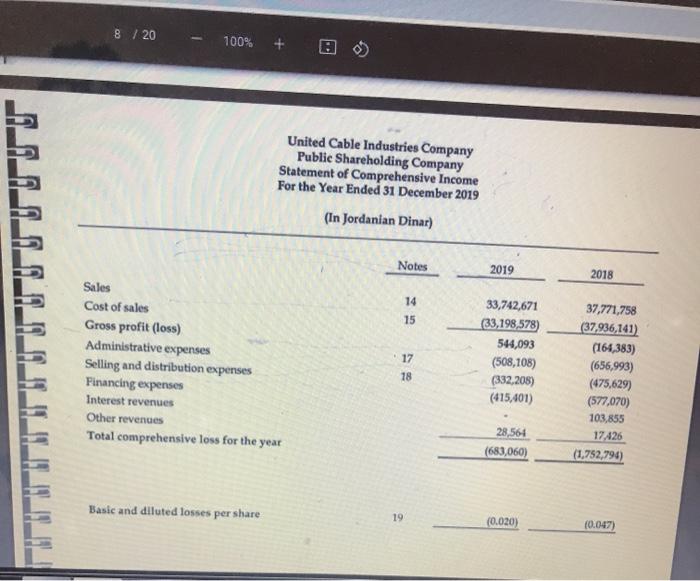

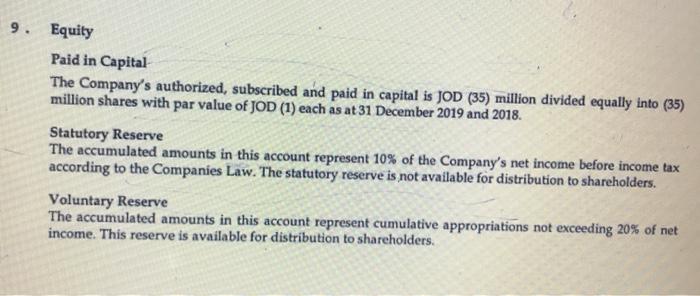

8 / 20 100% + United Cable Industries Company Public Shareholding Company Statement of Comprehensive Income For the Year Ended 31 December 2019 (In Jordanian Dinar) Notes 2019 2018 14 15 Sales Cost of sales Gross profit (loss) Administrative expenses Selling and distribution expenses Financing expenses Interest revenues Other revenues Total comprehensive loss for the year 17 18 33,742,671 (33,198,578) 544,093 (508,108) (332,208) (415,401) 37,771,758 (37,936,141) (164,383) (656,993) (475,629) (577,070) 103,855 17,426 (1,752,794) 28,564 (683,060) Basic and diluted losses per share 19 (0.020) (0.047) 7 / 20 100% + Notes 2019 2018 3 7 15,187,096 1,012,075 36,000 16,235,171 16,362,762 1,582,130 232,000 18,176,892 Assets Non-current assets Property, plant and equipment Notes receivable - long term Checks under collection - long term Total non-current assets Current assets Inventories Spare parts Sales tax withholdings Other current assets Accounts receivable Notes receivable - short term Checks under collection - short term Cash and cash equivalents Total current assets Total assets Equity and Liabilities Equity Paid-in capital Statutory reserve Voluntary reserve Accumulated losses Net equity 5 6 7 9,254,679 934 427 1,040,835 518,269 5,725,448 760.415 7,879,201 2,256,617 28,369,891 44,605,062 14,666,450 986,053 1,902,172 415,914 6,021,058 723,180 4,849,010 2,128,109 31,691,946 49,868,838 8 9 35,000,000 684,749 14,418 (2.424,009) 33,275,158 35,000,000 684,749 14.418 (1,740,949) 33,958,218 Liabilities Non-current liabilities Bank facilities - long term 10 1.133.945 1,623.219 6-2020%20(4).pdf 7 / 20 100% + Paid-in capital Statutory reserve Voluntary reserve Accumulated losses Net equity 35,000,000 684,749 14,418 (2,424,009) 33,275,158 35,000,000 684,749 14,418 (1,740,949) 33,958,218 10 1,133,945 1,623,219 Liabilities Non-current liabilities Bank facilities - long term Liabilities Bank facilities - short term Accounts payable Shareholders withholdings Postdated checks Other current liabilities Total current liabilities Total liabilities Total equity and liabilities 10 13 11 12 3,584,947 5,619,248 611,964 335,999 43,801 10,195,959 11,329,904 44,605,062 12,053,930 1,453,886 659,747 36,375 83,463 14,287,401 15,910,620 49,868,838 X + 620(4).pdf 10 / 20 100% + 2019 2018 (683,060) 1,276,128 (25,850) (1,752,794) 1,231,026 Operating activities Loss for the year Depreciation Gain from sale of property, plant and equipment Changes in working capital Checks under collection Accounts receivable Notes receivable Inventories Spare parts Other current assets Accounts payable Postdated checks Other current liabilities Sales tax withholdings Paid income tax Net cash flows from (used in) operating activities (2,834,191) 295,610 532,820 5,411,771 51,626 (102,355) 4,165,362 299,624 (39,662) 861,337 (159,284) (2,362,253) 1,073,376 2,674,096 (186,021) (55,824) (2,047,478) 36,375 20,524 (1.980,353) (74,602) (3,583,212) 9,209,160 Investing activities Property, plant and equipment Projects under construction Net cash flows used in investing activities (74,612) (396,956) (1,368,577) (1.765,533) (74,612) Financing activities Bank facilities Shareholders withholdings Capital decrease Paid dividends Net cash flows used in financing activities (8,958,257) (47.783) 5.472.827 (4.991,603) (813.138) (364,914) (9.006.010) AR 10 / 20 100% + Paid income tax Net cash flows from (used in) operating activities 9,209,160 (74,602) (3,583,212) Investing activities Property, plant and equipment Projects under construction Net cash flows used in investing activities (74,612) (396,956) (1,368,577) (1,765,533) (74,612) Financing activities Bank facilities Shareholders withholdings Capital decrease Paid dividends Net cash flows used in financing activities (8,958,257) (47,783) 5472,827 (4,994,603) (843,138) (364,914) (9,006,040) Changes in cash and cash equivalents Cash and cash equivalents, beginning of the year Cash and cash equivalents, end of the year 128,508 2,128,109 2,256,617 (5,713,659) 7,841,768 2,128,109 9. Equity Paid in Capital The Company's authorized, subscribed and paid in capital is JOD (35) million divided equally into (35) million shares with par value of JOD (1) each as at 31 December 2019 and 2018. Statutory Reserve The accumulated amounts in this account represent 10% of the Company's net income before income tax according to the Companies Law. The statutory reserve is not available for distribution to shareholders. Voluntary Reserve The accumulated amounts in this account represent cumulative appropriations not exceeding 20% of net income. This reserve is available for distribution to shareholders. (In Jordanian Dinar) General United Cable Industries Company was established on 5 July 2007 in accordance with Jordanian Companies Law No. (441) as a Public Shareholding Company. The Company head office is in the Hashemite Kingdom of Jordan. Company's main objective is manufacturing cables and related products. Company's shares are listed in Amman Stock Exchange. The accompanying financial statements were authorized for issue by the Company's Board of Directors in their meeting held on 27 February 2020 and it is subject to the General Assembly approval