Question

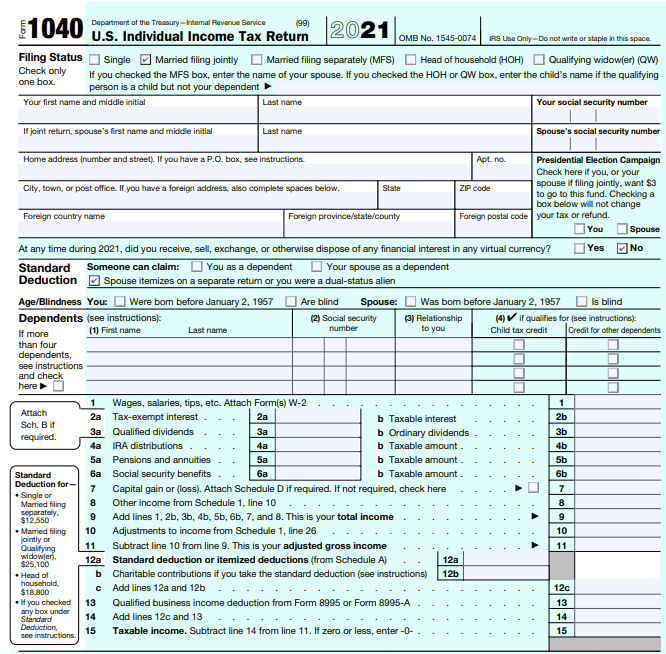

HOW TO FILL IN THE FORM 1040 WITH THE INFORMATION below? 1) John is 19-year-old. He has a W-2 for $20,000 with $2,000 federal withholding.

HOW TO FILL IN THE FORM 1040 WITH THE INFORMATION below?

1) John is 19-year-old. He has a W-2 for $20,000 with $2,000 federal withholding.

2) Pam (John's wife) is 24 years old. She has a W-2 for $50,000 with $5,000 federal withholding. Pam also has $250 in teacher expenses.

3) John has $2,000 student loan interest.

4) Pam has 3 kids from a previous marriage. The kids are 3, 4, and 5.

5) John is an accounting student. He has paid $5,000 in tuition.

6) Pam has $2,000 childcare expense.

7) John has $2,000 interest income.

8) Pam has $20,0000 mortgage interest, $18,000 medical expense, $10,000 church donations, and$10,000 RE Taxes.

9) John has Uber profit of $2,000.

10) Pam sold stocks $40,000 basis $30,000.

11) John has a farm loss of $8,000.

12) John has rental gain of $5,000.

Required: Prepare the tax return for John and Pam.

What is the refund amount?

And how to use the information to fill in the U.S. Individual Income Tax Return?

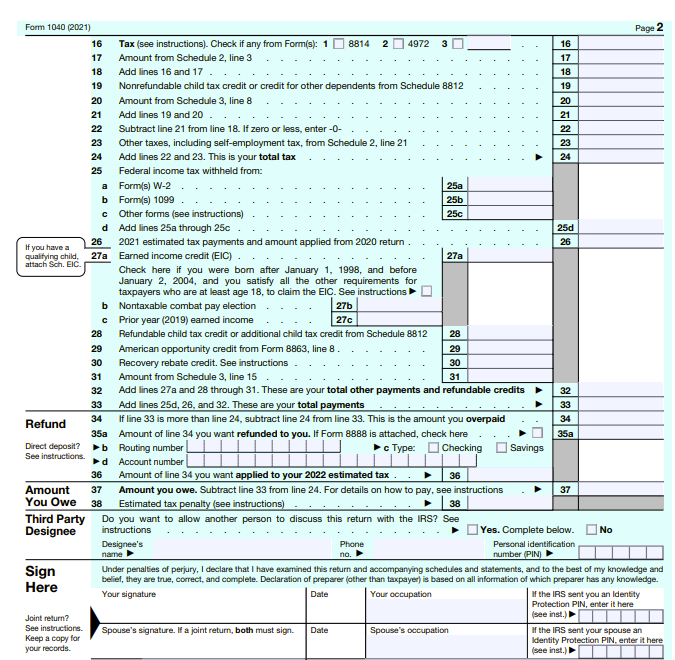

Form 1040 (2021) If you have a qualifying child, attach Sch. EIC. Refund Direct deposit? See instructions. Third Party Designee Sign Here 16 17 18 19 Joint return? See instructions. Keep a copy for your records. 20 21 22 23 24 25 a b d 26 27a 28 29 30 31 32 33 34 35a b Amount 37 You Owe 38 d 36 Tax (see instructions). Check if any from Form(s): 1 Amount from Schedule 2, line 3 Add lines 16 and 17. Nonrefundable child tax credit or credit for other dependents from Schedule 8812 Amount from Schedule 3, line 8 b Nontaxable combat pay election Prior year (2019) earned income Refundable child tax credit or additional child tax credit from Schedule 8812 American opportunity credit from Form 8863, line 8. Recovery rebate credit. See instructions. Add lines 19 and 20. Subtract line 21 from line 18. If zero or less, enter -0- Other taxes, including self-employment tax, from Schedule 2, line 21 Add lines 22 and 23. This is your total tax Federal income tax withheld from: Form(s) W-2 Form(s) 1099 Other forms (see instructions) 8814 2 4972 3 Add lines 25a through 25c 2021 estimated tax payments and amount applied from 2020 return. Earned income credit (EIC). Check here if you were born after January 1, 1998, and before January 2, 2004, and you satisfy all the other requirements for taxpayers who are at least age 18, to claim the EIC. See instructions 27b 27c Designee's name 25a 25b 25c Amount from Schedule 3, line 15 Add lines 27a and 28 through 31. These are your total other payments and refundable credits Add lines 25d, 26, and 32. These are your total payments If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid Account number 36 Amount of line 34 you want applied to your 2022 estimated tax . . Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions Estimated tax penalty (see instructions) 38 Do you want to allow another person to discuss this return with the IRS? See instructions 27a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here Routing number : Checking Spouse's signature. If a joint return, both must sign. Date Phone no. 28 29 30 31 Spouse's occupation Savings 16 17 18 19 20 21 22 23 24 25d 26 32 33 34 35a 37 Yes. Complete below. Personal identification number (PIN) No Page Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Your signature Date Your occupation If the IRS sent you an Identity Protection PIN, enter it here (see inst.) 2 If the IRS sent your spouse an Identity Protection PIN, enter it here (see inst.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is how I would fill out the Form 1040 using the information provided Form 1040 John and Pam Lin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started