Answered step by step

Verified Expert Solution

Question

1 Approved Answer

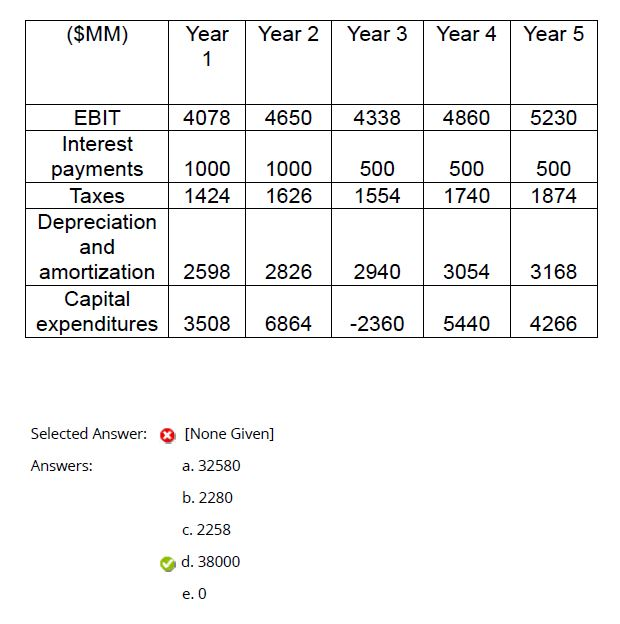

How to get the answer D? For the figures below, assume that there is zero inflation forecasted and that Blueberry expects real growth in sales

How to get the answer D?

For the figures below, assume that there is zero inflation forecasted and that Blueberry expects real growth in sales to be 1%. The WACC of the company equals 7%. The company is financed 30% with debt (investment grade bonds) and for the remainder with equity. Which of the amounts below is closest in magnitude to the terminal value of Blueberry cash flows as of t=5, using the free cash flow method for valuation purposes?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started