Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to forcecast Gross Room Rates in next 1 month ? ( Area occupancies were lower this year than the previous year. However, the market

How to forcecast Gross Room Rates in next 1 month ? ( Area occupancies were lower this year than the previous year. However, the market segment mix and weekday-to-weekend ratios remained similar to previous years )

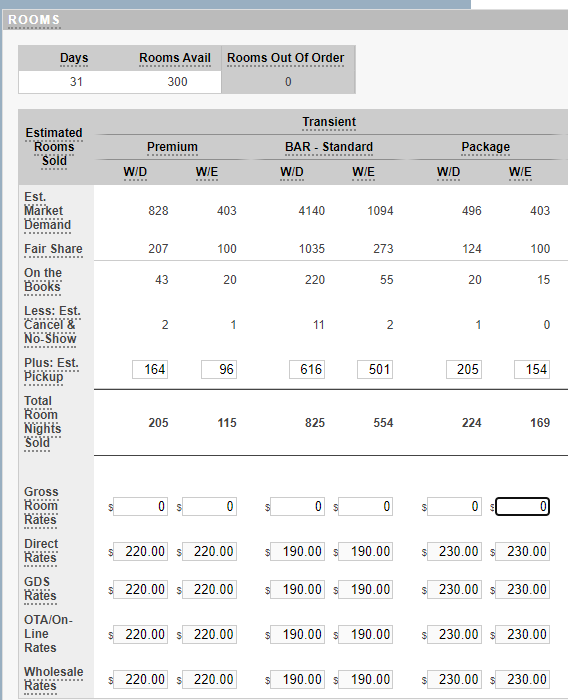

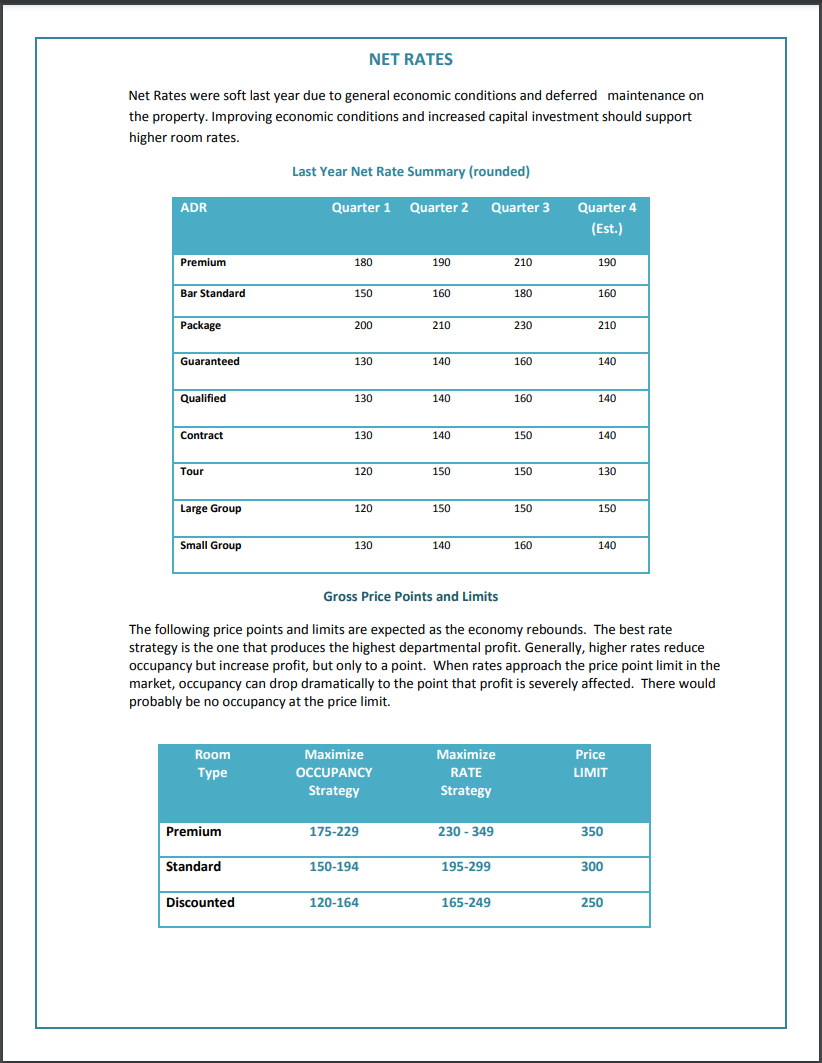

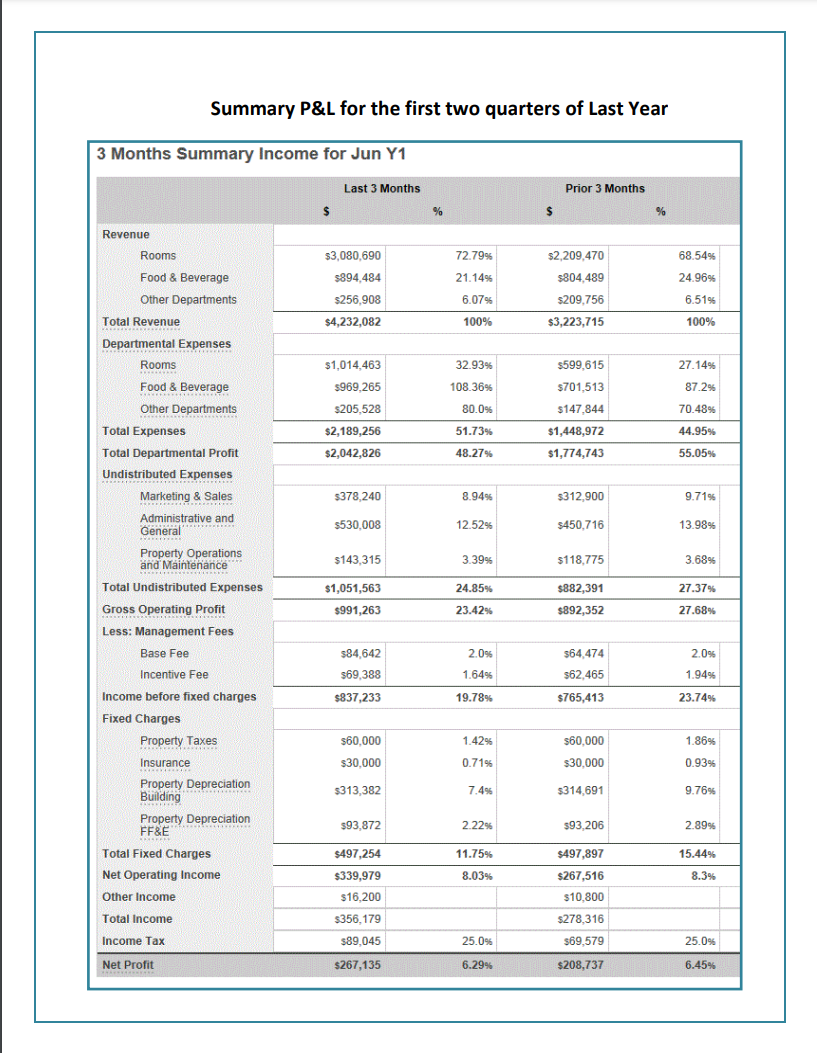

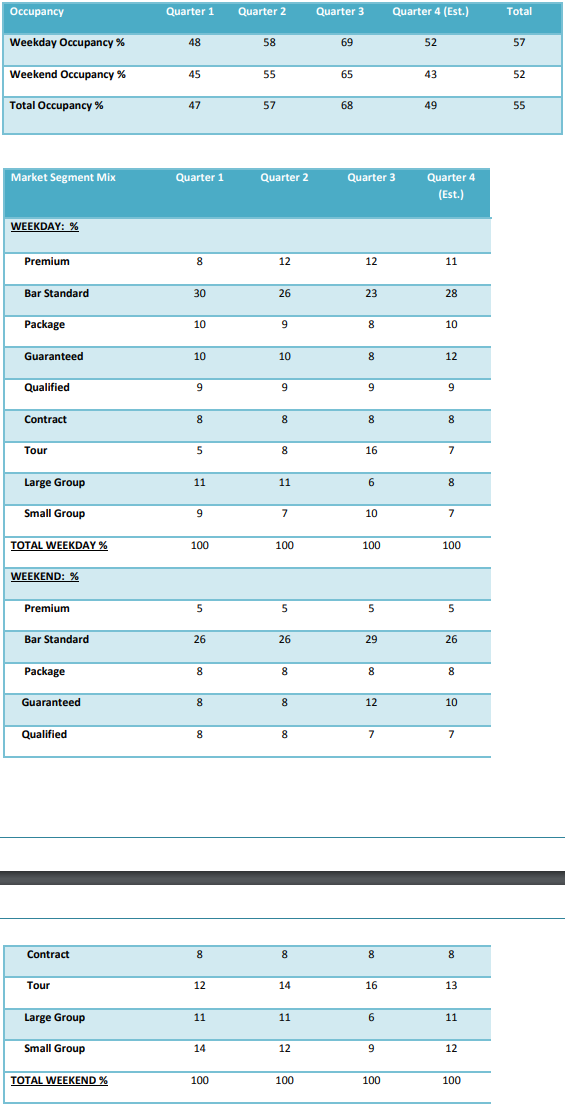

ROOMS \begin{tabular}{|c|c|c|} \hline Days & Rooms Avail & Rooms Out Of Order \\ \hline 31 & 300 & 0 \\ \hline \end{tabular} Net Rates were soft last year due to general economic conditions and deferred maintenance on the property. Improving economic conditions and increased capital investment should support higher room rates. Last Year Net Rate Summary (rounded) Gross Price Points and Limits The following price points and limits are expected as the economy rebounds. The best rate strategy is the one that produces the highest departmental profit. Generally, higher rates reduce occupancy but increase profit, but only to a point. When rates approach the price point limit in the market, occupancy can drop dramatically to the point that profit is severely affected. There would probably be no occupancy at the price limit. Summary P\&L for the first two quarters of Last Year \begin{tabular}{|lccccc|} \hline Occupancy & Quarter 1 & Quarter 2 & Quarter 3 & Quarter 4 (Est.) & Total \\ \hline Weekday Occupancy \% & 48 & 58 & 69 & 52 & 57 \\ \hline Weekend Occupancy \% & 45 & 55 & 65 & 43 & 52 \\ \hline Total Occupancy \% & 47 & 57 & 68 & 49 & 55 \\ \hline \end{tabular} WEEKDAY: \% WEEKEND: \% \begin{tabular}{|lcccc} \hline Premium & 5 & 5 & 5 & 5 \\ \hline Bar Standard & 26 & 26 & 29 & 26 \\ \hline Package & 8 & 8 & 8 & 8 \\ \hline Guaranteed & 8 & 8 & 12 & 10 \\ \hline Qualified & 8 & 8 & 7 & 7 \\ \hline \end{tabular} \begin{tabular}{|lcccc} \hline Contract & 8 & 8 & 8 & 8 \\ \hline Tour & 12 & 14 & 16 & 13 \\ \hline Large Group & 11 & 11 & 6 & 11 \\ \hline Small Group & 14 & 12 & 9 & 12 \\ \hline TOTAL WEEKEND \% & 100 & 100 & 100 & 100 \\ \hline \end{tabular} ROOMS \begin{tabular}{|c|c|c|} \hline Days & Rooms Avail & Rooms Out Of Order \\ \hline 31 & 300 & 0 \\ \hline \end{tabular} Net Rates were soft last year due to general economic conditions and deferred maintenance on the property. Improving economic conditions and increased capital investment should support higher room rates. Last Year Net Rate Summary (rounded) Gross Price Points and Limits The following price points and limits are expected as the economy rebounds. The best rate strategy is the one that produces the highest departmental profit. Generally, higher rates reduce occupancy but increase profit, but only to a point. When rates approach the price point limit in the market, occupancy can drop dramatically to the point that profit is severely affected. There would probably be no occupancy at the price limit. Summary P\&L for the first two quarters of Last Year \begin{tabular}{|lccccc|} \hline Occupancy & Quarter 1 & Quarter 2 & Quarter 3 & Quarter 4 (Est.) & Total \\ \hline Weekday Occupancy \% & 48 & 58 & 69 & 52 & 57 \\ \hline Weekend Occupancy \% & 45 & 55 & 65 & 43 & 52 \\ \hline Total Occupancy \% & 47 & 57 & 68 & 49 & 55 \\ \hline \end{tabular} WEEKDAY: \% WEEKEND: \% \begin{tabular}{|lcccc} \hline Premium & 5 & 5 & 5 & 5 \\ \hline Bar Standard & 26 & 26 & 29 & 26 \\ \hline Package & 8 & 8 & 8 & 8 \\ \hline Guaranteed & 8 & 8 & 12 & 10 \\ \hline Qualified & 8 & 8 & 7 & 7 \\ \hline \end{tabular} \begin{tabular}{|lcccc} \hline Contract & 8 & 8 & 8 & 8 \\ \hline Tour & 12 & 14 & 16 & 13 \\ \hline Large Group & 11 & 11 & 6 & 11 \\ \hline Small Group & 14 & 12 & 9 & 12 \\ \hline TOTAL WEEKEND \% & 100 & 100 & 100 & 100 \\ \hline \end{tabular}

ROOMS \begin{tabular}{|c|c|c|} \hline Days & Rooms Avail & Rooms Out Of Order \\ \hline 31 & 300 & 0 \\ \hline \end{tabular} Net Rates were soft last year due to general economic conditions and deferred maintenance on the property. Improving economic conditions and increased capital investment should support higher room rates. Last Year Net Rate Summary (rounded) Gross Price Points and Limits The following price points and limits are expected as the economy rebounds. The best rate strategy is the one that produces the highest departmental profit. Generally, higher rates reduce occupancy but increase profit, but only to a point. When rates approach the price point limit in the market, occupancy can drop dramatically to the point that profit is severely affected. There would probably be no occupancy at the price limit. Summary P\&L for the first two quarters of Last Year \begin{tabular}{|lccccc|} \hline Occupancy & Quarter 1 & Quarter 2 & Quarter 3 & Quarter 4 (Est.) & Total \\ \hline Weekday Occupancy \% & 48 & 58 & 69 & 52 & 57 \\ \hline Weekend Occupancy \% & 45 & 55 & 65 & 43 & 52 \\ \hline Total Occupancy \% & 47 & 57 & 68 & 49 & 55 \\ \hline \end{tabular} WEEKDAY: \% WEEKEND: \% \begin{tabular}{|lcccc} \hline Premium & 5 & 5 & 5 & 5 \\ \hline Bar Standard & 26 & 26 & 29 & 26 \\ \hline Package & 8 & 8 & 8 & 8 \\ \hline Guaranteed & 8 & 8 & 12 & 10 \\ \hline Qualified & 8 & 8 & 7 & 7 \\ \hline \end{tabular} \begin{tabular}{|lcccc} \hline Contract & 8 & 8 & 8 & 8 \\ \hline Tour & 12 & 14 & 16 & 13 \\ \hline Large Group & 11 & 11 & 6 & 11 \\ \hline Small Group & 14 & 12 & 9 & 12 \\ \hline TOTAL WEEKEND \% & 100 & 100 & 100 & 100 \\ \hline \end{tabular} ROOMS \begin{tabular}{|c|c|c|} \hline Days & Rooms Avail & Rooms Out Of Order \\ \hline 31 & 300 & 0 \\ \hline \end{tabular} Net Rates were soft last year due to general economic conditions and deferred maintenance on the property. Improving economic conditions and increased capital investment should support higher room rates. Last Year Net Rate Summary (rounded) Gross Price Points and Limits The following price points and limits are expected as the economy rebounds. The best rate strategy is the one that produces the highest departmental profit. Generally, higher rates reduce occupancy but increase profit, but only to a point. When rates approach the price point limit in the market, occupancy can drop dramatically to the point that profit is severely affected. There would probably be no occupancy at the price limit. Summary P\&L for the first two quarters of Last Year \begin{tabular}{|lccccc|} \hline Occupancy & Quarter 1 & Quarter 2 & Quarter 3 & Quarter 4 (Est.) & Total \\ \hline Weekday Occupancy \% & 48 & 58 & 69 & 52 & 57 \\ \hline Weekend Occupancy \% & 45 & 55 & 65 & 43 & 52 \\ \hline Total Occupancy \% & 47 & 57 & 68 & 49 & 55 \\ \hline \end{tabular} WEEKDAY: \% WEEKEND: \% \begin{tabular}{|lcccc} \hline Premium & 5 & 5 & 5 & 5 \\ \hline Bar Standard & 26 & 26 & 29 & 26 \\ \hline Package & 8 & 8 & 8 & 8 \\ \hline Guaranteed & 8 & 8 & 12 & 10 \\ \hline Qualified & 8 & 8 & 7 & 7 \\ \hline \end{tabular} \begin{tabular}{|lcccc} \hline Contract & 8 & 8 & 8 & 8 \\ \hline Tour & 12 & 14 & 16 & 13 \\ \hline Large Group & 11 & 11 & 6 & 11 \\ \hline Small Group & 14 & 12 & 9 & 12 \\ \hline TOTAL WEEKEND \% & 100 & 100 & 100 & 100 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started