Answered step by step

Verified Expert Solution

Question

1 Approved Answer

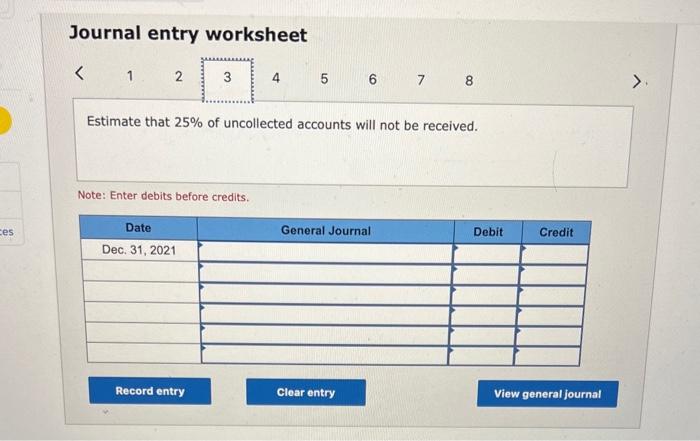

How to do this? Required information [The following information applies to the questions displayed below.] The following events occur for Morris Engineering during 2021 and

How to do this?

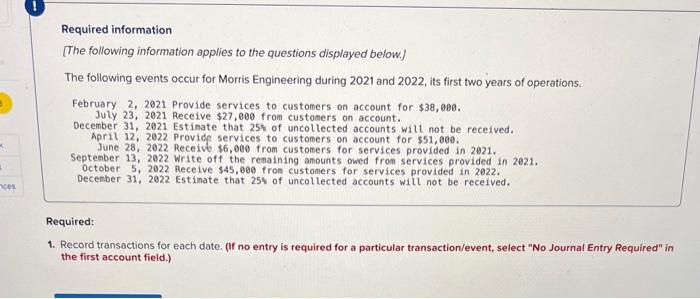

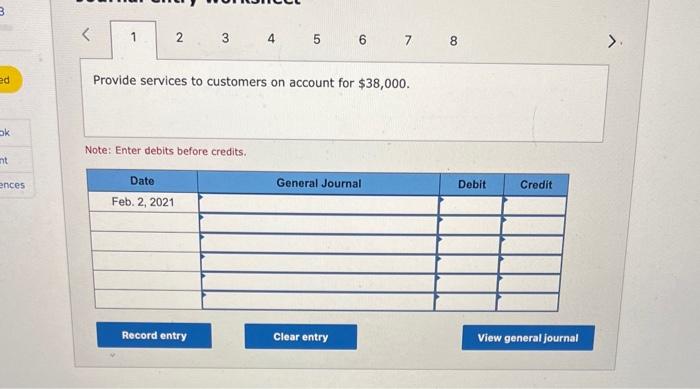

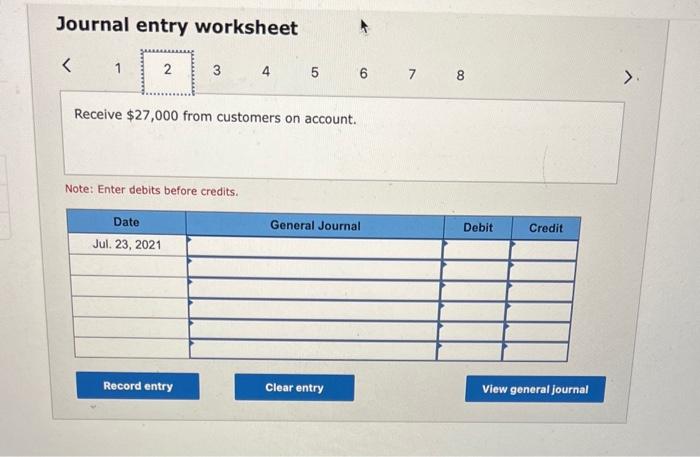

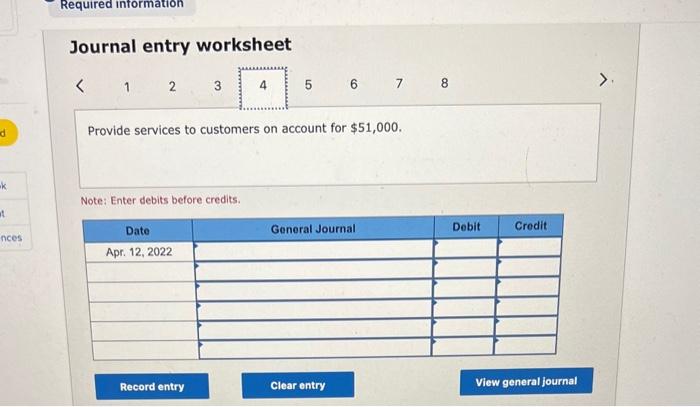

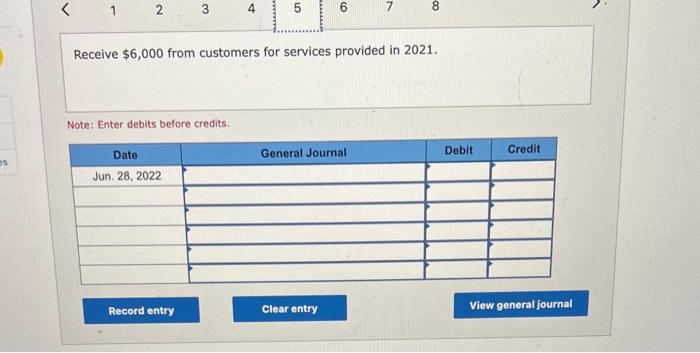

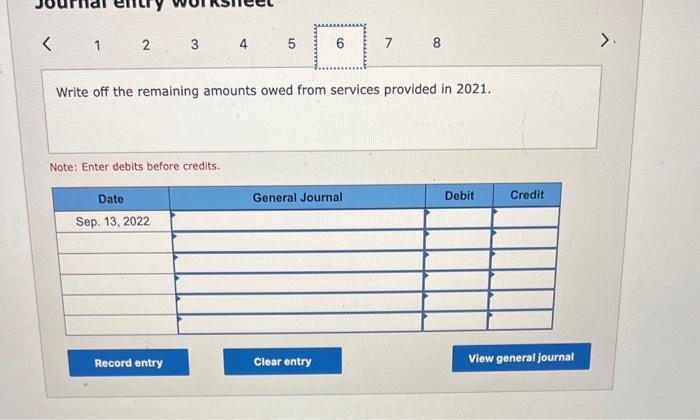

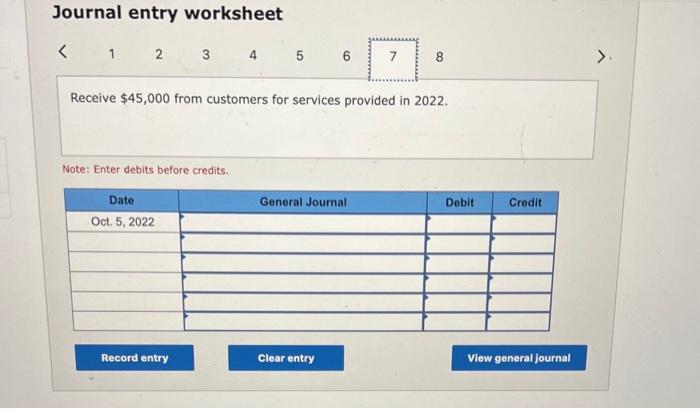

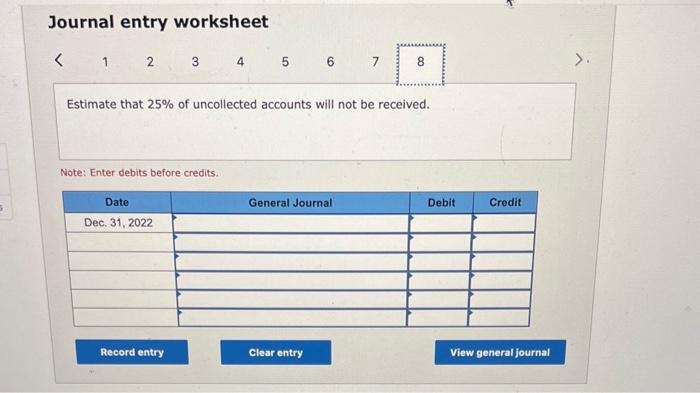

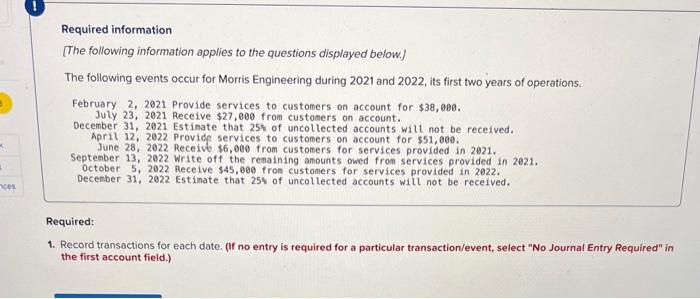

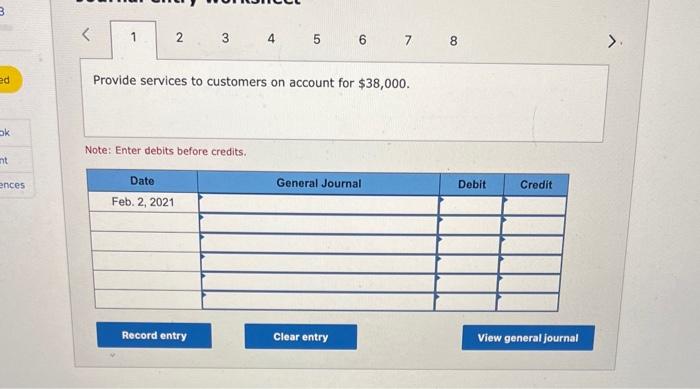

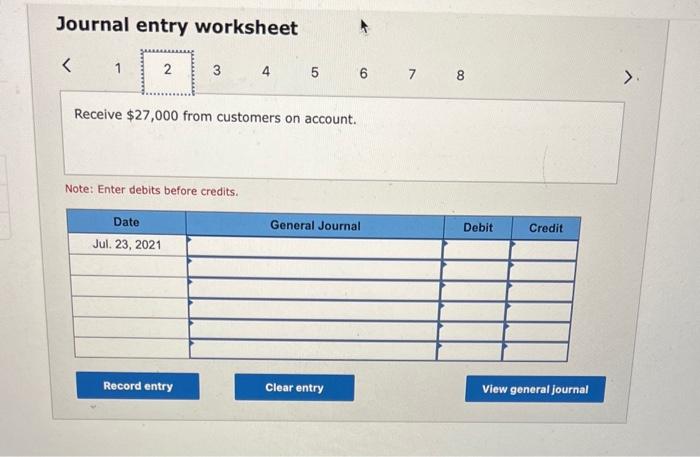

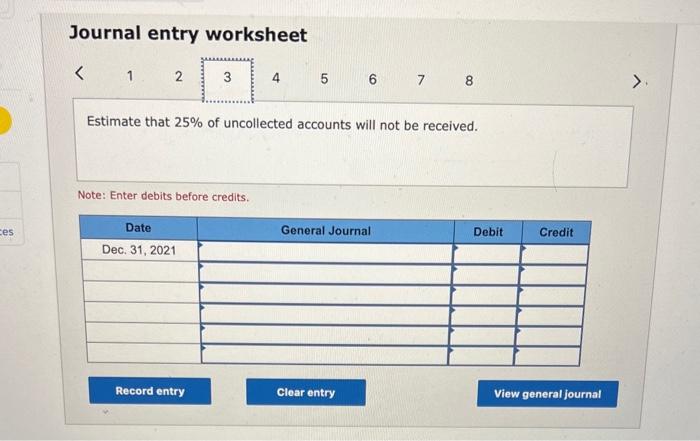

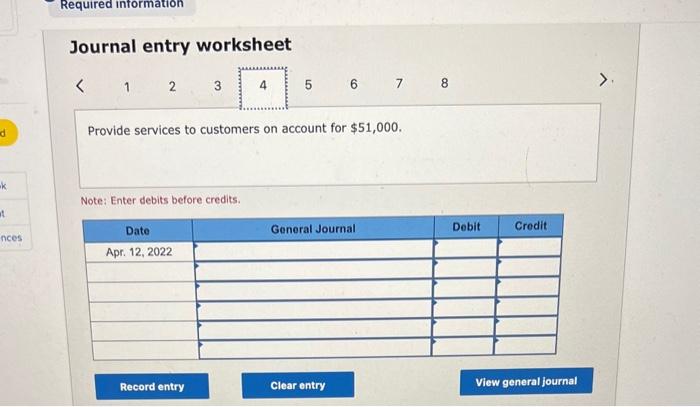

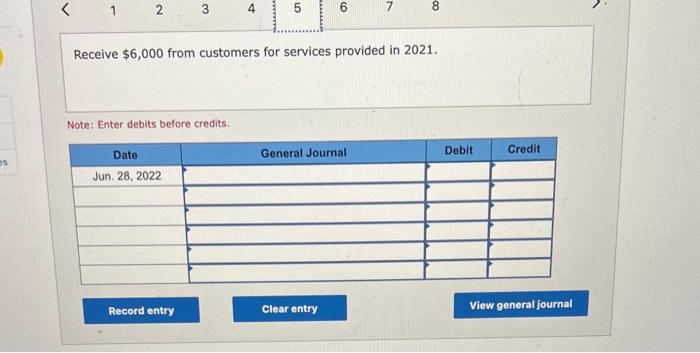

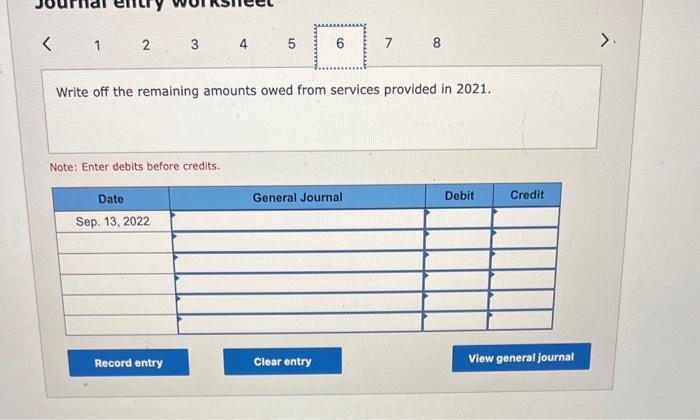

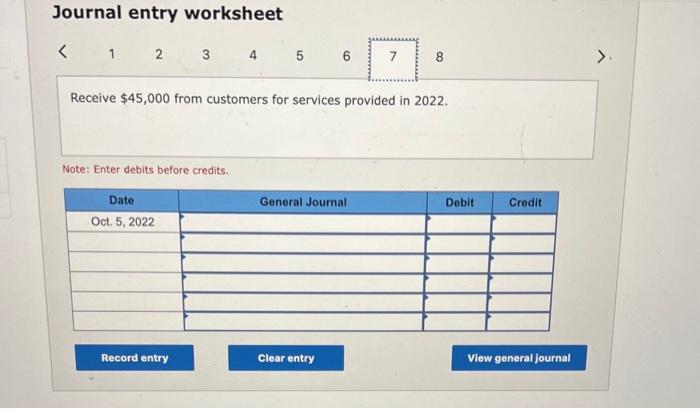

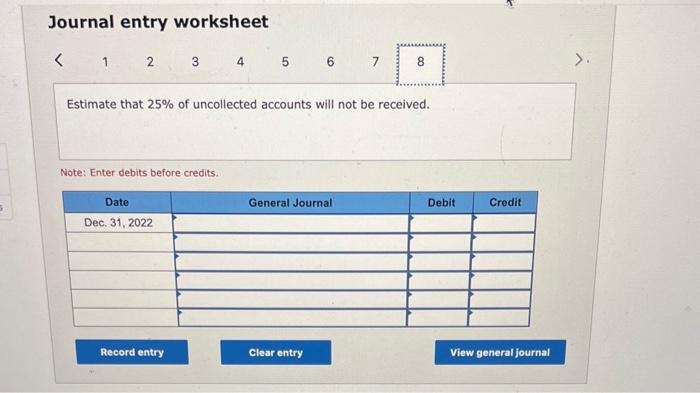

Required information [The following information applies to the questions displayed below.] The following events occur for Morris Engineering during 2021 and 2022, its first two years of operations. February 2, 2021 Provide services to customers on account for $38,060. July 23, 2021 Receive $27,000 from customers on account. December 31, 2021 Estimate that 25 tro of uncollected accounts witl not be received. April 12, 2022 Provide services to customers on account for $51,009. September 28, 2022 Receive \$6,000 from customers for services provided in 2021. September 13, 2022 Write off the remaining amounts owed from services provided in 2021. october 5,2022 Receive $45,000 from customers for services provided in 2022. Decenber 31, 2022 Estinate that 25 s of uncollected accounts witl not be received. ?equired: Record transactions for each date. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Provide services to customers on account for $38,000. Note: Enter debits before credits. Journal entry worksheet Receive $27,000 from customers on account. Note: Enter debits before credits. Journal entry worksheet Estimate that 25% of uncollected accounts will not be received. Note: Enter debits before credits. Journal entry worksheet Provide services to customers on account for $51,000. Note: Enter debits before credits. Receive $6,000 from customers for services provided in 2021 . Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started