Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how to figure it out tax on capital gains Question Help Rena purchased 400 shares of an equity mutual fund. During the year she received

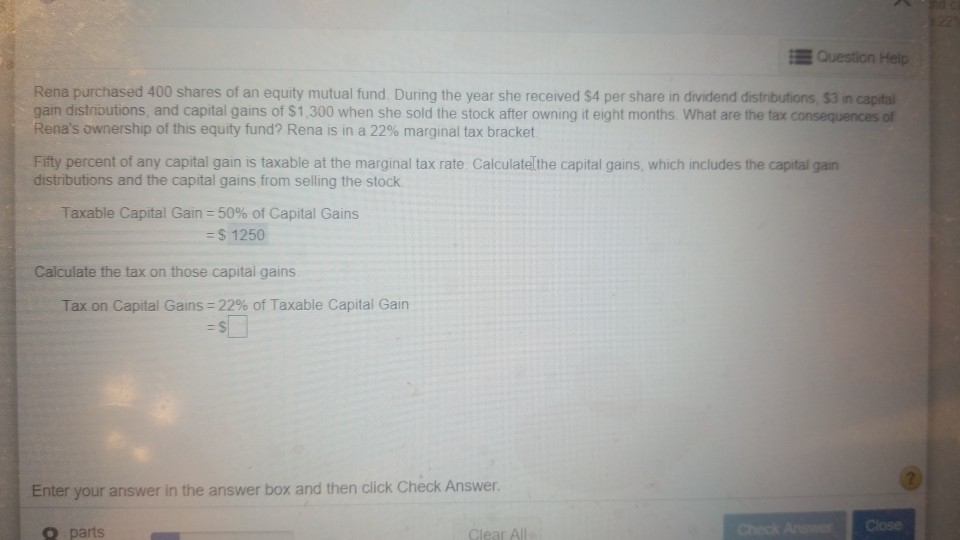

how to figure it out tax on capital gains

Question Help Rena purchased 400 shares of an equity mutual fund. During the year she received $4 per share in dividend distributions, $3 in capital gain distributions and capital gains of $1,300 when she sold the stock after owning it eight months. What are the tax consequences of Rena's ownership of this equity fund? Rena is in a 22% marginal tax bracket Fifty percent of any capital gain is taxable at the marginal tax rate. Calculate the capital gains, which includes the capital gain distributions and the capital gains from selling the stock Taxable Capital Gain =50% of Capital Gains = $ 1250 Calculate the tax on those capital gains Tax on Capital Gains = 22% of Taxable Capital Gain Enter your answer in the answer box and then click Check Answer. Close oparts Clear AllStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started