How to explain the Horizontal Analysis in WORDS on both Income Statement and Balance Sheet form these examples?(separately)

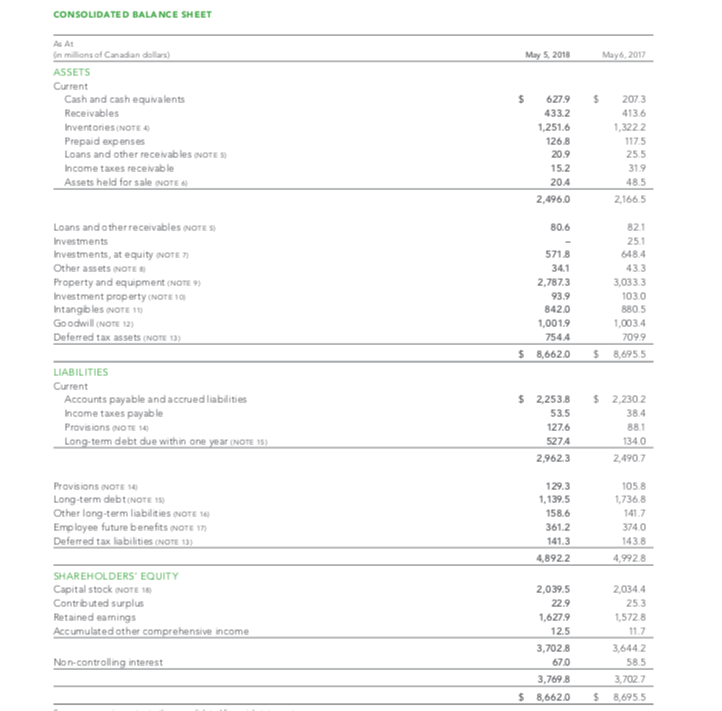

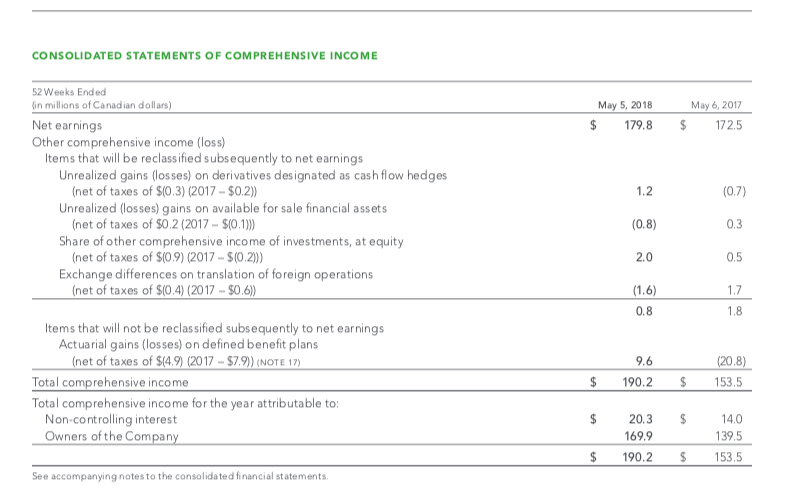

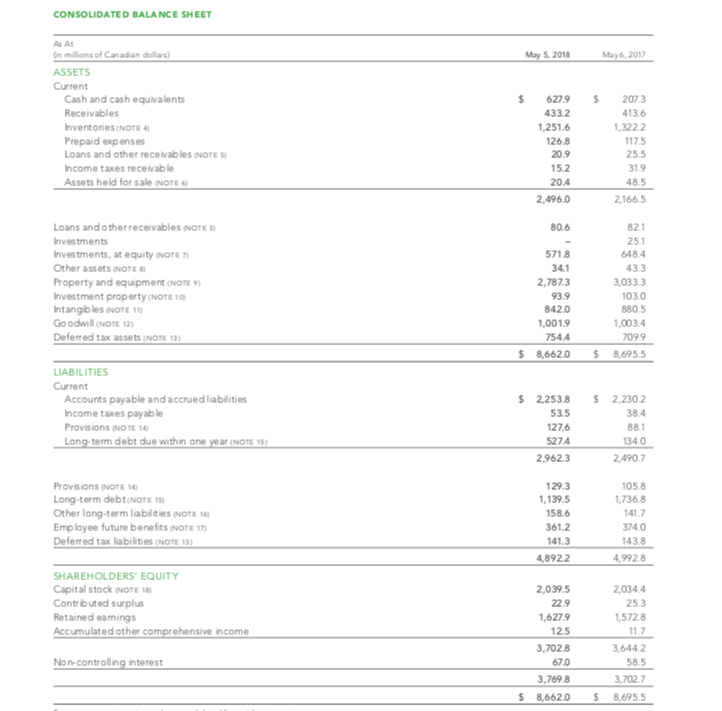

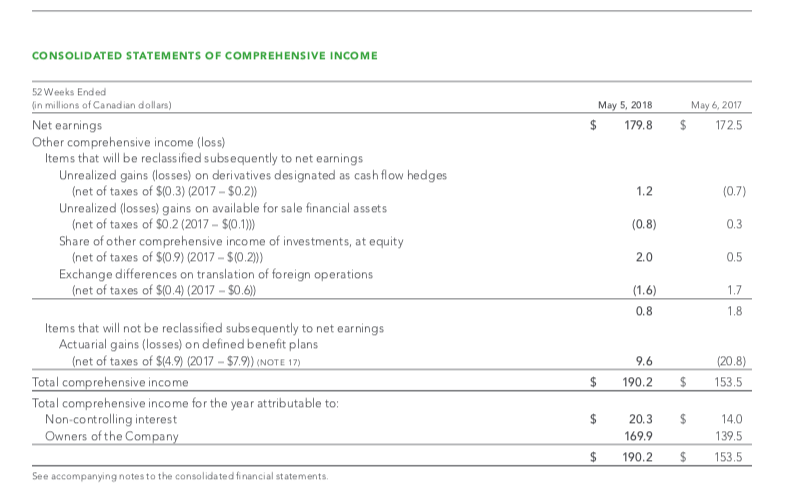

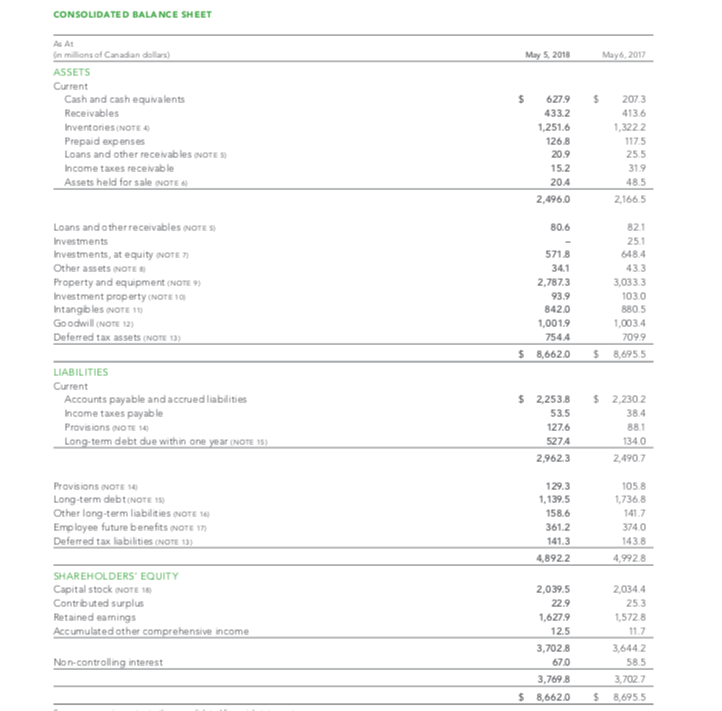

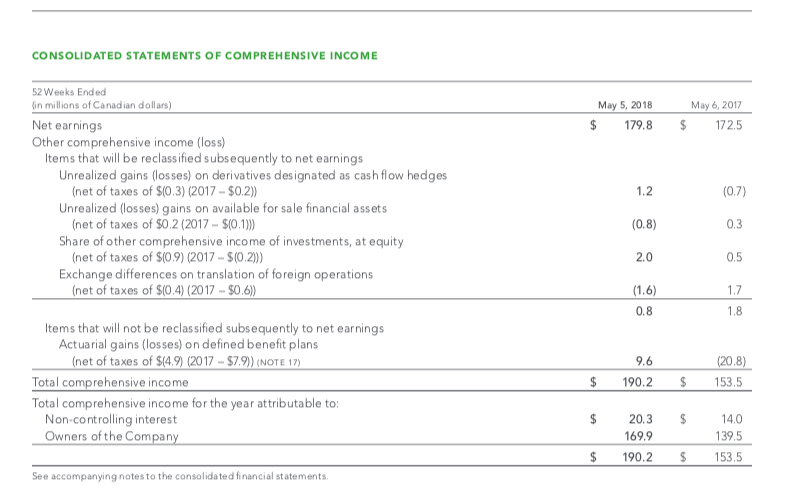

CONSOLIDATED BALANCE SHEET In millions of Canadian dollars) May 5. 2018 May6, 2017 ASSETS Current Cash and cash equivalents 627.9 207.3 Receivables 133.2 413.6 Inventones (NOTE ) 1,251.6 1,322 2 Prepaid expenses 126.8 117.5 Loans and other receivables (VOTE S 20.9 25.5 Income taxes receivable 15.2 31.9 Assets held for sale (NOTE & 48.5 2,496.0 2.166.5 Loans and other receivables (NOTE ) 80.6 821 Investments 25.1 Investments, at equity (NOTE n) 571.8 648.4 Other assets (NOTE & 34.1 43.3 Property and equipment (NOTE .) 2,787.3 3.03 3.3 Investment property (NOTE 10) 93.9 103.0 Intangibles (NOTE 11) 842.0 680.5 Goodwill (NOTE 12) 1,001.9 1,003.4 Deferred tax assets (NOTE 13) 754 7095 $ 8,662.0 $ 8,695.5 LIABILITIES Current Accounts payable and accrued liabilities $ 2,253.8 2,230 2 Income taxes payable 53.5 38.4 Provisions (NOTE 14) 127.6 88.1 Long-term debt due within one year (NOTE Is) 134.0 2,962.3 2,490.7 Provisions (NOTE 14) 129.3 105.8 Long-term debt(Note in 1,139.5 1,736.8 Other long-term liabilities (NOTE 1 158.6 141.7 Employee future benefits (NOTE In) 361.2 374.0 Deferred tax liabilities (NOTE 1) 141.3 143.8 4,892.2 4.9928 SHAREHOLDERS' EQUITY Capital stock (NOTE 140 2,039.5 2,034.4 Contributed surplus 22.9 25.3 Retained earnings 1,627.9 1,5728 Accumulated other comprehensive income 12.5 11.7 3,702.8 3,644.2 Non-controlling interest 67.0 58.5 3,769 8 3,702.7 $ 8,6620 $ 8,695.5CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME 52 Weeks Ended (in millions of Canadian dollars) May 5, 2018 May 6, 2017 Net earnings $ 179.8 $ 172.5 Other comprehensive income (loss) Items that will be reclassified subsequently to net earnings Unrealized gains (losses) on derivatives designated as cash flow hedges (net of taxes of $(0.3) (2017 - $0.2)) 1.2 (0.7) Unrealized (losses) gains on available for sale financial assets (net of taxes of $0.2 (2017 - $(0.1))) (0.8) 0,3 Share of other comprehensive income of investments, at equity (net of taxes of $(0.9) (2017 - $(0.2))) 2.0 0,5 Exchange differences on translation of foreign operations (net of taxes of $(0.4) (2017 - $0.6)) (1.6) 1,7 0.8 1.8 Items that will not be reclassified subsequently to net earnings Actuarial gains (losses) on defined benefit plans (net of taxes of $(4.9) (2017 - $7.9)) (NOTE 17) 9.6 (20.8) Total comprehensive income $ 190.2 $ 153.5 Total comprehensive income for the year attributable to: Non-controlling interest 20.3 14.0 Owners of the Company 169.9 139.5 $ 190.2 $ 153.5 See accompanying notes to the consolidated financial statements