How to do part b?

How to do part b?

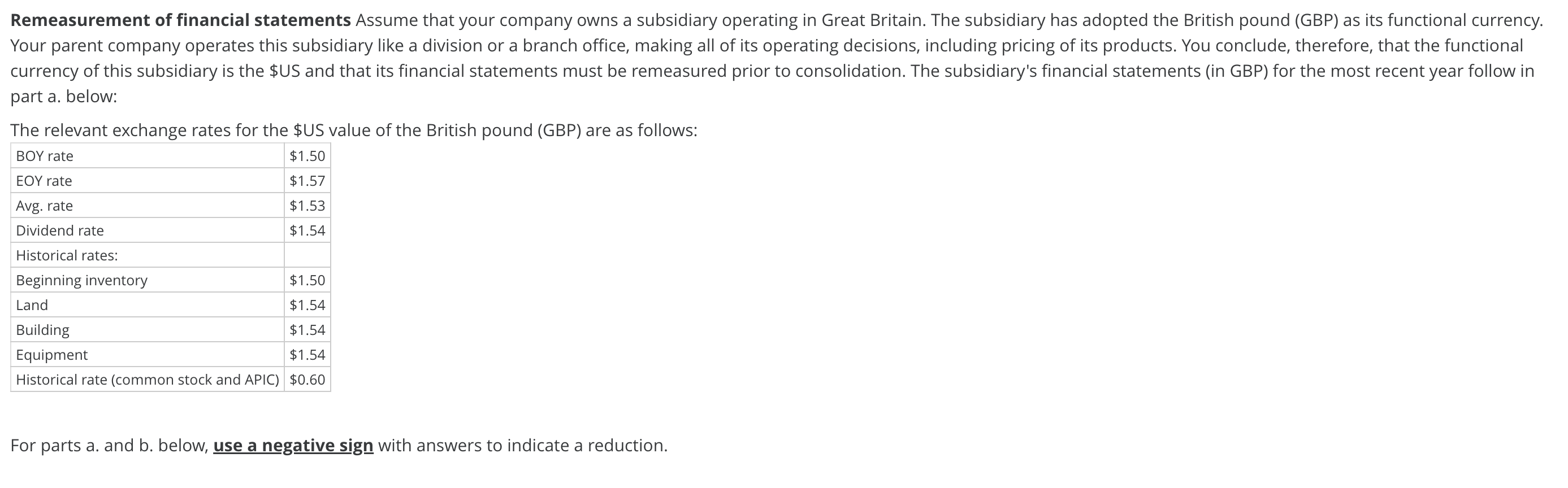

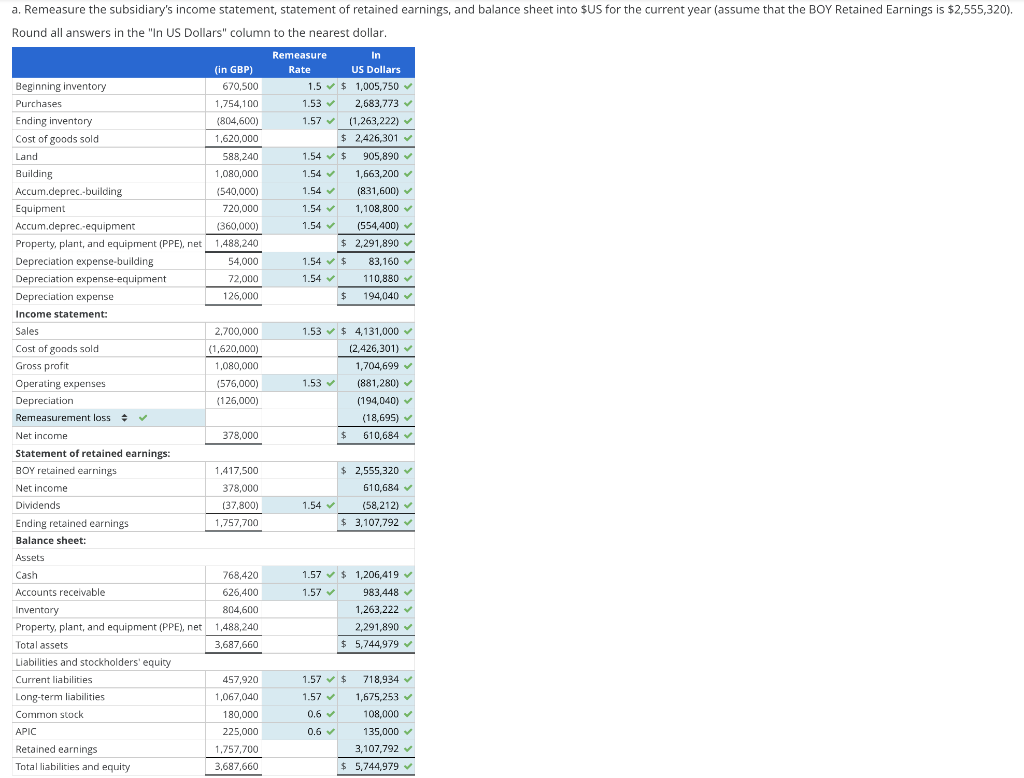

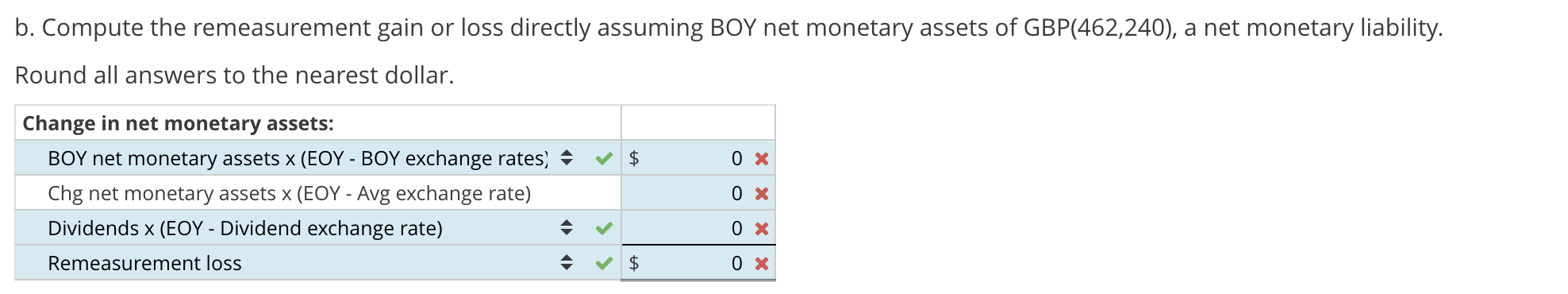

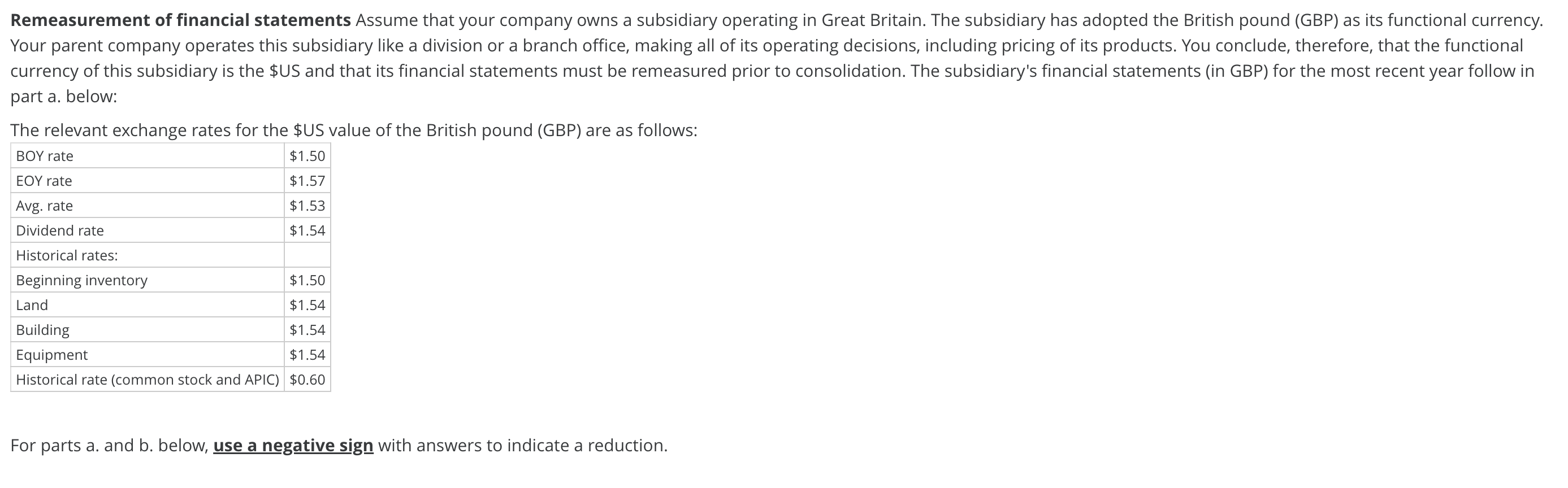

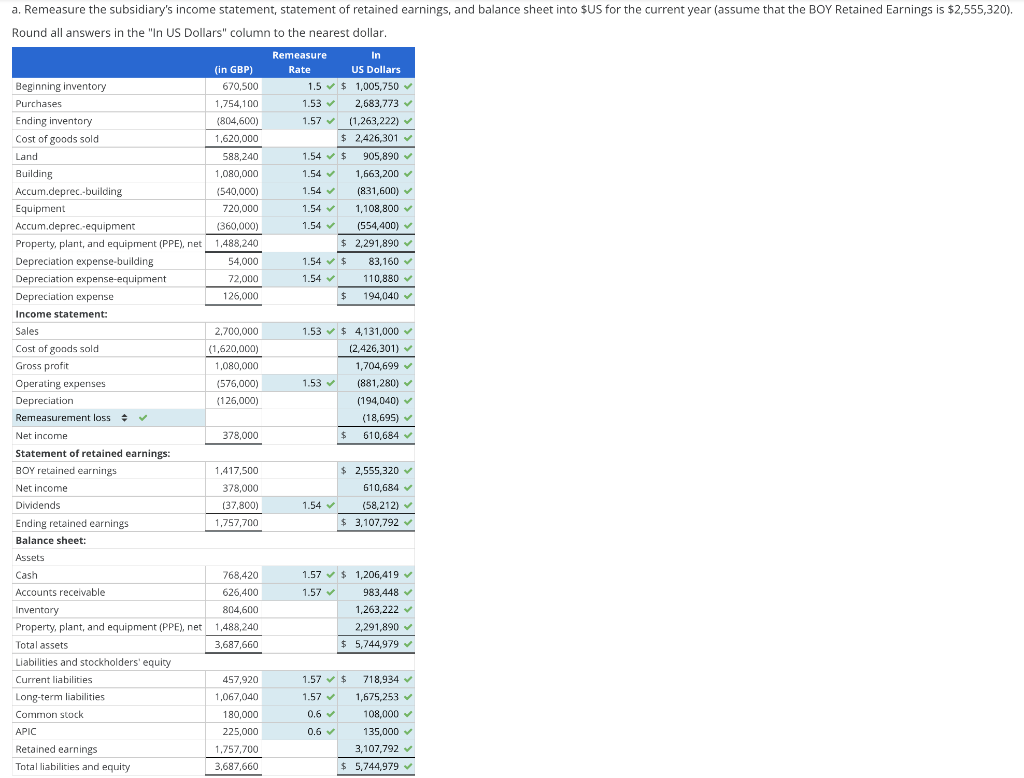

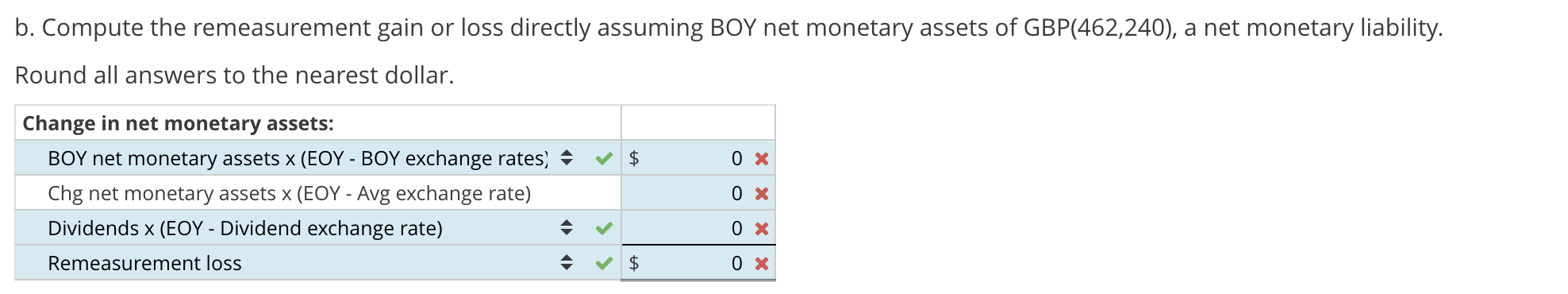

Remeasurement of financial statements Assume that your company owns a subsidiary operating in Great Britain. The subsidiary has adopted the British pound (GBP) as its functional currency. Your parent company operates this subsidiary like a division or a branch office, making all of its operating decisions, including pricing of its products. You conclude, therefore, that the functional currency of this subsidiary is the $US and that its financial statements must be remeasured prior to consolidation. The subsidiary's financial statements (in GBP) for the most recent year follow in part a. below: The relevant exchange rates for the \$US value of the British pound (GBP) are as follows: For parts a. and b. below, use a negative sign with answers to indicate a reduction. a. Remeasure the subsidiary's income statement, statement of retained earnings, and balance sheet into $ US for the current year (assume that the BOY Retained Earnings is $2,555,320 ). Round all answers in the "In US Dollars" column to the nearest dollar. b. Compute the remeasurement gain or loss directly assuming BOY net monetary assets of GBP(462,240), a net monetary liability. Round all answers to the nearest dollar. Remeasurement of financial statements Assume that your company owns a subsidiary operating in Great Britain. The subsidiary has adopted the British pound (GBP) as its functional currency. Your parent company operates this subsidiary like a division or a branch office, making all of its operating decisions, including pricing of its products. You conclude, therefore, that the functional currency of this subsidiary is the $US and that its financial statements must be remeasured prior to consolidation. The subsidiary's financial statements (in GBP) for the most recent year follow in part a. below: The relevant exchange rates for the \$US value of the British pound (GBP) are as follows: For parts a. and b. below, use a negative sign with answers to indicate a reduction. a. Remeasure the subsidiary's income statement, statement of retained earnings, and balance sheet into $ US for the current year (assume that the BOY Retained Earnings is $2,555,320 ). Round all answers in the "In US Dollars" column to the nearest dollar. b. Compute the remeasurement gain or loss directly assuming BOY net monetary assets of GBP(462,240), a net monetary liability. Round all answers to the nearest dollar

How to do part b?

How to do part b?