How to fill this form detail?

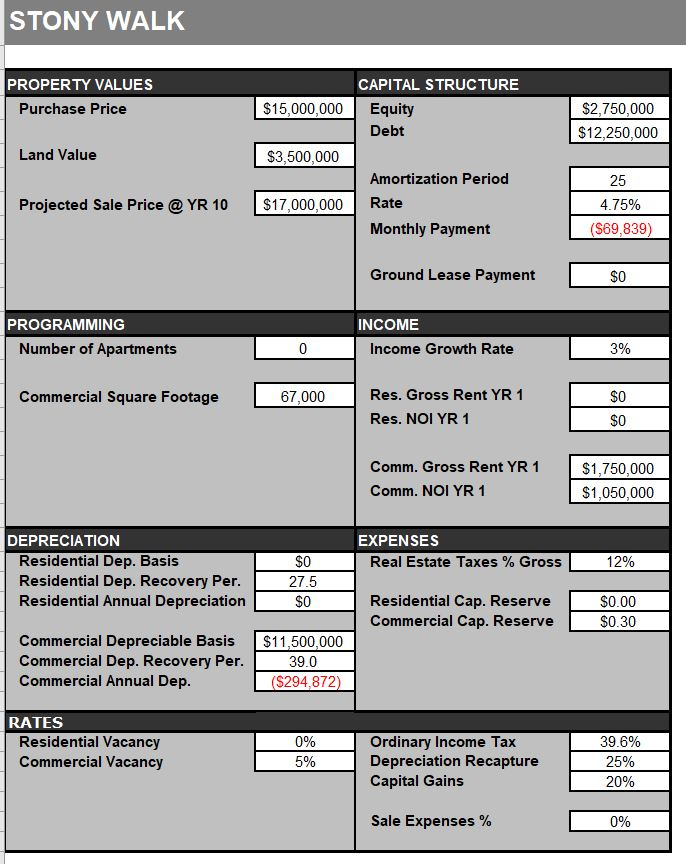

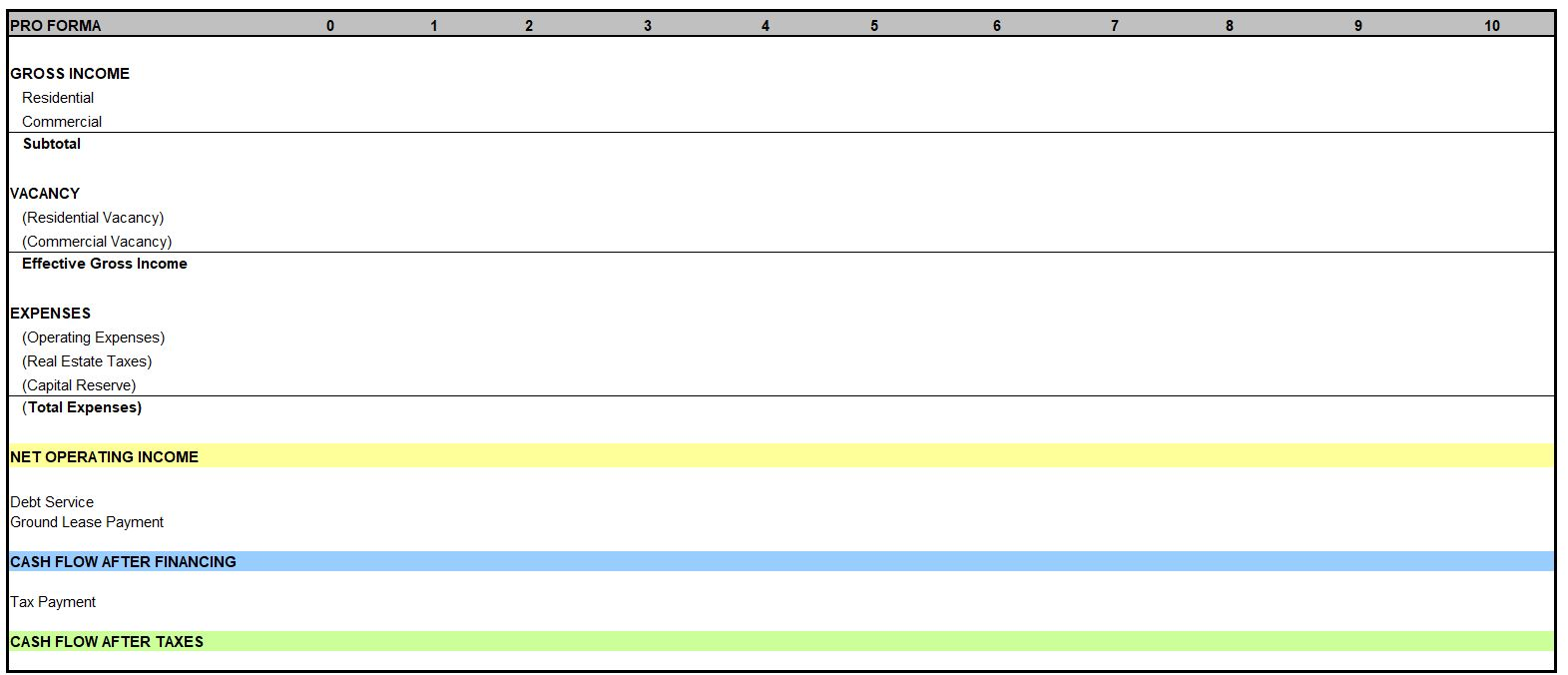

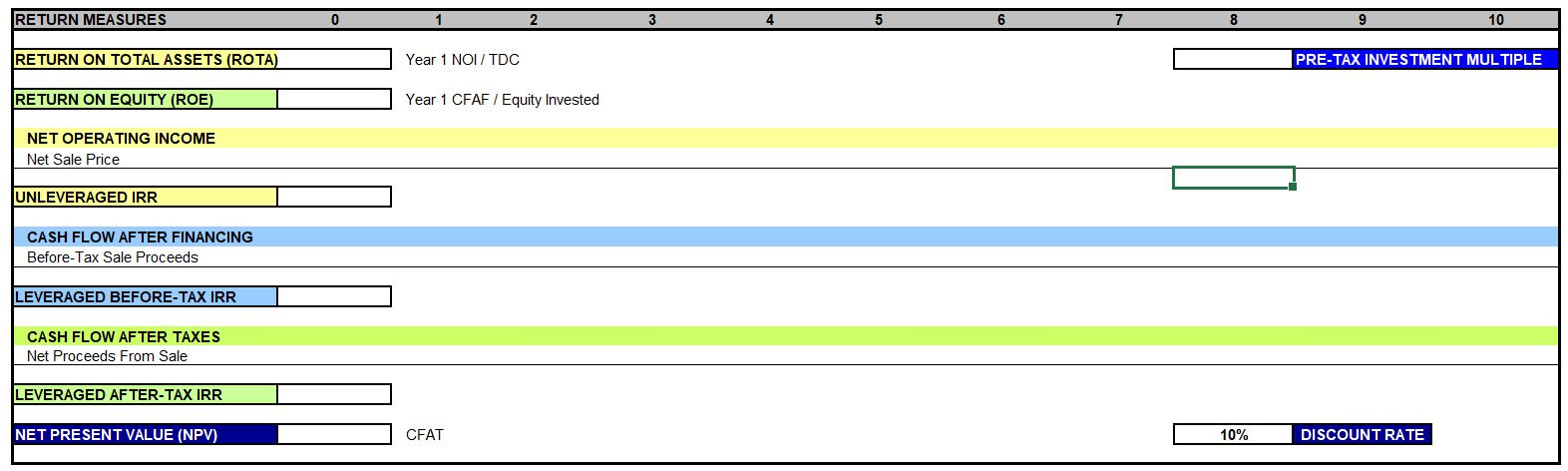

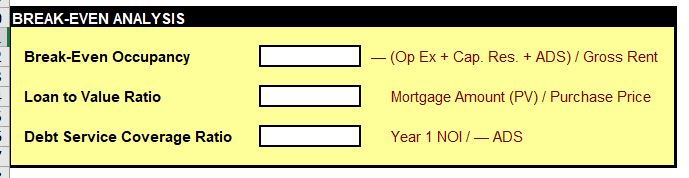

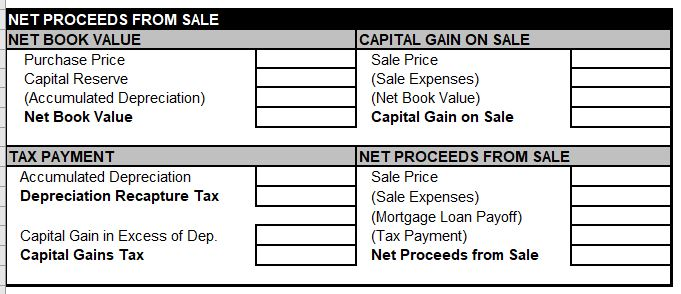

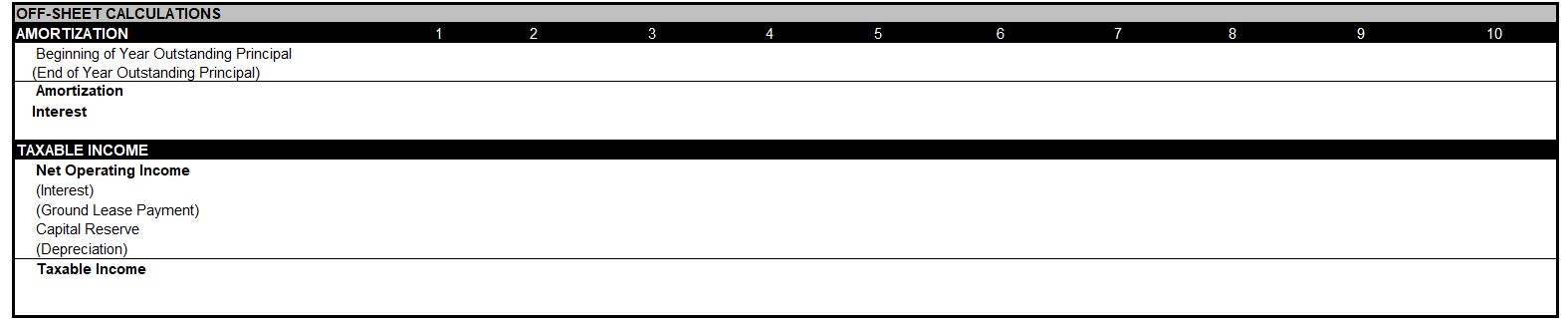

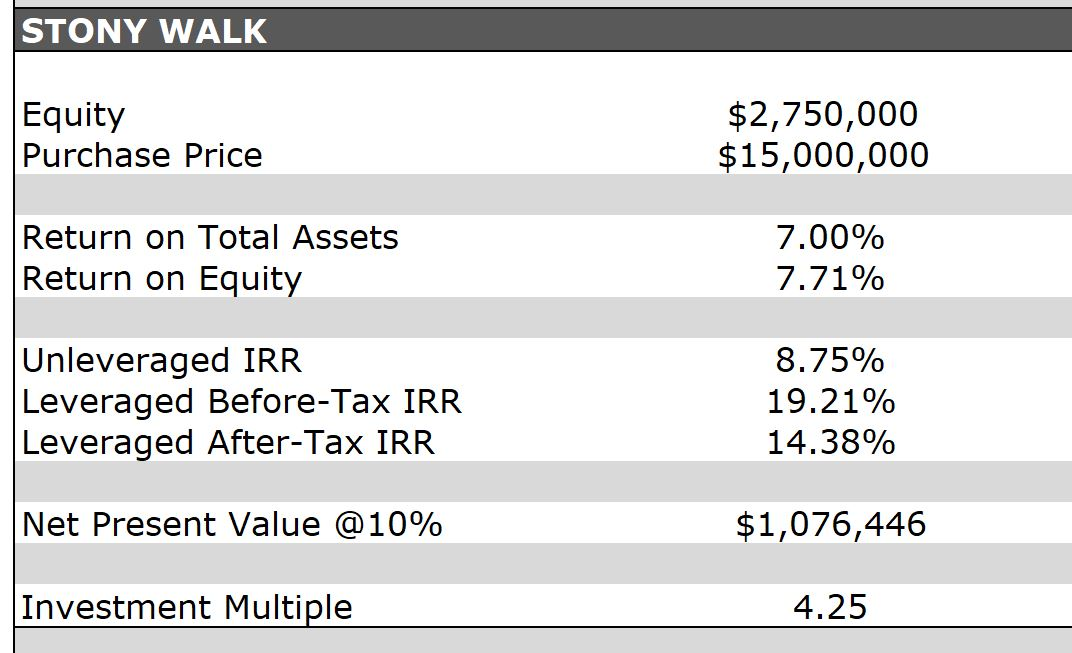

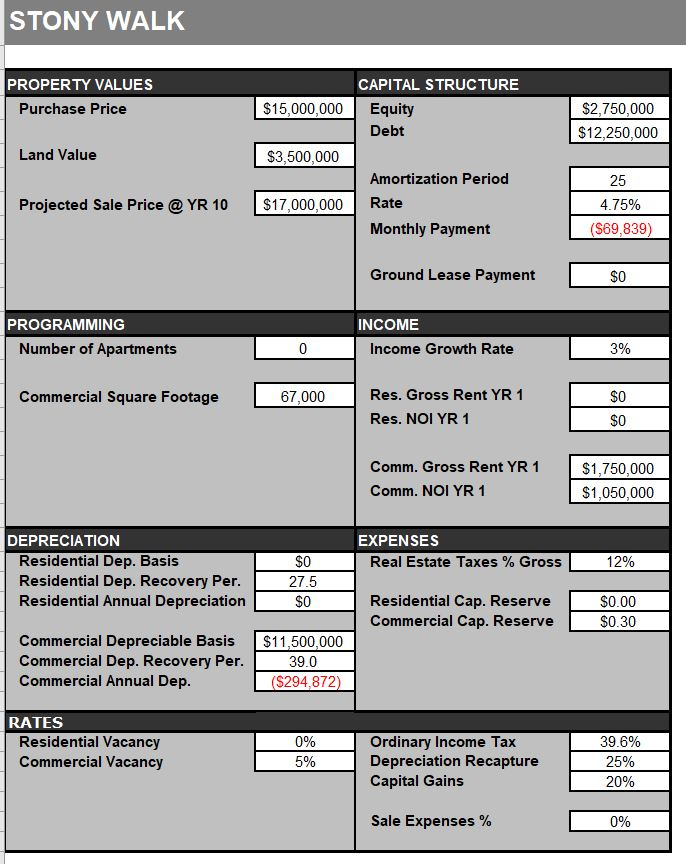

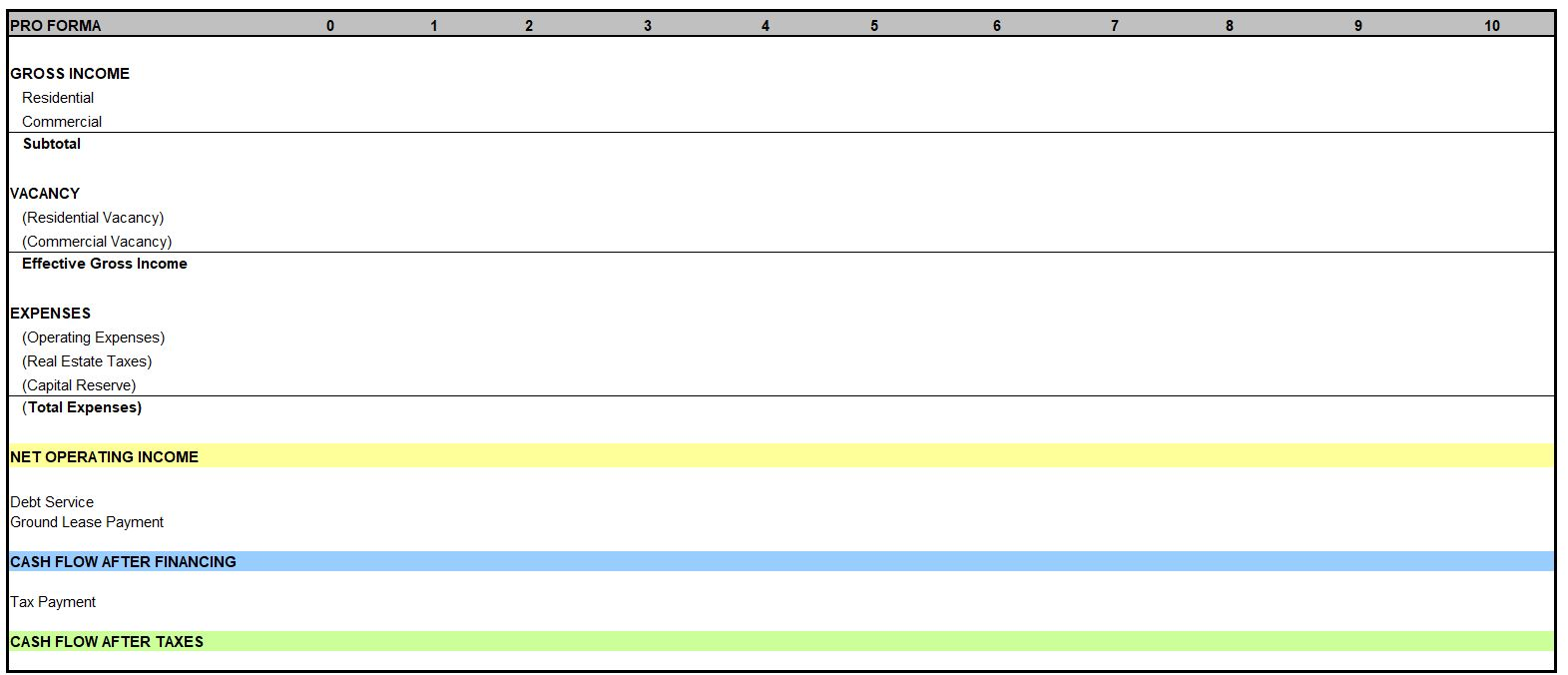

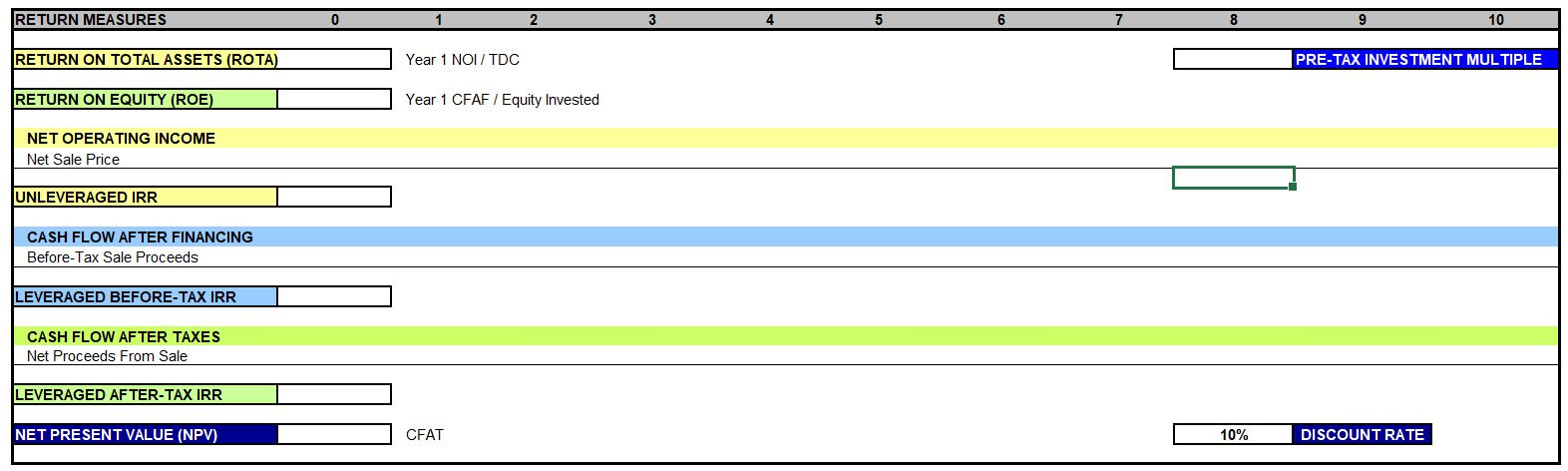

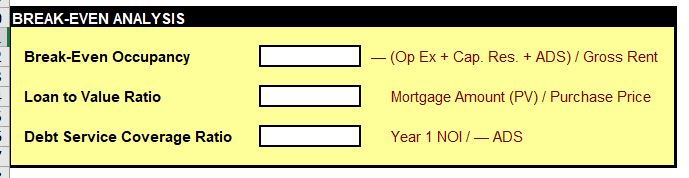

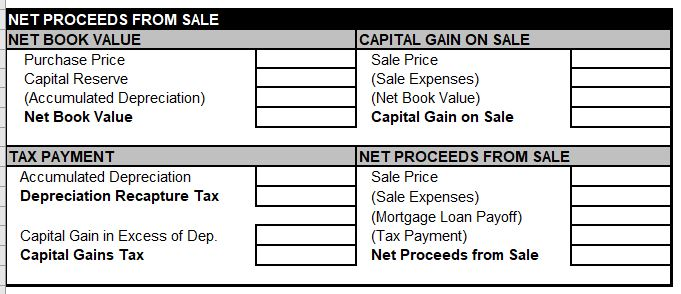

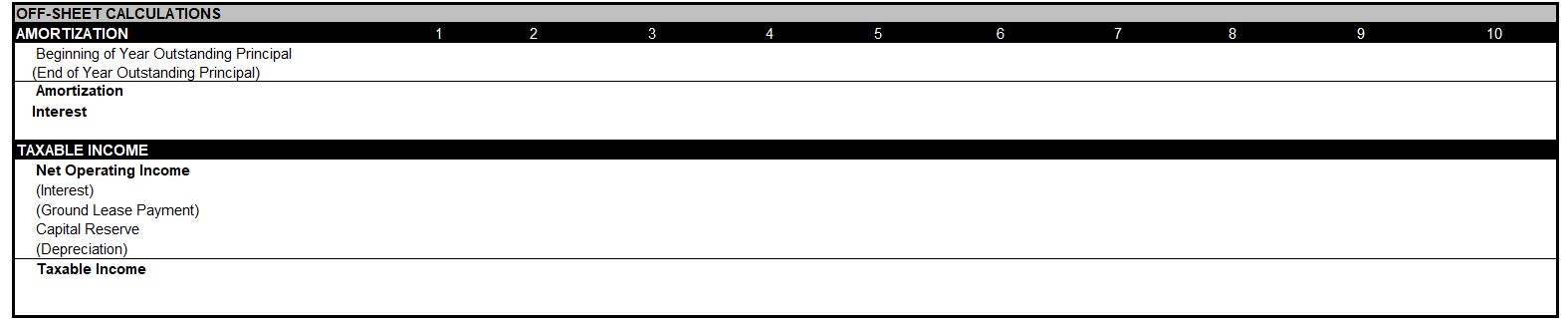

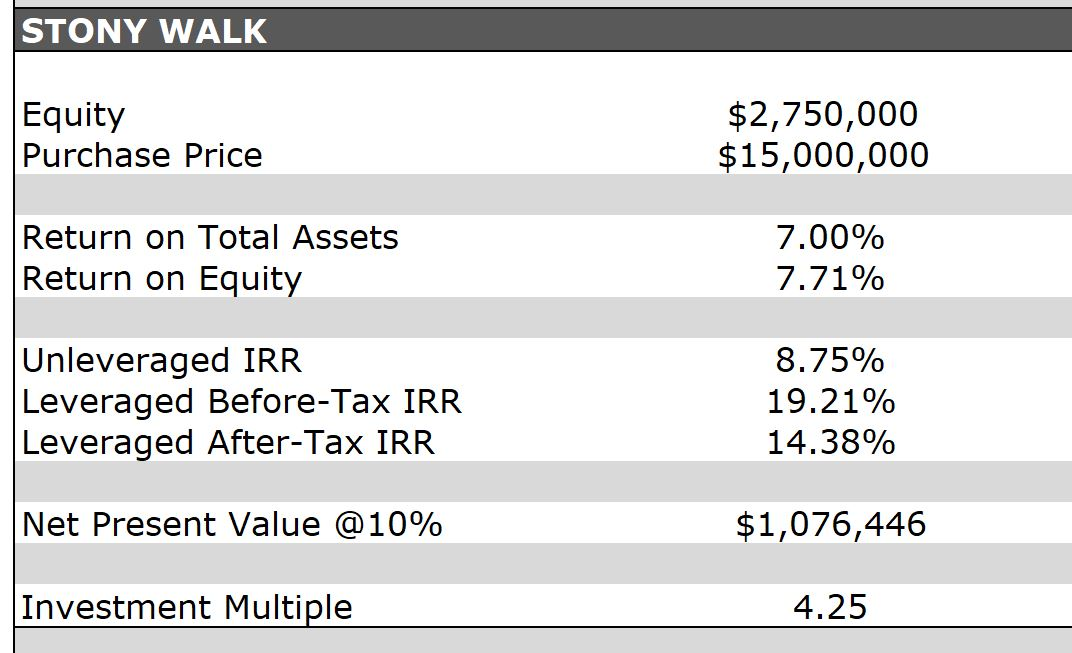

STONY WALK PROPERTY VALUES Purchase Price $15,000,000 CAPITAL STRUCTURE Equity Debt $2,750,000 $12,250,000 Land Value $3,500,000 25 Projected Sale Price @ YR 10 $17,000,000 Amortization Period Rate Monthly Payment 4.75% (369,839) Ground Lease Payment $0 PROGRAMMING Number of Apartments INCOME Income Growth Rate 0 3% Commercial Square Footage 67,000 Res. Gross Rent YR 1 Res. NOI YR 1 $O $O Comm. Gross Rent YR 1 Comm. NOI YR 1 $1,750,000 $1,050,000 EXPENSES Real Estate Taxes % Gross 12% DEPRECIATION Residential Dep. Basis Residential Dep. Recovery Per. Residential Annual Depreciation $0 27.5 $0 Residential Cap. Reserve Commercial Cap. Reserve $0.00 $0.30 Commercial Depreciable Basis Commercial Dep. Recovery Per. Commercial Annual Dep. $11,500,000 39.0 ($294,872) RATES Residential Vacancy Commercial Vacancy 0% 5% Ordinary Income Tax Depreciation Recapture Capital Gains 39.6% 25% 20% Sale Expenses % 0% PRO FORMA 0 1 2 3 5 6 7 8 9 10 GROSS INCOME Residential Commercial Subtotal VACANCY (Residential Vacancy) (Commercial Vacancy) Effective Gross Income EXPENSES (Operating Expenses) (Real Estate Taxes) (Capital Reserve) (Total Expenses) NET OPERATING INCOME Debt Service Ground Lease Payment CASH FLOW AFTER FINANCING Tax Payment CASH FLOW AFTER TAXES RETURN MEASURES 0 1 2 3 4 5 6 8 9 10 RETURN ON TOTAL ASSETS (ROTA) Year 1 NOI / TDC PRE-TAX INVESTMENT MULTIPLE RETURN ON EQUITY (ROE) Year 1 CFAF / Equity Invested NET OPERATING INCOME Net Sale Price UNLEVERAGED IRR CASH FLOW AFTER FINANCING Before-Tax Sale Proceeds LEVERAGED BEFORE-TAX IRR CASH FLOW AFTER TAXES Net Proceeds From Sale LEVERAGED AFTER-TAX IRR NET PRESENT VALUE (NPV) CFAT 10% DISCOUNT RATE BREAK-EVEN ANALYSIS -(Op Ex + Cap. Res. + ADS) / Gross Rent - Break-Even Occupancy = Loan to Value Ratio 000 Mortgage Amount (PV) / Purchase Price Debt Service Coverage Ratio Year 1 NOI/ ADS NET PROCEEDS FROM SALE NET BOOK VALUE Purchase Price Capital Reserve (Accumulated Depreciation) Net Book Value CAPITAL GAIN ON SALE Sale Price (Sale Expenses) (Net Book Value) Capital Gain on Sale TAX PAYMENT Accumulated Depreciation Depreciation Recapture Tax INET PROCEEDS FROM SALE Sale Price (Sale Expenses) (Mortgage Loan Payoff) (Tax Payment) Net Proceeds from Sale Capital Gain in Excess of Dep. Capital Gains Tax 2 3 6 8 9 10 OFF-SHEET CALCULATIONS AMORTIZATION Beginning of Year Outstanding Principal (End of Year Outstanding Principal) Amortization Interest TAXABLE INCOME Net Operating Income (Interest) (Ground Lease Payment) Capital Reserve (Depreciation) Taxable Income STONY WALK Equity Purchase Price $2,750,000 $15,000,000 Return on Total Assets Return on Equity 7.00% 7.71% Unleveraged IRR Leveraged Before-Tax IRR Leveraged After-Tax IRR 8.75% 19.21% 14.38% Net Present Value @10% $1,076,446 Investment Multiple 4.25 STONY WALK PROPERTY VALUES Purchase Price $15,000,000 CAPITAL STRUCTURE Equity Debt $2,750,000 $12,250,000 Land Value $3,500,000 25 Projected Sale Price @ YR 10 $17,000,000 Amortization Period Rate Monthly Payment 4.75% (369,839) Ground Lease Payment $0 PROGRAMMING Number of Apartments INCOME Income Growth Rate 0 3% Commercial Square Footage 67,000 Res. Gross Rent YR 1 Res. NOI YR 1 $O $O Comm. Gross Rent YR 1 Comm. NOI YR 1 $1,750,000 $1,050,000 EXPENSES Real Estate Taxes % Gross 12% DEPRECIATION Residential Dep. Basis Residential Dep. Recovery Per. Residential Annual Depreciation $0 27.5 $0 Residential Cap. Reserve Commercial Cap. Reserve $0.00 $0.30 Commercial Depreciable Basis Commercial Dep. Recovery Per. Commercial Annual Dep. $11,500,000 39.0 ($294,872) RATES Residential Vacancy Commercial Vacancy 0% 5% Ordinary Income Tax Depreciation Recapture Capital Gains 39.6% 25% 20% Sale Expenses % 0% PRO FORMA 0 1 2 3 5 6 7 8 9 10 GROSS INCOME Residential Commercial Subtotal VACANCY (Residential Vacancy) (Commercial Vacancy) Effective Gross Income EXPENSES (Operating Expenses) (Real Estate Taxes) (Capital Reserve) (Total Expenses) NET OPERATING INCOME Debt Service Ground Lease Payment CASH FLOW AFTER FINANCING Tax Payment CASH FLOW AFTER TAXES RETURN MEASURES 0 1 2 3 4 5 6 8 9 10 RETURN ON TOTAL ASSETS (ROTA) Year 1 NOI / TDC PRE-TAX INVESTMENT MULTIPLE RETURN ON EQUITY (ROE) Year 1 CFAF / Equity Invested NET OPERATING INCOME Net Sale Price UNLEVERAGED IRR CASH FLOW AFTER FINANCING Before-Tax Sale Proceeds LEVERAGED BEFORE-TAX IRR CASH FLOW AFTER TAXES Net Proceeds From Sale LEVERAGED AFTER-TAX IRR NET PRESENT VALUE (NPV) CFAT 10% DISCOUNT RATE BREAK-EVEN ANALYSIS -(Op Ex + Cap. Res. + ADS) / Gross Rent - Break-Even Occupancy = Loan to Value Ratio 000 Mortgage Amount (PV) / Purchase Price Debt Service Coverage Ratio Year 1 NOI/ ADS NET PROCEEDS FROM SALE NET BOOK VALUE Purchase Price Capital Reserve (Accumulated Depreciation) Net Book Value CAPITAL GAIN ON SALE Sale Price (Sale Expenses) (Net Book Value) Capital Gain on Sale TAX PAYMENT Accumulated Depreciation Depreciation Recapture Tax INET PROCEEDS FROM SALE Sale Price (Sale Expenses) (Mortgage Loan Payoff) (Tax Payment) Net Proceeds from Sale Capital Gain in Excess of Dep. Capital Gains Tax 2 3 6 8 9 10 OFF-SHEET CALCULATIONS AMORTIZATION Beginning of Year Outstanding Principal (End of Year Outstanding Principal) Amortization Interest TAXABLE INCOME Net Operating Income (Interest) (Ground Lease Payment) Capital Reserve (Depreciation) Taxable Income STONY WALK Equity Purchase Price $2,750,000 $15,000,000 Return on Total Assets Return on Equity 7.00% 7.71% Unleveraged IRR Leveraged Before-Tax IRR Leveraged After-Tax IRR 8.75% 19.21% 14.38% Net Present Value @10% $1,076,446 Investment Multiple 4.25