Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to get the FCFE 7. Nestlu operates in an economy with a risk-free rate of 4%. In year 0, the firm had earnings of

How to get the FCFE

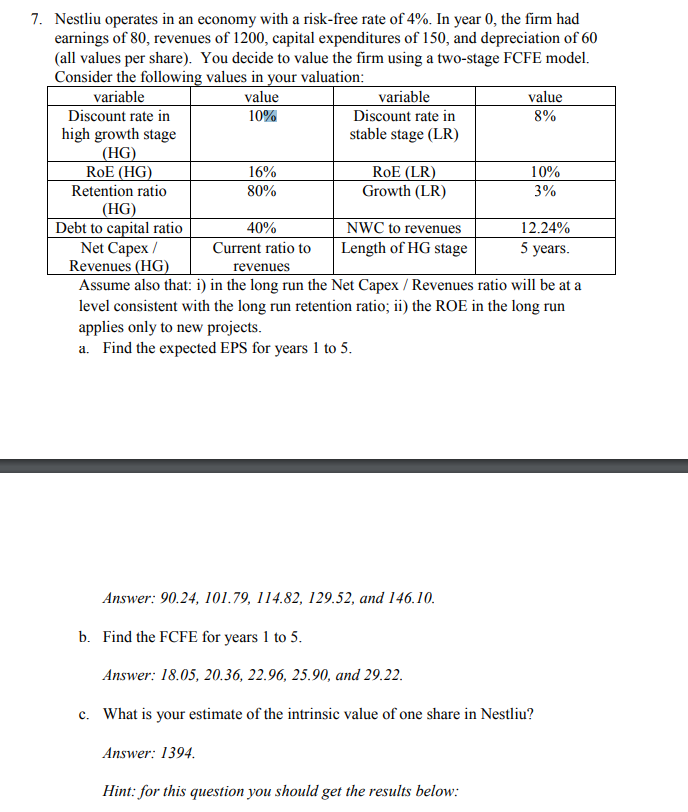

7. Nestlu operates in an economy with a risk-free rate of 4%. In year 0, the firm had earnings of 80, revenues of 1200, capital expenditures of 150, and depreciation of 60 (all values per share). You decide to value the firm using a two-stage FCFE model. Consider the following values in your valuation variable Discount rate in high growth stage HG RoE (HG) Retention ratio HG) Debt to capital ratio Net Capex / Revenues (HG) value 10% variable Discount rate in stable stage (LR) value 8% 16% 80% RoE (LR) Growth (LR) 10% 3% 40% NWC to revenues 12.24% 5 years Current ratio to Length of HG stage revenues Assume also that: i) in the long run the Net Capex /Revenues ratio will be at a level consistent with the long run retention ratio; ii) the ROE in the long run applies only to new projects a. Find the expected EPS for years 1 to 5 Answer: 90.24, 101.79, 114.82, 129.52, and 146.10 b. Find the FCFE for years 1 to 5 Answer: 18.05, 20.36, 22.96, 25.90, and 29.22 What is your estimate of the intrinsic value of one share in Nestliu? Answer: 1394 Hint: for this question you should get the results below cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started