Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to do this question? teach me how to get the answer.. Is there any formula need to use? The following is the balance sheet

How to do this question? teach me how to get the answer.. Is there any formula need to use?

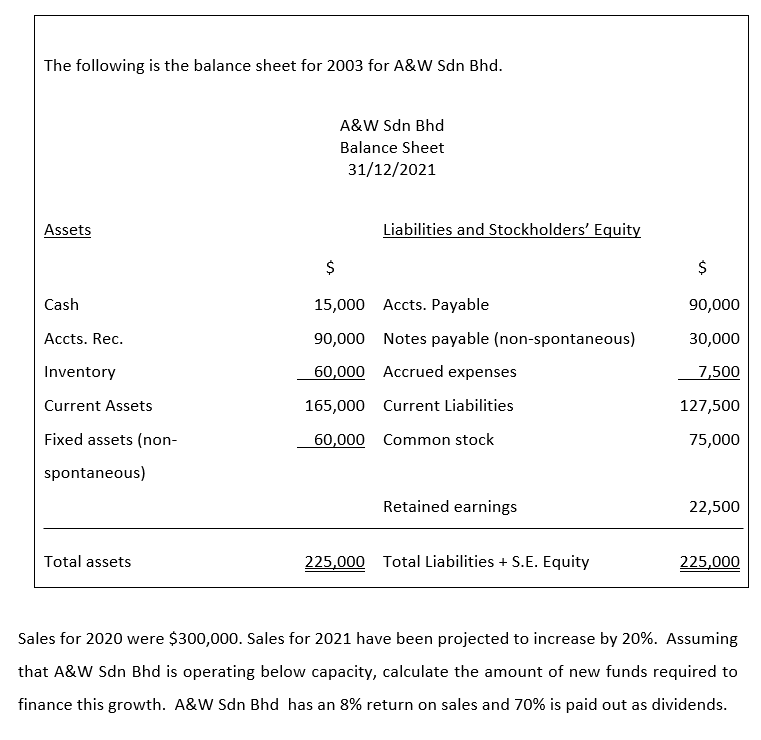

The following is the balance sheet for 2003 for A&W Sdn Bhd. A&W Sdn Bhd Balance Sheet 31/12/2021 Assets Liabilities and Stockholders' Equity $ $ Cash 90,000 15,000 Accts. Payable 90,000 Notes payable (non-spontaneous) Accts. Rec. 30,000 Inventory 60,000 Accrued expenses 7,500 Current Assets 165,000 Current Liabilities 127,500 Fixed assets (non- 60,000 Common stock 75,000 spontaneous) Retained earnings 22,500 Total assets 225,000 Total Liabilities + S.E. Equity 225,000 Sales for 2020 were $300,000. Sales for 2021 have been projected to increase by 20%. Assuming that A&W Sdn Bhd is operating below capacity, calculate the amount of new funds required to finance this growth. A&W Sdn Bhd has an 8% return on sales and 70% is paid out as dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started