Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How to get these MCQ answers 1) Peter exchanged similar assets with Sunshine Company in a transaction without commercial substance. Peter gave up equipment that

How to get these MCQ answers

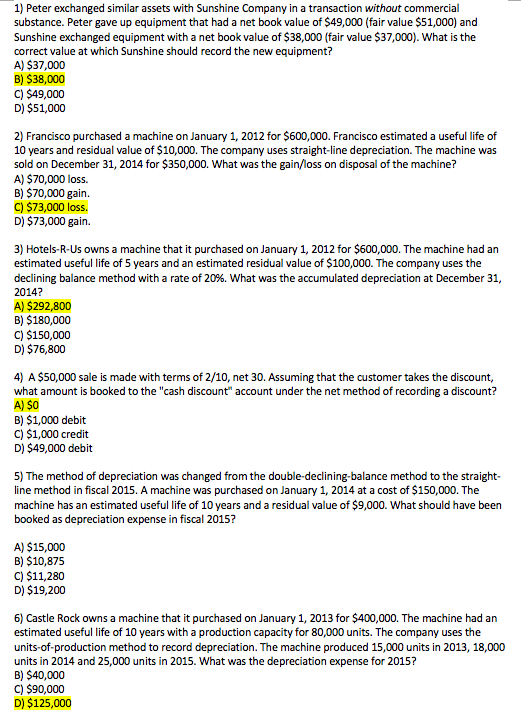

1) Peter exchanged similar assets with Sunshine Company in a transaction without commercial substance. Peter gave up equipment that had a net book value of $49,000 (fair value $51,000) and Sunshine exchanged equipment with a net book value of $38,000 (fair value $37,000). What is the correct value at which Sunshine should record the new equipment? A) $37,000 B) $38,000 C) $49,000 D) $51,000 2) Francisco purchased a machine on January 1, 2012 for $600,000. Francisco estimated a useful life of 10 years and residual value of $10,000. The company uses straight-line depreciation. The machine was sold on December 31, 2014 for $350,000. What was the gain/loss on disposal of the machine? A) $70,000 loss. B) $70,000 gain. C) $73,000 loss. D) $73,000 gain. 3) Hotels-R-Us owns a machine that it purchased on January 1, 2012 for $600,000. The machine had an estimated useful life of 5 years and an estimated residual value of $100,000. The company uses the declining balance method with a rate of 20%. What was the accumulated depreciation at December 31, 2014? A) $292,800 B) $180,000 C) $150,000 D) $76,800 4) A $50,000 sale is made with terms of 2/10, net 30. Assuming that the customer takes the discount, what amount is booked to the "cash discount" account under the net method of recording a discount? A) $O B) $1,000 debit C) $1,000 credit D) $49,000 debit 5) The method of depreciation was changed from the double-declining-balance method to the straight- line method in fiscal 2015. A machine was purchased on January 1, 2014 at a cost of $150,000. The machine has an estimated useful life of 10 years and a residual value of $9,000. What should have been booked as depreciation expense in fiscal 2015? A) $15,000 B) $10,875 C) $11,280 D) $19,200 6) Castle Rock owns a machine that it purchased on January 1, 2013 for $400,000. The machine had an estimated useful life of 10 years with a production capacity for 80,000 units. The company uses the units-of-production method to record depreciation. The machine produced 15,000 units in 2013, 18,000 units in 2014 and 25,000 units in 2015. What was the depreciation expense for 2015? B) $40,000 C) $90,000 D) $125,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started