How to get NPV of Projects and years?

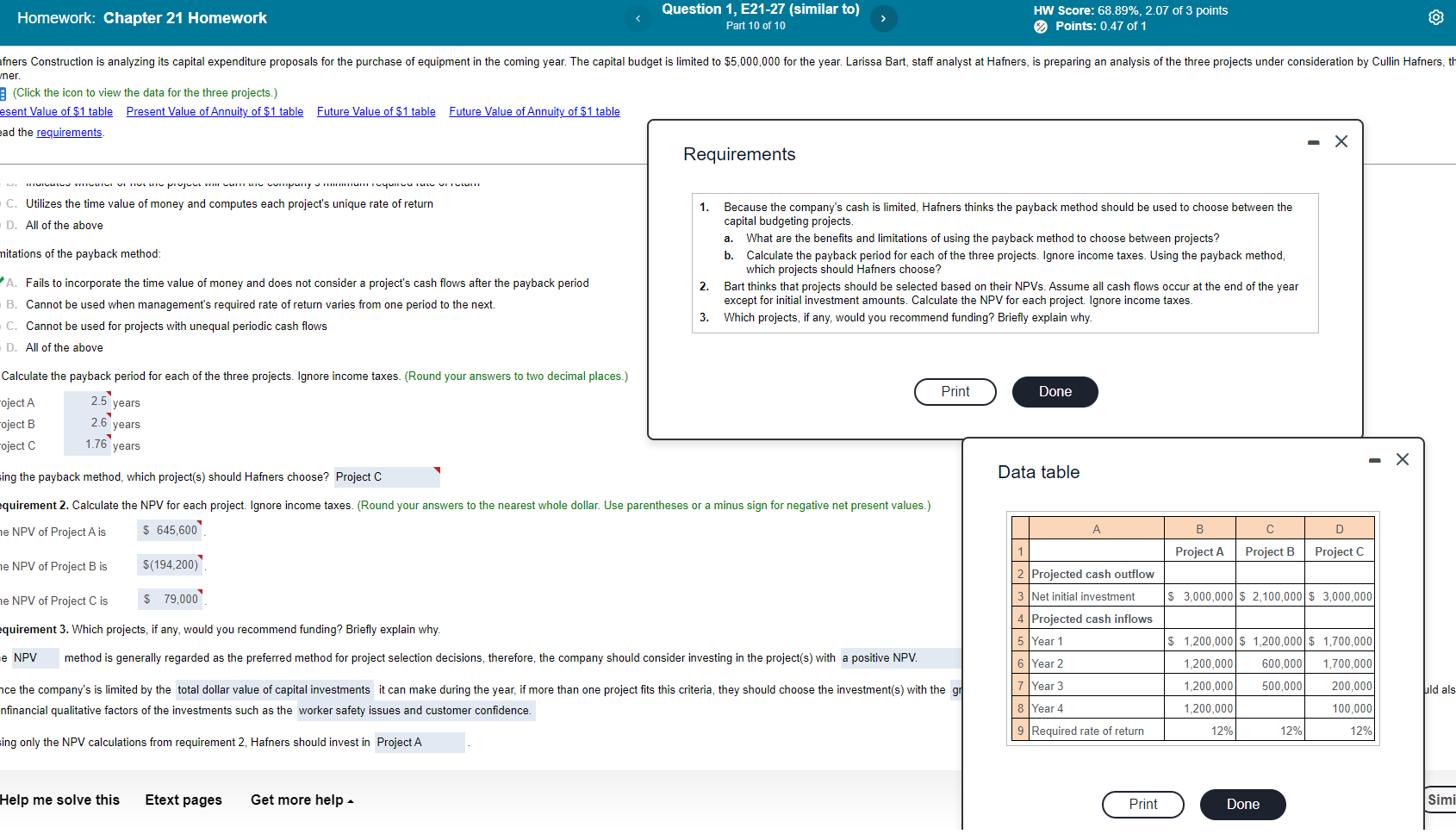

Homework: Chapter 21 Homework Question 1, E21-27 (similar to) Part 10 of 10 HW Score: 68.89%, 2.07 of 3 points Points: 0.47 of 1 O fners Construction is analyzing its capital expenditure proposals for the purchase of equipment in the coming year. The capital budget is limited to $5,000,000 for the year. Larissa Bart, staff analyst at Hafners, is preparing an analysis of the three projects under consideration by Cullin Hafners, th wner. (Click the icon to view the data for the three projects.) esent Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of $1 table ead the requirements. - X Requirements TUILLUS VITULIIVI VI TULLII prvjuu III IV VUpuny... YU TULU VIII C. Utilizes the time value of money and computes each project's unique rate of return D. All of the above a. mitations of the payback method: 1. Because the company's cash is limited, Hafners thinks the payback method should be used to choose between the capital budgeting projects. What are the benefits and limitations of using the payback method to choose between projects? b. Calculate the payback period for each of the three projects. Ignore income taxes. Using the payback method, which projects should Hafners choose? 2. Bart thinks that projects should be selected based on their NPVs. Assume all cash flows occur at the end of the year except for initial investment amounts. Calculate the NPV for each project. Ignore income taxes. 3. Which projects, if any, would you recommend funding? Briefly explain why. A. Fails to incorporate the time value of money and does not consider a project's cash flows after the payback period B. Cannot be used when management's required rate of return varies from one period to the next. C. Cannot be used for projects with unequal periodic cash flows D. All of the above Calculate the payback period for each of the three projects. Ignore income taxes. (Round your answers to two decimal places.) Print Done oject A roject B roject C 2.5 years 26 years 1.76 years ing the payback method, which project(s) should Hafners choose? Project C Data table quirement 2. Calculate the NPV for each project. Ignore income taxes. (Round your answers to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) he NPV of Project A is $ 645,600 A B C D 1 Project A Project B Project C he NPV of Project B is $(194,200) ne NPV of Project C is $ 79,000 2 Projected cash outflow 3 Net initial investment 4 Projected cash inflows $ 3,000,000 $2,100,000 $ 3,000,000 quirement 3. Which projects, if any, would you recommend funding? Briefly explain why. method is generally regarded as the preferred method for project selection decisions, therefore, the company should consider investing in the project(s) with a positive NPV. 5 Year 1 $ 1,200,000 $ 1,200,000 $ 1,700,000 e NPV 6 Year 2 1,200,000 600,000 1,700,000 7 Year 3 1,200,000 500,000 200,000 uld als nce the company's is limited by the total dollar value of capital investments it can make during the year, if more than one project fits this criteria, they should choose the investment(s) with the gr nfinancial qualitative factors of the investments such as the worker safety issues and customer confidence. 8 Year 4 1,200,000 100,000 9 Required rate of return 12% 12% 12% ing only the NPV calculations from requirement 2, Hafners should invest in Project A Help me solve this Etext pages Get more help 1 Print Done Simi