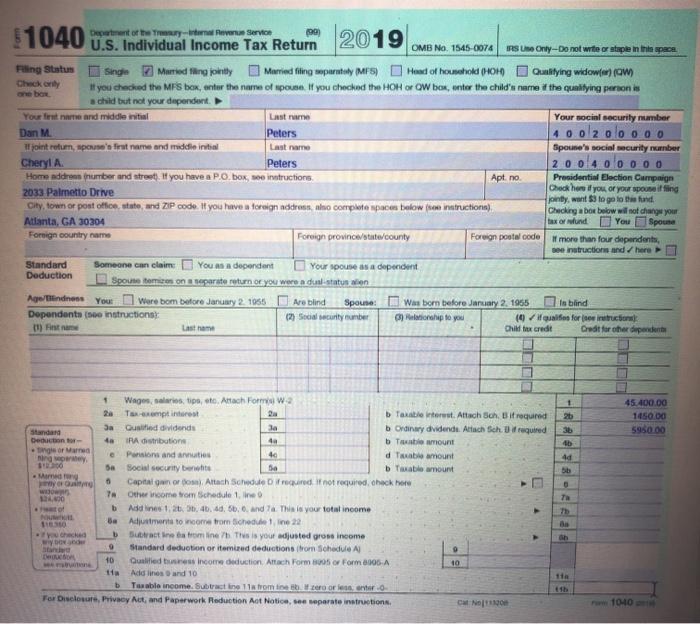

How to fill out 1040 with information provided in Word Doc?

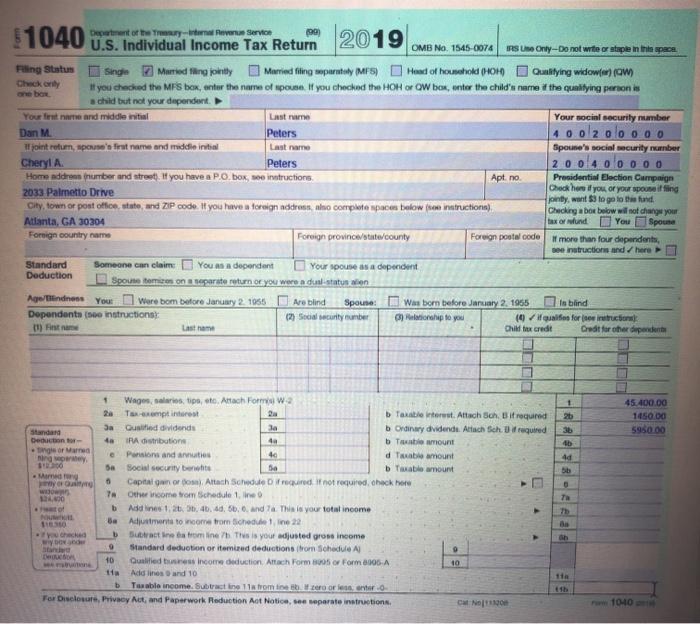

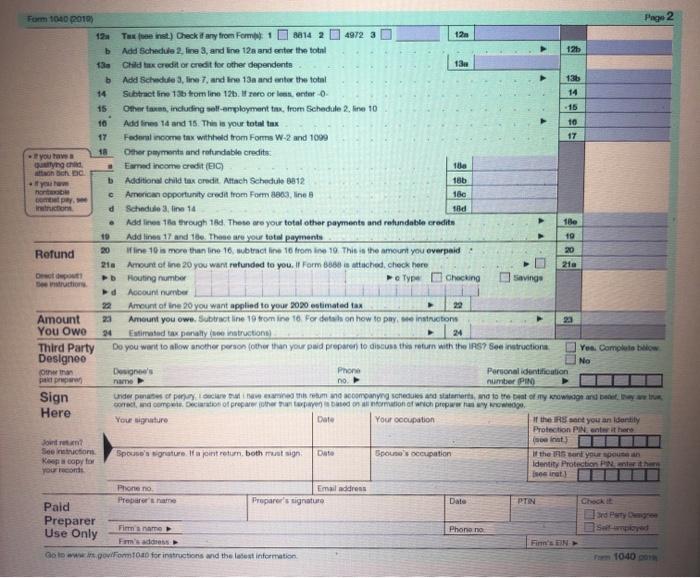

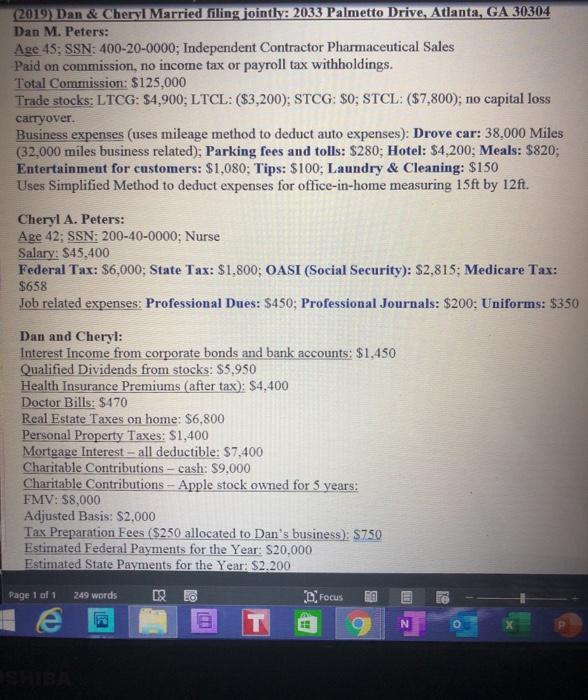

$1040 Department of the revenue Service U.S. Individual Income Tax Return 2019 OMB No. 1545-0074 RS Une Only-Do not write or staple in the space Filling Status Single Married ting pointly Married filing separately MFS) Head of household (HOH | Qualifying widower) com Check only # you checked the MPS box, enter the name of powe. If you checked the HOH or OW box, enter the child's name of the qualifying person is child but not your dependent Your first name and middle initial Last name Your social security mamber Dan M. Peters 4 0 0/2 olo ooo joint return, one's first name and middle initial Last name Spouse's social security number Cheryl A Peters 2 o o 4 o o ooo Home address number and street). If you have a P.O box, ne instruction, Apt no Presidential Election Campaign Check here if you or your spouse fing 2033 Palmetto Drive pinty, want to go to the find City, town or post office state, and ZIP code. If you have a foreign address, also complete proces below from instruction) Checking box below will not change your Atlanta, GA 30304 tax or und You Spouse Foreign country name Foreign provincetto county Foreign postal code more than four dependents, Beenstruction and here Standard Someone can claim you as a dependent Your spouse as a dependent Deduction Spoustomizes on separate return of you were a dual status in Age/indnes You Were bom before January 21055 Are blind Spouse: Was born before January 2, 1965 Is blind Dependenta (so instructions (2) Social security number inchip to you (9 fulf for rutruction (1) Fiesta Child tax credit Credit for other dependent 1 2b 36 45.400.00 1450.00 5950.00 4 db 4d bb 1 Wageries, tips to Attach Form W2 Temptinet Tante interest. Attach Sch. Bit required Ja la Gusi dividende Standard b Ordinary dividende. Attach Schif required Dettono ta IRA distribution bobmount gior Mama 40 Pensions and antis ning d Taube amount on Social security bene Sa Table arount Mind 0 Capital gain or Altach Schedule of required if not required, check here WEDO TA 2,10 Other come from Schedule 1. line b Addnes 1. 46. 4. 5. 6. anda. This is your total income ht Adjustments to come from Schedule 1 line 22 checked Surat in rominh This is your adjusted gross income WY 9 Bandar Standard deduction or itemized deductions or Schedule Al De 10 Qualified tuss income deduction Attach Form 5 or Form 6906-A 10 11 Add lines and 10 Taxable income. Subtractie 11 from libero ore vero For Disclosure Privacy Act, and Paperwork Reduction Act Notice, se separate instructions Cat Noir Ale b 1040 Page 2 10 Form 1040 2010 Tus inst) Check it any from Formel 1 8814 2 4972 3 120 b Add Schedule 2. Iina 8, and line 12 and enter the total 12 13 Child tax creditor credit for other dependents 13 b Add Schedule 3, line 7, and line 130 and enter the total 14 Subtractine 136 tromline 125. roroorlontero 14 15 Other ron, including self-employment tax, from Schedule 2. line 10 -15 10 Add fines 14 and 15. This is your total tax 10 17 Federal income tax withheld trom Forms W-2 and 1099 17 you have Other payments and refundable credits Earned income credit (EC) on bich DC b you Additional child tax credit. Attach Schedule 1812 186 American opportunity credit from Formas, lines 180 pay. d Schedule 3 line 14 Add line 18 trough 18d. These are your total other payments and refundable credits 18 Add line 17 and 1e. These are your total paymente 10 30 Refund Win 10 is more than line 16, subtract line 16 from line 19. This is the amount you everpaid 20 21 Amount of ine 20 you want rotunded to you. If Form 6061 attached, check here 21a Det Houting number eTypeChocking Saving Account number 22 Amount of ine 20 you want applied to your 2020 estimated tax Amount za Amount you owe. Subtractine 19 from in 16 for details on how to pay me instructors You Owo 94 Estimated tax paralystructions) 24 Third Party Do you want to slow another person other than your paid prepare to discuss this return with the RSS intruction, Yes. Complete blow Designeo No Other than Designs Phone Personal identification pan porn name no number PINO Sign under pues et pour les columna accompanying schedules and statements, and to repeat try now and we so, dom Declaration of prepare the opened on information of which propwwwy nowego Here Your signature Date Your occupation If the sont you an identity Protection PIN antither Jount sont Section Spouse's signature of a joint returnboth must sign Spouse's Ocupation the 15 and your Rocopy for Identity Protection PN yourcom sestra) Phone no Email address Preparere Preparer's signature Date PTN Paid Bard Party Degree Preparer Use Only Fimm name Phone na Fm's address Fins EN Go to www.golFormod for instructions and the latest information T 1040 DOT 22 (2019) Dan & Cheryl Married filing jointly: 2033 Palmetto Drive, Atlanta, GA 30304 Dan M. Peters: Age 45; SSN: 400-20-0000; Independent Contractor Pharmaceutical Sales Paid on commission, no income tax or payroll tax withholdings. Total Commission: $125,000 Trade stocks: LTCG: $4,900; LTCL: ($3,200): STCG: SO; STCL: ($7,800); no capital loss carryover. Business expenses (uses mileage method to deduct auto expenses): Drove car: 38,000 Miles (32,000 miles business related); Parking fees and tolls: $280; Hotel: $4,200; Meals: $820; Entertainment for customers: $1,080; Tips: $100; Laundry & Cleaning: $150 Uses Simplified Method to deduct expenses for office-in-home measuring 15ft by 12ft. Cheryl A. Peters: Age 42: SSN: 200-40-0000; Nurse Salary: $45,400 Federal Tax: $6,000; State Tax: $1.800; OASI (Social Security): $2,815; Medicare Tax: $658 Job related expenses: Professional Dues: $450; Professional Journals: $200: Uniforms: $350 Dan and Cheryl: Interest Income from corporate bonds and bank accounts: $1,450 Qualified Dividends from stocks: $5,950 Health Insurance Premiums (after tax): $4,400 Doctor Bills: $470 Real Estate Taxes on home: $6,800 Personal Property Taxes: S1,400 Mortgage Interest - all deductible: $7,400 Charitable Contributions - cash: $9,000 Charitable Contributions - Apple stock owned for 5 years: FMV: $8,000 Adjusted Basis: $2,000 Tax Preparation Fees ($250 allocated to Dan's business): 3750 Estimated Federal Payments for the Year: S20,000 Estimated State Payments for the Year: $2.200 Page 1 of 1 249 words KE D Focus E N