Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to do statment of profit/lose (income statement) for this question? Question 1 Nikita has prepared the following statement of financial position at the end

How to do statment of profit/lose (income statement) for this question?

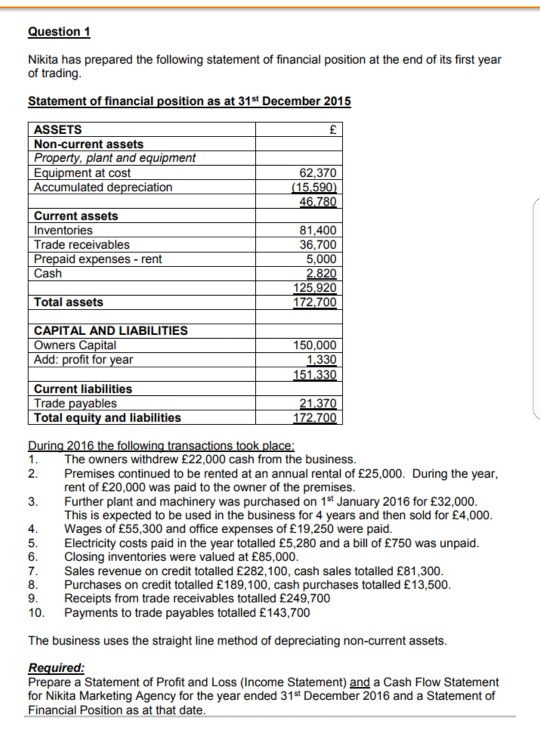

Question 1 Nikita has prepared the following statement of financial position at the end of its first year of trading Statement of financial position as at 31st December 2015 ASSETS Non-current assets ant and 62,370 Equipment at cost Accumulated depreciation Current assets Inventories Trade receivables 81,400 36,700 5,000 aid expenses rent Cash Total assets APITAL AND LIABILITIES Owners Capital Add: profit for 150,000 Current liabilities Trade payables Total equity and liabilities The owners withdrew 22,000 cash from the business 2. Premises continued to be rented at an annual rental of 25,000. During the year rent of 20,000 was paid to the owner of the premises. Further plant and machinery was purchased on 1st January 2016 for 32,000 This is expected to be used in the business for 4 years and then sold for 4,000 3. 4. Wages of 55,300 and office expenses of 19,250 were paid 5. Electricity costs paid in the year totalled 5,280 and a bill of 750 was unpaid. 6. Closing inventories were valued at 85,000 7. Sales revenue on credit totalled 282,100, cash sales totalled 81,300 8. Purchases on credit totalled 189,100, cash purchases totalled 13,500 9.Receipts from trade receivables totalled 249,700 10. Payments to trade payables totalled 143,700 The business uses the straight line method of depreciating non-current assets Required: Prepare a Statement of Profit and Loss (Income Statement) and a Cash Flow Statement for Nikita Marketing Agency for the year ended 31st December 2016 and a Statement of Financial Position as at that date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started