how to find growth in sales for these two companies?

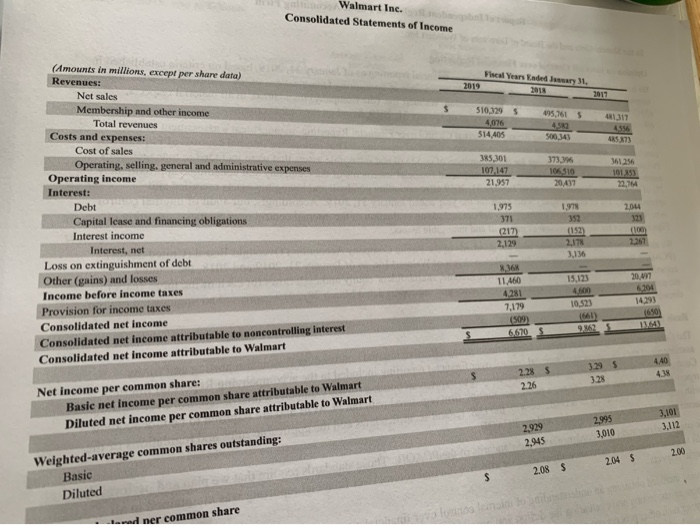

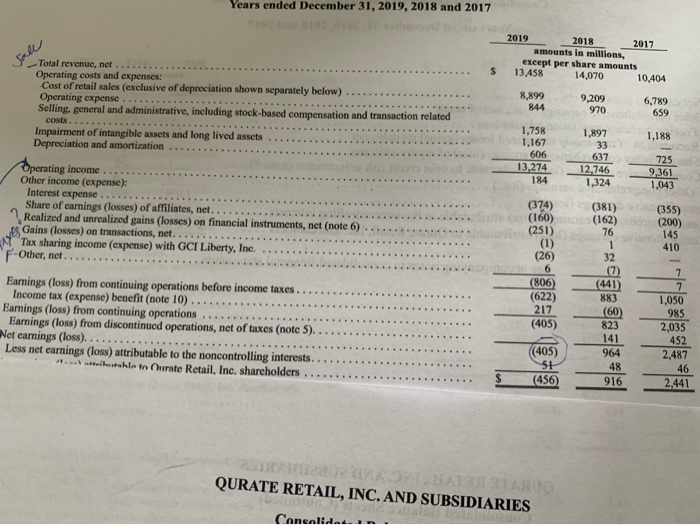

Walmart Inc. Consolidated Statements of Income Fiscal Year Ended war 31 2018 2019 2011 $ $ 5,761 $ 41.311 510329 4,076 514405 4573 385,301 107,147 21.957 373.95 106510 20,437 361.256 101333 22,764 (Amounts in millions, except per share data) Revenues: Net sales Membership and other income Total revenues Costs and expenses: Cost of sales Operating, selling, general and administrative expenses Operating income Interest: Debt Capital lease and financing obligations Interest income Interest, net Loss on extinguishment of debt Other (gains) and losses Income before income taxes Provision for income taxes Consolidated net income Consolidated net income attributable to noncontrolling interest 1.975 371 (217 2,129 1,978 352 (152) 2,178 2,044 373 (100 2267 20,9 6304 X 11460 4281 7,179 (509 6670 S 15,123 4.00 10.523 1661 9462 14293 13.143 Consolidated net income attributable to Walmart 440 2.28 $ 226 3.29 $ 3.28 Net income per common share: Basic net income per common share attributable to Walmart Diluted net income per common share attributable to Walmart 3,101 3,112 2,995 3,010 2.929 2,945 2.00 2.04 $ 2.08 $ Weighted-average common shares outstanding: Basic Diluted $ med ner common share onds Years ended December 31, 2019, 2018 and 2017 Sall 2019 2018 2017 amounts in millions, except per share amounts 13.458 14,070 10,404 $ 8,899 844 9,209 970 6,789 659 1,188 1,758 1.167 606 13,274 184 1,897 33 637 12,746 1,324 725 9,361 1,043 Total revenue, net Operating costs and expenses: Cost of retail sales (exclusive of depreciation shown separately below) Operating expense Selling, general and administrative, including stock-based compensation and transaction related costs..... Impairment of intangible assets and long lived assets Depreciation and amortization Operating income Other income (expense): Interest expense Share of earnings (losses) of affiliates, net. Realized and unrealized gains (losses) on financial instruments, net (note 6) ve Gains (losses) on transactions, net. Tax sharing income (expense) with GCI Liberty, Inc. F-Other, net.. Earnings (loss) from continuing operations before income taxes Income tax (expense) benefit (note 10) Earnings (loss) from continuing operations Earnings (loss) from discontinued operations, net of taxes (note 5). Net earnings (loss)... Less net earnings (loss) attributable to the noncontrolling interests. -.-ritahle to Ourate Retail, Inc. shareholders (381) (162) 76 (355) (200) 145 410 (374) (160) (251) (1) (26) 6 (806) (622) 217 (405) 32 (7) (441) 883 (60) 823 141 964 48 916 7 7 1,050 985 2,035 452 2,487 46 2.441 (405) 51 (456) QURATE RETAIL, INC. AND SUBSIDIARIES Canealidad