Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to do these questions? Question 2 [15 points] As your response to this question, your handwritten or typed answer to all parts needs to

How to do these questions?

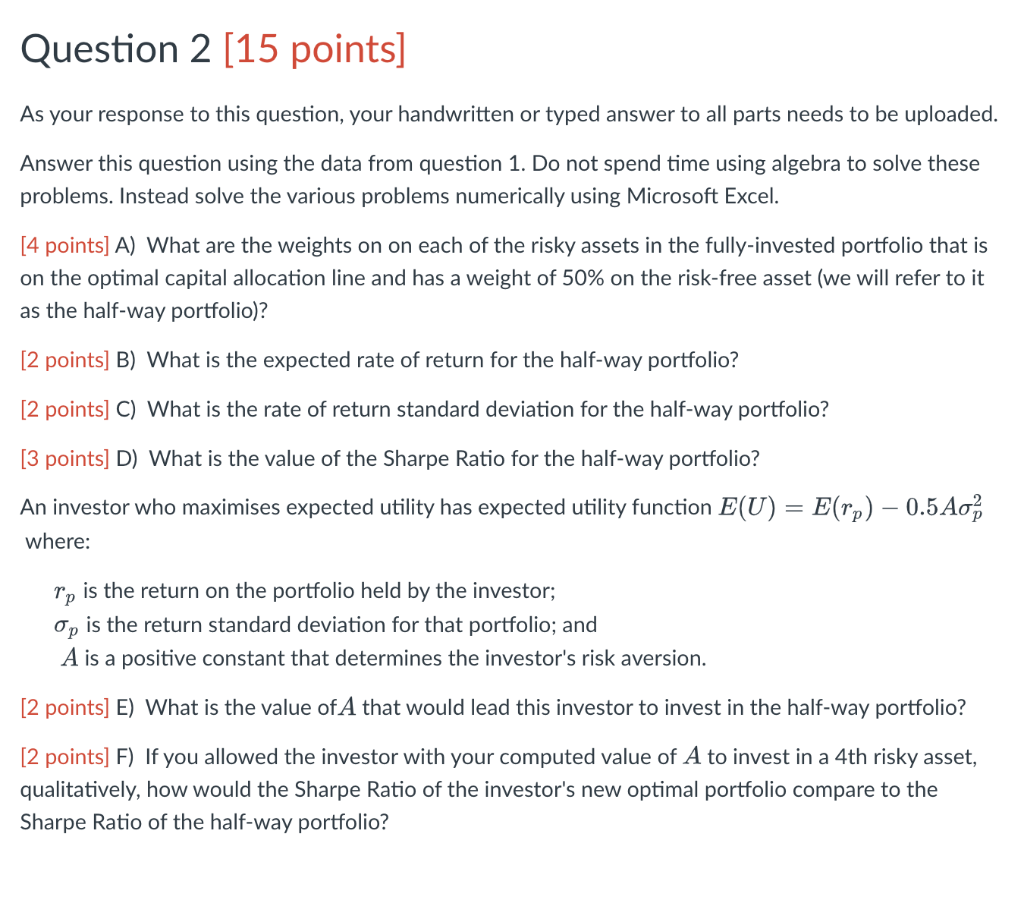

Question 2 [15 points] As your response to this question, your handwritten or typed answer to all parts needs to be uploaded. Answer this question using the data from question 1. Do not spend time using algebra to solve these problems. Instead solve the various problems numerically using Microsoft Excel. [4 points] A) What are the weights on on each of the risky assets in the fully-invested portfolio that is on the optimal capital allocation line and has a weight of 50% on the risk-free asset (we will refer to it as the half-way portfolio)? [2 points] B) What is the expected rate of return for the half-way portfolio? [2 points] C) What is the rate of return standard deviation for the half-way portfolio? [3 points] D) What is the value of the Sharpe Ratio for the half-way portfolio? An investor who maximises expected utility has expected utility function E(U) = E(rp) 0.5Ao where: is the return on the portfolio held by the investor; Op is the return standard deviation for that portfolio; and A is a positive constant that determines the investor's risk aversion. [2 points] E) What is the value of A that would lead this investor to invest in the half-way portfolio? [2 points] F) If you allowed the investor with your computed value of A to invest in a 4th risky asset, qualitatively, how would the Sharpe Ratio of the investor's new optimal portfolio compare to the Sharpe Ratio of the half-way portfolio? Question 2 [15 points] As your response to this question, your handwritten or typed answer to all parts needs to be uploaded. Answer this question using the data from question 1. Do not spend time using algebra to solve these problems. Instead solve the various problems numerically using Microsoft Excel. [4 points] A) What are the weights on on each of the risky assets in the fully-invested portfolio that is on the optimal capital allocation line and has a weight of 50% on the risk-free asset (we will refer to it as the half-way portfolio)? [2 points] B) What is the expected rate of return for the half-way portfolio? [2 points] C) What is the rate of return standard deviation for the half-way portfolio? [3 points] D) What is the value of the Sharpe Ratio for the half-way portfolio? An investor who maximises expected utility has expected utility function E(U) = E(rp) 0.5Ao where: is the return on the portfolio held by the investor; Op is the return standard deviation for that portfolio; and A is a positive constant that determines the investor's risk aversion. [2 points] E) What is the value of A that would lead this investor to invest in the half-way portfolio? [2 points] F) If you allowed the investor with your computed value of A to invest in a 4th risky asset, qualitatively, how would the Sharpe Ratio of the investor's new optimal portfolio compare to the Sharpe Ratio of the half-way portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started